Triple Net Lease (NNN) requires tenants to pay base rent plus property taxes, insurance, and maintenance costs, shifting most expenses to the tenant and providing landlords with predictable income. Modified Gross Lease offers a middle ground where tenants pay base rent and a portion of operating expenses, making it easier to budget but potentially less predictable for landlords. Choosing between NNN and Modified Gross depends on the tenant's willingness to manage additional costs and the landlord's preference for stable returns or shared expense responsibility.

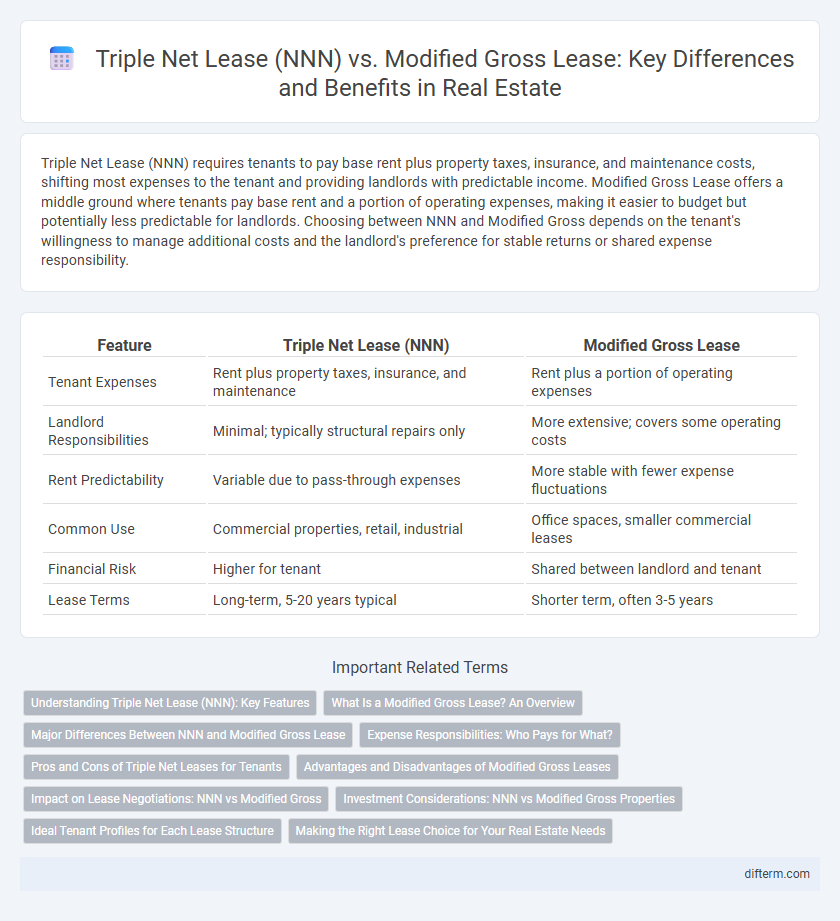

Table of Comparison

| Feature | Triple Net Lease (NNN) | Modified Gross Lease |

|---|---|---|

| Tenant Expenses | Rent plus property taxes, insurance, and maintenance | Rent plus a portion of operating expenses |

| Landlord Responsibilities | Minimal; typically structural repairs only | More extensive; covers some operating costs |

| Rent Predictability | Variable due to pass-through expenses | More stable with fewer expense fluctuations |

| Common Use | Commercial properties, retail, industrial | Office spaces, smaller commercial leases |

| Financial Risk | Higher for tenant | Shared between landlord and tenant |

| Lease Terms | Long-term, 5-20 years typical | Shorter term, often 3-5 years |

Understanding Triple Net Lease (NNN): Key Features

Triple Net Lease (NNN) requires tenants to pay not only rent but also property taxes, insurance, and maintenance costs, transferring most operating expenses from landlord to tenant. This lease structure provides landlords with predictable income and lower management responsibilities, while tenants gain control over expenses and property upkeep. Understanding these key features helps investors and tenants evaluate risk, cash flow, and long-term financial commitments in commercial real estate agreements.

What Is a Modified Gross Lease? An Overview

A Modified Gross Lease is a commercial leasing agreement where the tenant pays base rent plus a portion of operating expenses, such as utilities, maintenance, or property taxes, differing from the full expense responsibility in a Triple Net Lease (NNN). This type of lease provides a balance, limiting tenant liabilities compared to NNN leases, where tenants cover all property expenses including insurance and structural repairs. Property investors and commercial tenants often prefer Modified Gross Leases for predictable costs and shared financial responsibility.

Major Differences Between NNN and Modified Gross Lease

Triple Net Lease (NNN) requires tenants to pay base rent plus property taxes, insurance, and maintenance costs, placing most operational expenses on the tenant. Modified Gross Lease splits operating expenses between landlord and tenant, with the landlord typically covering property taxes and insurance while tenants handle utilities and janitorial costs. The major difference is the allocation of expenses, where NNN leases provide predictable landlord income, and Modified Gross Leases offer more shared financial responsibility and fewer tenant obligations.

Expense Responsibilities: Who Pays for What?

Triple Net Lease (NNN) requires tenants to pay property taxes, insurance, and maintenance expenses in addition to base rent, shifting most operating costs to the tenant. Modified Gross Lease typically splits expenses between landlord and tenant, with the landlord covering structural costs and tenants paying a portion of utilities or maintenance. Understanding these distinctions helps investors and tenants assess risk exposure and cash flow predictability in commercial real estate agreements.

Pros and Cons of Triple Net Leases for Tenants

Triple Net Leases (NNN) require tenants to cover property taxes, insurance, and maintenance costs, leading to lower base rents but potentially unpredictable expenses. Tenants benefit from control over property upkeep and reduced landlord management responsibilities but face financial risk from fluctuating operating costs. This lease structure suits businesses seeking long-term stability and expense transparency while accepting variable total occupancy costs.

Advantages and Disadvantages of Modified Gross Leases

Modified Gross Leases balance tenant and landlord responsibilities by requiring tenants to pay base rent plus a portion of operating expenses, offering predictable costs and simplified budgeting compared to Triple Net Leases. Tenants benefit from reduced exposure to variable expenses such as property taxes, insurance, and maintenance, while landlords retain some cost control and flexibility in expense management. However, the potential for cost disputes and less transparency in expense allocation can create challenges for both parties under Modified Gross Leases.

Impact on Lease Negotiations: NNN vs Modified Gross

Triple Net Lease (NNN) shifts most property expenses, including taxes, insurance, and maintenance, to the tenant, often leading to lower base rent but more complex lease negotiations due to variable costs. Modified Gross Lease simplifies negotiations with a fixed rent that covers some or all operating expenses, providing predictability and reducing landlord-tenant disputes over fluctuating costs. Understanding these distinctions is crucial for negotiating rent adjustments, expense caps, and maintenance responsibilities effectively.

Investment Considerations: NNN vs Modified Gross Properties

Triple Net Lease (NNN) properties typically attract investors seeking predictable, low-risk cash flow due to tenants bearing property expenses like taxes, insurance, and maintenance. Modified Gross Leases offer a higher level of landlord expense responsibility, which can result in variable returns but potentially higher control over property upkeep and tenant relations. Evaluating investment considerations includes analyzing risk tolerance, desired cash flow stability, and long-term value appreciation between NNN and Modified Gross lease agreements.

Ideal Tenant Profiles for Each Lease Structure

Triple Net Lease (NNN) agreements suit tenants with stable cash flow, such as established retail chains, medical offices, and franchise operations, due to their responsibility for property expenses including taxes, insurance, and maintenance. Modified Gross Leases attract tenants like startups, small businesses, or service providers seeking predictable monthly costs with shared responsibility for operating expenses. Understanding tenant financial strength and preference for expense management is crucial in selecting the most suitable lease structure.

Making the Right Lease Choice for Your Real Estate Needs

Choosing between a Triple Net Lease (NNN) and a Modified Gross Lease hinges on your willingness to manage expenses and control financial risk. NNN leases require tenants to cover property taxes, insurance, and maintenance, offering landlords predictable income and tenants greater control over operating costs. Modified Gross Leases simplify budgeting by combining base rent with some expenses, ideal for tenants seeking less financial responsibility and landlords preferring less administrative complexity.

Triple Net Lease (NNN) vs Modified Gross Lease Infographic

difterm.com

difterm.com