Closing costs are one-time fees paid at the end of a real estate transaction, including lender fees, title insurance, and escrow charges. Prepaid costs refer to expenses paid in advance, such as property taxes, homeowners insurance, and mortgage interest, which cover the period after closing. Understanding the difference between these costs helps buyers prepare financially for both the transaction and ongoing homeownership expenses.

Table of Comparison

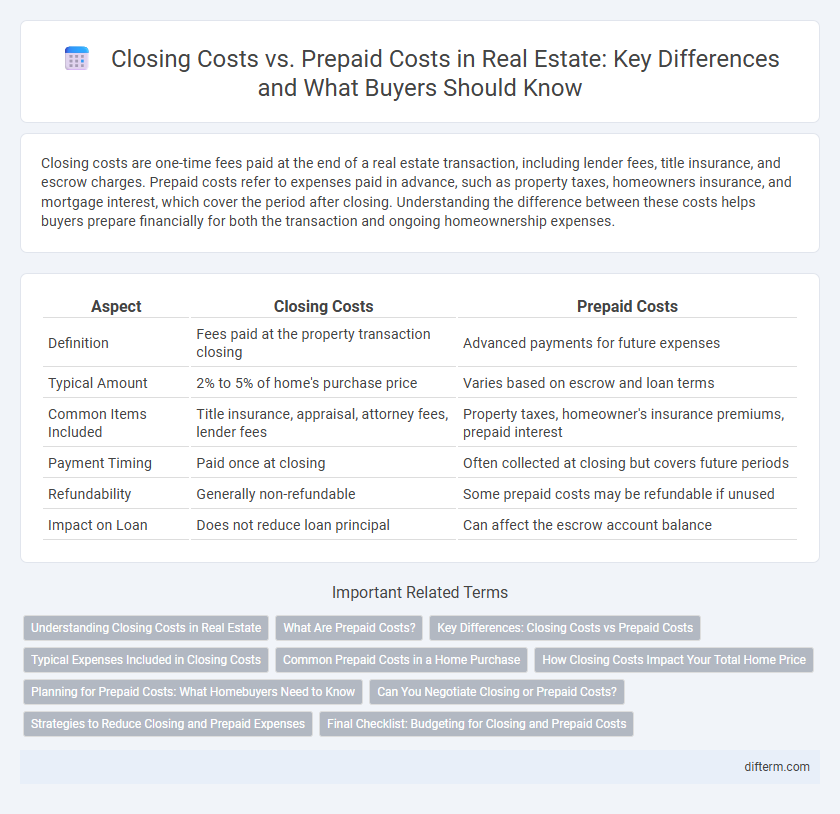

| Aspect | Closing Costs | Prepaid Costs |

|---|---|---|

| Definition | Fees paid at the property transaction closing | Advanced payments for future expenses |

| Typical Amount | 2% to 5% of home's purchase price | Varies based on escrow and loan terms |

| Common Items Included | Title insurance, appraisal, attorney fees, lender fees | Property taxes, homeowner's insurance premiums, prepaid interest |

| Payment Timing | Paid once at closing | Often collected at closing but covers future periods |

| Refundability | Generally non-refundable | Some prepaid costs may be refundable if unused |

| Impact on Loan | Does not reduce loan principal | Can affect the escrow account balance |

Understanding Closing Costs in Real Estate

Closing costs in real estate typically include fees for loan origination, title insurance, appraisal, attorney services, and recording charges, representing the expenses necessary to finalize a property transaction. Prepaid costs are upfront payments for future expenses such as property taxes, homeowners insurance, and mortgage interest, which are collected at closing but cover periods beyond the closing date. Understanding the distinction between closing costs and prepaid costs is essential for accurate budgeting when purchasing or refinancing real estate.

What Are Prepaid Costs?

Prepaid costs in real estate refer to expenses paid upfront during the closing process, such as property taxes, homeowners insurance premiums, and interest accrued before the first mortgage payment. These costs are necessary to ensure that future obligations are covered before the borrower begins regular mortgage payments. Understanding prepaid costs helps buyers budget accurately and avoid surprises at closing.

Key Differences: Closing Costs vs Prepaid Costs

Closing costs encompass fees paid during the property transfer process, including title insurance, appraisal, and attorney fees, while prepaid costs cover expenses paid upfront for future services like property taxes, homeowners insurance, and mortgage interest. Closing costs are typically one-time payments due at closing, whereas prepaid costs are advance payments that secure coverage or taxes for a set period. Understanding this distinction helps buyers budget effectively for the total upfront expenses in a real estate transaction.

Typical Expenses Included in Closing Costs

Typical expenses included in closing costs encompass lender fees, title insurance, appraisal fees, escrow fees, and attorney fees, all essential for finalizing a real estate transaction. These costs often represent 2% to 5% of the property's purchase price and are paid at the closing of the sale. Closing costs differ from prepaid costs, which cover future expenses like property taxes and homeowners insurance paid in advance.

Common Prepaid Costs in a Home Purchase

Common prepaid costs in a home purchase include property taxes, homeowner's insurance premiums, and prepaid interest, which are funds paid upfront at closing to cover expenses due shortly after ownership transfer. These costs differ from closing costs that cover fees for services such as title insurance, appraisals, and lender processing fees. Understanding prepaid costs helps buyers prepare for immediate financial obligations post-closing and ensures a smoother transition into homeownership.

How Closing Costs Impact Your Total Home Price

Closing costs typically range from 2% to 5% of the home's purchase price, significantly influencing the overall amount a buyer pays at settlement. These expenses include lender fees, title insurance, and escrow charges, which are separate from prepaid costs like property taxes and homeowner's insurance that cover future expenses. Understanding how closing costs contribute to the total home price helps buyers accurately budget for the full financial commitment beyond the listed sale price.

Planning for Prepaid Costs: What Homebuyers Need to Know

Understanding prepaid costs is crucial for accurate budgeting in real estate transactions, as these expenses include items like property taxes, homeowners insurance, and mortgage interest paid upfront at closing. Homebuyers should plan for these fees separately from closing costs, which cover lender fees, title insurance, and appraisal charges. Properly estimating prepaid costs ensures sufficient funds are available to avoid delays in closing and secures a smooth home purchase process.

Can You Negotiate Closing or Prepaid Costs?

Buyers can often negotiate certain closing costs such as attorney fees, title insurance, and lender fees by requesting seller concessions or shopping around for service providers. Prepaid costs like property taxes and homeowners insurance are typically fixed amounts set by external entities and are less flexible for negotiation. Understanding which fees are negotiable empowers buyers to reduce upfront expenses when purchasing real estate.

Strategies to Reduce Closing and Prepaid Expenses

Negotiating seller concessions can significantly reduce closing costs by shifting fees like title insurance and escrow fees to the seller. Opting for a no-closing-cost mortgage helps minimize upfront expenses by incorporating fees into the loan balance or interest rate. Additionally, accurately estimating prepaid costs such as property taxes and homeowners insurance ensures buyers avoid overpaying at closing while maintaining a well-planned budget.

Final Checklist: Budgeting for Closing and Prepaid Costs

Closing costs typically include lender fees, title insurance, and escrow charges, while prepaid costs cover property taxes, homeowners insurance, and interest accrued before the first mortgage payment. Budgeting for both categories is critical to avoid unexpected financial strain during the homebuying process. A comprehensive final checklist ensures accurate estimation of all fees, helping buyers allocate sufficient funds and streamline the closing process.

Closing Costs vs Prepaid Costs Infographic

difterm.com

difterm.com