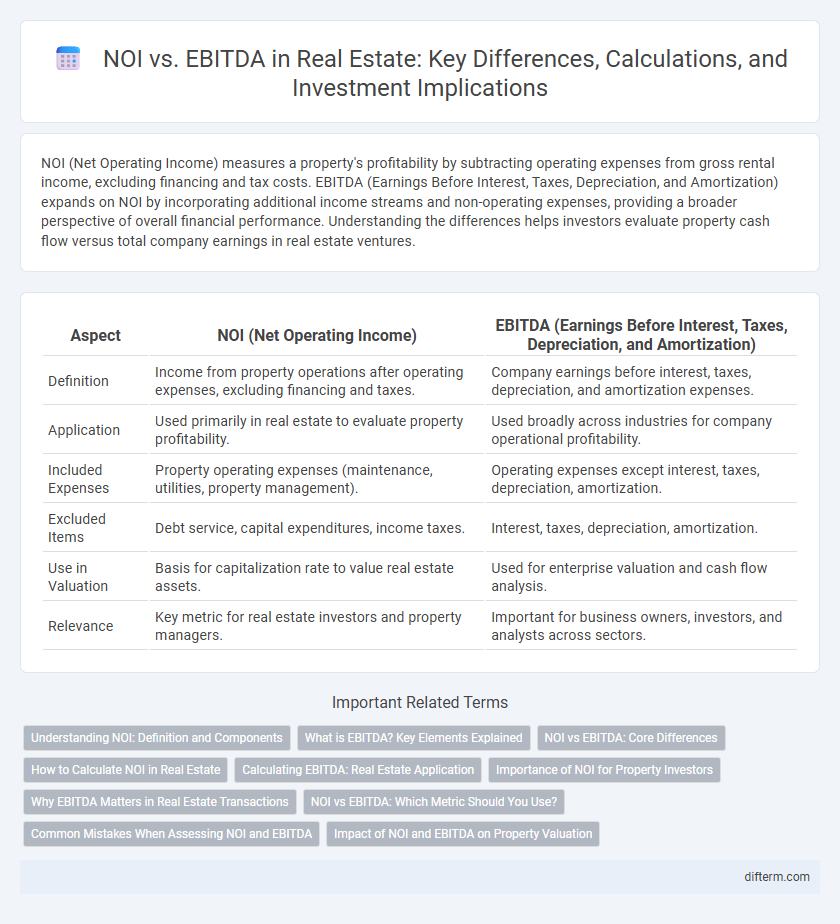

NOI (Net Operating Income) measures a property's profitability by subtracting operating expenses from gross rental income, excluding financing and tax costs. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) expands on NOI by incorporating additional income streams and non-operating expenses, providing a broader perspective of overall financial performance. Understanding the differences helps investors evaluate property cash flow versus total company earnings in real estate ventures.

Table of Comparison

| Aspect | NOI (Net Operating Income) | EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) |

|---|---|---|

| Definition | Income from property operations after operating expenses, excluding financing and taxes. | Company earnings before interest, taxes, depreciation, and amortization expenses. |

| Application | Used primarily in real estate to evaluate property profitability. | Used broadly across industries for company operational profitability. |

| Included Expenses | Property operating expenses (maintenance, utilities, property management). | Operating expenses except interest, taxes, depreciation, amortization. |

| Excluded Items | Debt service, capital expenditures, income taxes. | Interest, taxes, depreciation, amortization. |

| Use in Valuation | Basis for capitalization rate to value real estate assets. | Used for enterprise valuation and cash flow analysis. |

| Relevance | Key metric for real estate investors and property managers. | Important for business owners, investors, and analysts across sectors. |

Understanding NOI: Definition and Components

Net Operating Income (NOI) in real estate represents the property's total income minus operating expenses, excluding financing costs, taxes, and depreciation. Key components of NOI include gross rental income, vacancy losses, and operating expenses such as maintenance, property management, and utilities. Unlike EBITDA, which is used broadly in corporate finance to assess overall profitability before interest, taxes, depreciation, and amortization, NOI specifically measures a property's operational profitability.

What is EBITDA? Key Elements Explained

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a financial metric used to evaluate a property's operational profitability by excluding non-operating expenses and non-cash charges. Key elements of EBITDA include revenue generated from property operations, operating expenses such as maintenance and management fees, and the exclusion of interest, taxes, depreciation, and amortization costs. Unlike NOI, which focuses solely on net income from operations, EBITDA provides a broader view of overall earnings before financial and accounting deductions.

NOI vs EBITDA: Core Differences

Net Operating Income (NOI) measures a property's income after operating expenses but before interest and taxes, focusing solely on real estate performance. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) provides a broader business profitability view, including non-property expenses and revenues outside core real estate operations. The core difference lies in NOI's specificity to real estate assets versus EBITDA's application to overall corporate financial health.

How to Calculate NOI in Real Estate

Net Operating Income (NOI) in real estate is calculated by subtracting operating expenses from the total revenue generated by the property, excluding financing costs, taxes, depreciation, and amortization. This measure focuses solely on the income produced by the property's operations, providing a clearer view of its profitability compared to EBITDA, which includes non-operating expenses and revenues. Understanding NOI helps investors evaluate a property's performance and compare potential investments effectively within the real estate market.

Calculating EBITDA: Real Estate Application

EBITDA in real estate measures a property's profitability by calculating earnings before interest, taxes, depreciation, and amortization, providing a clearer picture of operational efficiency. Unlike NOI, which excludes financing and tax expenses but includes depreciation, EBITDA adds back these non-cash items to reveal cash flow potential. Calculating EBITDA involves adjusting NOI by subtracting administrative expenses and adding non-operating income, making it essential for assessing investment performance and comparing real estate assets.

Importance of NOI for Property Investors

Net Operating Income (NOI) is a crucial metric for property investors as it directly measures the profitability of real estate investments by calculating revenue minus operating expenses, excluding financing and taxes. Unlike EBITDA, which is broader and used primarily in corporate finance, NOI provides a clearer insight into a property's cash flow potential and operational efficiency. Accurate NOI assessment allows investors to evaluate property performance, compare investment opportunities, and determine appropriate valuation multiples in the real estate market.

Why EBITDA Matters in Real Estate Transactions

NOI (Net Operating Income) measures a property's profitability by subtracting operating expenses from gross income, excluding financing and tax costs. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) extends this analysis by incorporating additional income and expense items, offering a broader view of a real estate asset's operational efficiency. EBITDA matters in real estate transactions because it provides investors and lenders with a clearer picture of cash flow potential and the overall financial health beyond basic property income, aiding in more accurate valuation and investment decisions.

NOI vs EBITDA: Which Metric Should You Use?

NOI (Net Operating Income) focuses solely on income and expenses directly related to property operations, excluding financing costs, taxes, and depreciation, making it ideal for evaluating real estate asset performance. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) provides a broader view of a company's overall profitability, including non-property business activities. For real estate investors analyzing property-level cash flow and operational efficiency, NOI is the preferred metric, whereas EBITDA suits investors evaluating corporate financial health across diverse business units.

Common Mistakes When Assessing NOI and EBITDA

Common mistakes when assessing NOI and EBITDA in real estate include confusing operating expenses excluded from NOI but included in EBITDA calculations, such as depreciation and amortization. Investors often overlook capital expenditures and debt servicing costs, leading to inflated NOI figures that do not reflect true cash flow. Accurate analysis requires distinguishing between NOI's focus on property-level profitability and EBITDA's broader scope encompassing overall business performance.

Impact of NOI and EBITDA on Property Valuation

NOI (Net Operating Income) directly influences property valuation by reflecting the income generated from operations before financing and taxes, serving as a key metric for investors to assess cash flow and property performance. EBITDA includes additional expenses like depreciation and amortization, offering a broader view of operational profitability but may obscure the true operational income specific to real estate assets. Accurate property valuation relies heavily on NOI due to its focus on net revenue from core operations, making it a more precise indicator of a property's income potential and market value.

NOI (Net Operating Income) vs EBITDA Infographic

difterm.com

difterm.com