Short sales allow homeowners to sell their property for less than the outstanding mortgage balance, often providing a faster resolution and minimizing credit damage compared to foreclosure. Pre-foreclosure occurs when the homeowner has missed mortgage payments but the property has not yet been officially foreclosed, presenting an opportunity to negotiate with lenders or purchase the property before it goes to auction. Understanding the differences between short sale and pre-foreclosure helps buyers and sellers make informed decisions in distressed real estate transactions.

Table of Comparison

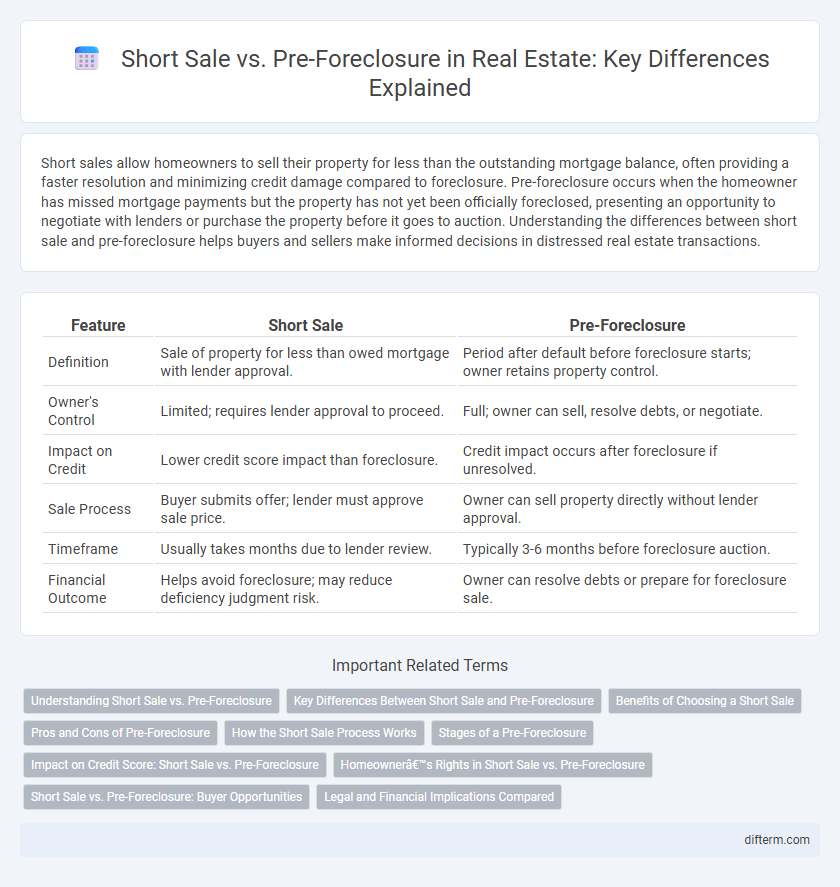

| Feature | Short Sale | Pre-Foreclosure |

|---|---|---|

| Definition | Sale of property for less than owed mortgage with lender approval. | Period after default before foreclosure starts; owner retains property control. |

| Owner's Control | Limited; requires lender approval to proceed. | Full; owner can sell, resolve debts, or negotiate. |

| Impact on Credit | Lower credit score impact than foreclosure. | Credit impact occurs after foreclosure if unresolved. |

| Sale Process | Buyer submits offer; lender must approve sale price. | Owner can sell property directly without lender approval. |

| Timeframe | Usually takes months due to lender review. | Typically 3-6 months before foreclosure auction. |

| Financial Outcome | Helps avoid foreclosure; may reduce deficiency judgment risk. | Owner can resolve debts or prepare for foreclosure sale. |

Understanding Short Sale vs. Pre-Foreclosure

Short sale involves a homeowner selling their property for less than the outstanding mortgage balance with lender approval, aiming to avoid foreclosure and minimize credit impact. Pre-foreclosure is the initial stage when the homeowner has missed mortgage payments but the property hasn't been auctioned or repossessed yet. Understanding the distinction helps buyers and sellers navigate negotiations, timelines, and potential financial consequences in distressed real estate transactions.

Key Differences Between Short Sale and Pre-Foreclosure

Short sale occurs when a homeowner sells the property for less than the outstanding mortgage balance with lender approval to avoid foreclosure. Pre-foreclosure refers to the initial stage after missed mortgage payments, where the lender issues a notice of default but the property is not yet sold. Key differences include the short sale involving a negotiated sale to satisfy debt, while pre-foreclosure is a warning period allowing owners to resolve delinquency before foreclosure proceedings.

Benefits of Choosing a Short Sale

Choosing a short sale allows homeowners to sell their property for less than the outstanding mortgage balance, often avoiding the lengthy and damaging foreclosure process. Sellers can negotiate with lenders to minimize credit score impact and potentially receive relocation assistance or debt forgiveness. This option provides a less stressful alternative with more control over the sale timeline compared to pre-foreclosure, which can lead to sudden foreclosure auctions and limited negotiation opportunities.

Pros and Cons of Pre-Foreclosure

Pre-foreclosure offers the opportunity to purchase properties below market value, often attracting investors and buyers seeking bargains. However, it carries risks such as potential liens, unclear title status, and the urgency of timelines dictated by lenders. Buyers may face challenges with seller cooperation and the need for thorough due diligence before committing to a pre-foreclosure purchase.

How the Short Sale Process Works

The short sale process involves negotiating with the lender to accept a payoff amount lower than the outstanding mortgage balance, allowing the homeowner to sell the property and avoid foreclosure. Sellers must provide financial hardship documentation and a hardship letter, while buyers often submit an offer with proof of funds or pre-approval to the lender for approval. This process can take several months, requiring coordination between the seller, buyer, and lender to finalize the sale and release the seller from the mortgage obligation.

Stages of a Pre-Foreclosure

The stages of a pre-foreclosure begin when a homeowner misses mortgage payments, triggering the lender to issue a notice of default or demand for payment. This period allows the borrower to negotiate with the lender to avoid foreclosure, often through loan modification, repayment plans, or short sale agreements. Understanding the timeline during the pre-foreclosure phase helps buyers identify opportunities for purchasing properties at a discount before the foreclosure auction occurs.

Impact on Credit Score: Short Sale vs. Pre-Foreclosure

A short sale typically results in a credit score drop of 85 to 160 points, reflecting a negotiated debt settlement process that lenders report as less severe than foreclosure. Pre-foreclosure, often preceding a foreclosure filing, can cause a more significant credit impact, with drops ranging from 110 to 240 points due to late payments and missed mortgage obligations. The timeline and severity of credit reporting differ, making short sales a potentially less damaging alternative to the credit score compared to pre-foreclosure status.

Homeowner’s Rights in Short Sale vs. Pre-Foreclosure

Homeowners in a short sale maintain more control over the sale process and can negotiate with lenders to potentially reduce debt, while pre-foreclosure status limits options as the lender initiates foreclosure proceedings. In a short sale, the homeowner must obtain lender approval before selling the property, preserving some authority over timing and terms. During pre-foreclosure, homeowners must act quickly to avoid foreclosure, but they still have rights to cure the default or negotiate alternatives such as loan modifications.

Short Sale vs. Pre-Foreclosure: Buyer Opportunities

Short sales offer buyers the chance to purchase properties below market value by negotiating with lenders before foreclosure occurs, often resulting in less competition and potential savings. Pre-foreclosure properties provide buyers with early access to distressed homes, allowing for due diligence and negotiation before the property is officially listed for sale. Understanding the differences between short sales and pre-foreclosures can help buyers identify strategic investment opportunities in the real estate market.

Legal and Financial Implications Compared

Short sales involve selling a property for less than the owed mortgage with lender approval, often minimizing credit damage and legal liabilities compared to pre-foreclosure, where missed payments can lead to foreclosure lawsuits and higher credit impact. In pre-foreclosure, homeowners risk losing the property and may face deficiency judgments if the sale proceeds don't cover the mortgage debt, resulting in potential legal and financial burdens. Short sales typically require lender negotiation but offer a structured way to settle debt, while pre-foreclosure can entail prolonged legal processes and increased financial vulnerability.

short sale vs pre-foreclosure Infographic

difterm.com

difterm.com