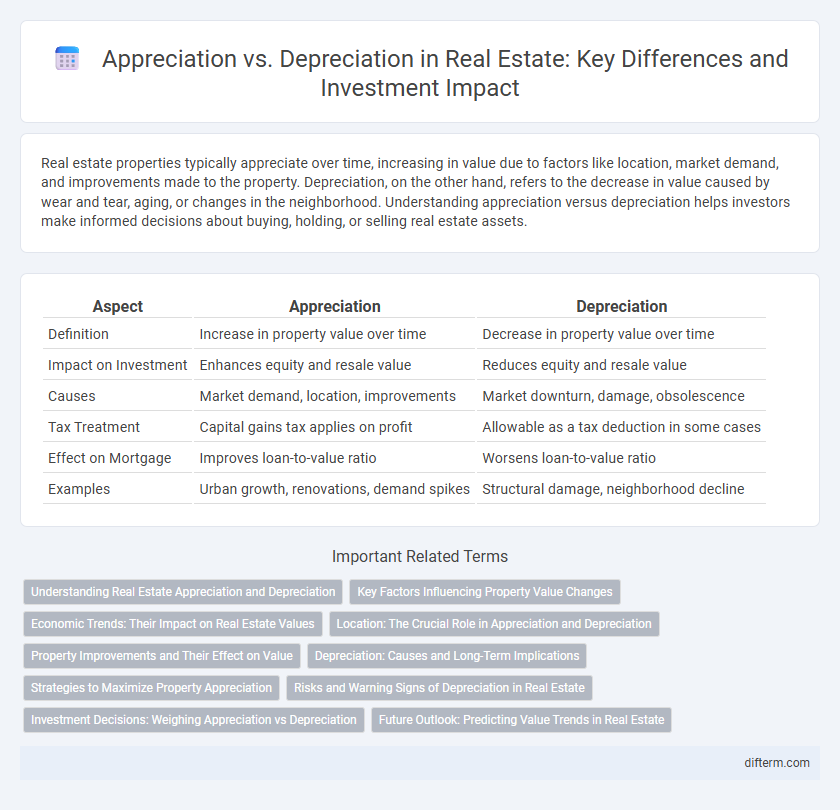

Real estate properties typically appreciate over time, increasing in value due to factors like location, market demand, and improvements made to the property. Depreciation, on the other hand, refers to the decrease in value caused by wear and tear, aging, or changes in the neighborhood. Understanding appreciation versus depreciation helps investors make informed decisions about buying, holding, or selling real estate assets.

Table of Comparison

| Aspect | Appreciation | Depreciation |

|---|---|---|

| Definition | Increase in property value over time | Decrease in property value over time |

| Impact on Investment | Enhances equity and resale value | Reduces equity and resale value |

| Causes | Market demand, location, improvements | Market downturn, damage, obsolescence |

| Tax Treatment | Capital gains tax applies on profit | Allowable as a tax deduction in some cases |

| Effect on Mortgage | Improves loan-to-value ratio | Worsens loan-to-value ratio |

| Examples | Urban growth, renovations, demand spikes | Structural damage, neighborhood decline |

Understanding Real Estate Appreciation and Depreciation

Real estate appreciation refers to the increase in property value over time due to factors such as location, market demand, and upgrades, directly impacting an investor's equity and return on investment. Depreciation, conversely, represents the reduction in property value caused by wear and tear, aging structures, or unfavorable market conditions, which can also offer tax benefits through allowable deductions. Understanding these dynamics is crucial for accurate property valuation, strategic investment decisions, and effective financial planning in the real estate market.

Key Factors Influencing Property Value Changes

Property value changes are primarily influenced by location quality, economic conditions, and supply-demand dynamics in the real estate market. Infrastructure developments, neighborhood safety, and school district ratings significantly impact appreciation rates. Conversely, property depreciation can result from physical wear and tear, market downturns, and changes in zoning regulations.

Economic Trends: Their Impact on Real Estate Values

Economic trends significantly influence real estate values through appreciation and depreciation. When local economies expand, increasing employment rates and income levels, property demand rises, driving appreciation in real estate prices. Conversely, economic downturns, such as rising unemployment or inflation, often lead to depreciation, reducing property values and slowing investment growth in the real estate market.

Location: The Crucial Role in Appreciation and Depreciation

Location is a paramount factor influencing real estate appreciation and depreciation, as properties situated in high-demand areas with access to quality amenities, schools, and transportation typically see significant value increases. Conversely, properties in areas affected by economic decline, poor infrastructure, or environmental hazards are prone to depreciation due to reduced buyer interest and lower resale values. Understanding local market trends and neighborhood development plans is essential for accurately assessing potential property value changes.

Property Improvements and Their Effect on Value

Property improvements such as renovations, landscaping, and energy-efficient upgrades significantly contribute to the appreciation of real estate by increasing its market value and appeal to potential buyers. High-quality enhancements often lead to higher resale prices and faster sales, reflecting positively on the property's overall investment potential. Conversely, neglecting maintenance or outdated features can cause depreciation, diminishing value and reducing buyer interest over time.

Depreciation: Causes and Long-Term Implications

Depreciation in real estate primarily results from physical wear and tear, functional obsolescence, and external factors such as neighborhood decline or economic shifts. It reduces a property's market value over time, impacting investment returns and potentially increasing maintenance costs. Long-term implications include diminished equity for owners and challenges in securing favorable financing or resale terms.

Strategies to Maximize Property Appreciation

Implementing strategic renovations such as modern kitchen upgrades and energy-efficient installations significantly boosts property appreciation by increasing market appeal and value. Location analysis involves targeting emerging neighborhoods with strong economic growth indicators, ensuring long-term property value increase. Consistent property maintenance and proactive market research allow investors to capitalize on favorable market conditions, maximizing overall appreciation potential.

Risks and Warning Signs of Depreciation in Real Estate

Depreciation in real estate presents significant risks including declining property values, increased maintenance costs, and reduced rental income potential, all of which can erode investment returns. Warning signs include noticeable physical deterioration, shifts in neighborhood demographics, reduced demand, and poor local economic conditions. Investors should conduct thorough due diligence, monitor market trends, and assess property condition regularly to mitigate depreciation risks effectively.

Investment Decisions: Weighing Appreciation vs Depreciation

Investment decisions in real estate require careful analysis of property appreciation and depreciation trends to maximize returns. Properties located in high-growth areas tend to appreciate over time, enhancing equity and rental income potential. Conversely, understanding factors that drive depreciation, such as market decline or property damage, helps investors mitigate risks and optimize portfolio performance.

Future Outlook: Predicting Value Trends in Real Estate

Appreciation in real estate refers to the increase in property value over time, driven by factors such as economic growth, urban development, and demand-supply dynamics. Depreciation, conversely, results from wear and tear, changes in neighborhood desirability, or economic downturns that negatively impact property worth. Predicting future value trends requires analyzing market indicators, local infrastructure projects, and demographic shifts to gauge potential appreciation or depreciation accurately.

Appreciation vs Depreciation Infographic

difterm.com

difterm.com