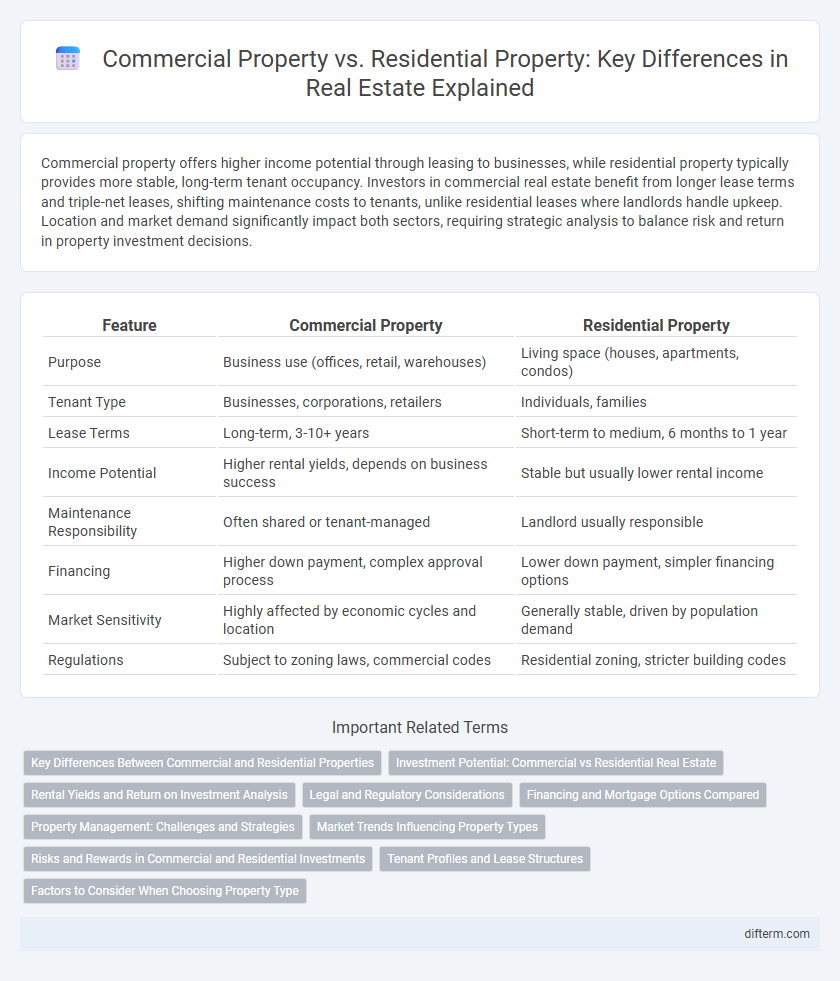

Commercial property offers higher income potential through leasing to businesses, while residential property typically provides more stable, long-term tenant occupancy. Investors in commercial real estate benefit from longer lease terms and triple-net leases, shifting maintenance costs to tenants, unlike residential leases where landlords handle upkeep. Location and market demand significantly impact both sectors, requiring strategic analysis to balance risk and return in property investment decisions.

Table of Comparison

| Feature | Commercial Property | Residential Property |

|---|---|---|

| Purpose | Business use (offices, retail, warehouses) | Living space (houses, apartments, condos) |

| Tenant Type | Businesses, corporations, retailers | Individuals, families |

| Lease Terms | Long-term, 3-10+ years | Short-term to medium, 6 months to 1 year |

| Income Potential | Higher rental yields, depends on business success | Stable but usually lower rental income |

| Maintenance Responsibility | Often shared or tenant-managed | Landlord usually responsible |

| Financing | Higher down payment, complex approval process | Lower down payment, simpler financing options |

| Market Sensitivity | Highly affected by economic cycles and location | Generally stable, driven by population demand |

| Regulations | Subject to zoning laws, commercial codes | Residential zoning, stricter building codes |

Key Differences Between Commercial and Residential Properties

Commercial properties are primarily designed for business activities, including offices, retail spaces, and industrial buildings, whereas residential properties are intended for living purposes such as houses, apartments, and condominiums. Commercial real estate typically involves longer lease terms, higher rental rates, and complex zoning regulations, while residential properties usually have shorter lease durations and more straightforward zoning laws. Investment considerations also differ, as commercial properties often demand larger capital outlays with potentially higher returns, contrasted with the generally lower entry costs and steady demand seen in residential markets.

Investment Potential: Commercial vs Residential Real Estate

Commercial property typically offers higher income potential through longer lease terms and triple net leases, which can reduce landlord expenses and provide more financial stability. Residential properties often appeal to investors seeking lower entry costs and higher liquidity, benefiting from steady demand driven by population growth and rental market trends. Analyzing market cycles and local economic factors is crucial to maximizing returns from either commercial or residential real estate investments.

Rental Yields and Return on Investment Analysis

Commercial property typically offers higher rental yields ranging from 6% to 12%, compared to residential property yields averaging 3% to 5%, making it attractive for investors seeking steady income. Return on investment (ROI) analysis reveals that commercial properties often incur higher initial costs and longer vacancy periods but deliver greater long-term profit potential through lease stability and rent escalations. Residential properties provide more liquidity and lower entry barriers, appealing to investors focused on capital appreciation and faster occupancy turnover.

Legal and Regulatory Considerations

Commercial property regulations often involve complex zoning laws, environmental restrictions, and compliance with the Americans with Disabilities Act (ADA), requiring thorough due diligence before acquisition. Residential property transactions are primarily governed by local housing codes, tenant rights laws, and disclosure obligations to protect homeowners and renters. Both property types demand meticulous attention to contractual terms, permitting processes, and local government regulations to mitigate legal risks effectively.

Financing and Mortgage Options Compared

Commercial property financing typically involves higher down payments, often ranging from 20% to 30%, and requires more stringent credit evaluations compared to residential properties, which usually have lower down payments around 5% to 20%. Mortgage terms for commercial properties are generally shorter, commonly 5 to 20 years, with variable interest rates and complex underwriting processes, whereas residential mortgages offer longer terms up to 30 years with fixed or adjustable rates. Investors in commercial real estate also face unique challenges such as income-based loan approval and higher interest rates due to increased risk, contrasting with residential loans that prioritize borrower creditworthiness and property value.

Property Management: Challenges and Strategies

Commercial property management involves complex lease agreements, higher maintenance costs, and diverse tenant needs, requiring specialized expertise in contract negotiation and facilities management. Residential property management focuses on tenant retention, prompt maintenance, and regulatory compliance with housing laws, emphasizing communication and quick issue resolution. Effective strategies include leveraging technology for maintenance tracking and tenant communication while establishing clear policies to handle disputes and ensure rent collection.

Market Trends Influencing Property Types

Commercial property markets are currently shaped by increasing demand for flexible office spaces and e-commerce-driven warehouse facilities, reflecting shifts in business operations and online retail growth. Residential property trends show a surge in suburban and rural home purchases fueled by remote work adoption and growing preference for spacious living environments. Investment strategies are adapting as commercial spaces evolve with technological integration, while residential markets respond to demographic changes and affordability challenges.

Risks and Rewards in Commercial and Residential Investments

Commercial property investments often offer higher income potential through longer lease terms and triple net leases, yet they carry risks like market volatility, higher vacancy rates, and significant management complexities. Residential properties typically provide more stability and liquidity with consistent demand, but face challenges such as tenant turnover, maintenance costs, and regulatory constraints. Balancing these factors requires investors to assess risk tolerance, cash flow needs, and market conditions to optimize returns in either sector.

Tenant Profiles and Lease Structures

Commercial property tenants typically include businesses such as retailers, offices, and industrial users, with lease structures favoring longer terms and percentage rent clauses tied to revenue. Residential property tenants are usually individuals or families, with leases often structured as fixed-term agreements for one year or less, emphasizing tenant stability and ease of turnover. Understanding these differences helps investors tailor risk management strategies and optimize property income streams effectively.

Factors to Consider When Choosing Property Type

Evaluating location, intended use, and market demand are crucial factors when choosing between commercial and residential property. Commercial property often requires considerations such as zoning laws, business traffic potential, and return on investment through tenant leases, while residential property emphasizes neighborhood quality, school districts, and lifestyle suitability. Understanding financing options and maintenance responsibilities also impacts the decision between commercial and residential real estate investments.

Commercial Property vs Residential Property Infographic

difterm.com

difterm.com