Commingling in real estate occurs when an agent mixes client funds with personal or business accounts, creating risks of mismanagement and legal violations. Conversion refers to the unauthorized use or misappropriation of client funds for personal benefit, which is a serious ethical breach often resulting in severe penalties. Proper escrow management and strict adherence to fiduciary duties are essential to prevent both commingling and conversion, ensuring client trust and regulatory compliance.

Table of Comparison

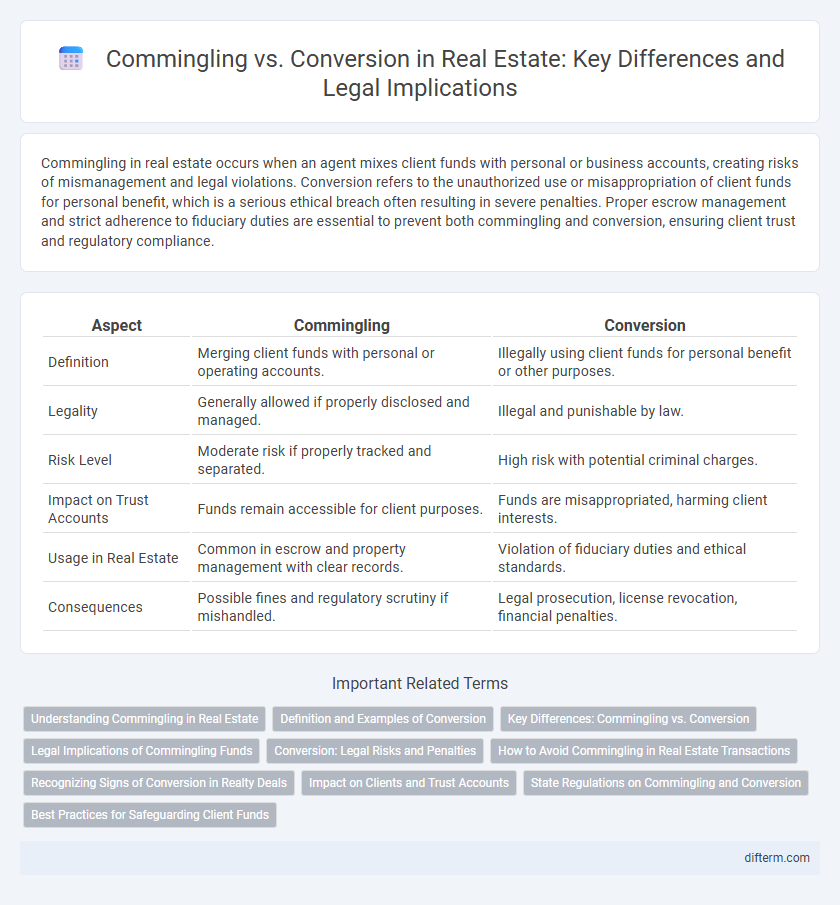

| Aspect | Commingling | Conversion |

|---|---|---|

| Definition | Merging client funds with personal or operating accounts. | Illegally using client funds for personal benefit or other purposes. |

| Legality | Generally allowed if properly disclosed and managed. | Illegal and punishable by law. |

| Risk Level | Moderate risk if properly tracked and separated. | High risk with potential criminal charges. |

| Impact on Trust Accounts | Funds remain accessible for client purposes. | Funds are misappropriated, harming client interests. |

| Usage in Real Estate | Common in escrow and property management with clear records. | Violation of fiduciary duties and ethical standards. |

| Consequences | Possible fines and regulatory scrutiny if mishandled. | Legal prosecution, license revocation, financial penalties. |

Understanding Commingling in Real Estate

Commingling in real estate occurs when a broker mixes client funds with personal or business accounts, violating fiduciary duties and regulatory requirements. This improper blending jeopardizes client assets and can lead to legal penalties, including license suspension or revocation. Understanding commingling is essential for real estate professionals to maintain trust, ensure fund protection, and adhere to state laws governing escrow and trust accounts.

Definition and Examples of Conversion

Conversion in real estate refers to the unauthorized use or misappropriation of client funds for purposes other than those intended, such as an agent using escrow money for personal expenses. A common example includes a property manager applying a tenant's security deposit to cover repair costs without consent, which breaches fiduciary duty. This differs from commingling, where client and personal funds are improperly mixed but not necessarily misused.

Key Differences: Commingling vs. Conversion

Commingling in real estate refers to mixing client funds with personal or business accounts, which violates fiduciary duties by obscuring financial transparency. Conversion occurs when a real estate agent or broker illegally uses or appropriates client funds for personal benefit, constituting theft or fraud. The key difference lies in commingling being an improper mixing of funds, while conversion is the unauthorized use or misappropriation of those funds.

Legal Implications of Commingling Funds

Commingling funds in real estate transactions violates fiduciary duties by mixing client money with personal or operational accounts, risking legal penalties and license suspension. Real estate agents must keep client funds in separate escrow or trust accounts to ensure transparency and protect against claims of misappropriation. Courts often impose severe sanctions, including financial restitution and criminal charges, when conversion results from improper commingling practices.

Conversion: Legal Risks and Penalties

Conversion in real estate involves the unauthorized use or misappropriation of client funds, leading to severe legal risks including civil lawsuits and criminal charges. Penalties for conversion can result in substantial fines, restitution orders, and potential imprisonment, especially if the act involves intentional fraud or breach of fiduciary duty. Real estate professionals must maintain strict compliance with escrow regulations to avoid allegations of conversion and protect their licenses from suspension or revocation.

How to Avoid Commingling in Real Estate Transactions

Maintaining separate escrow accounts for client funds is essential to avoid commingling in real estate transactions, ensuring that personal and business monies remain distinct. Strict record-keeping practices and regular audits provide transparency and accountability, preventing inadvertent mixing of funds. Implementing clear internal policies and training staff on fiduciary responsibilities further safeguards against financial mismanagement and legal violations.

Recognizing Signs of Conversion in Realty Deals

Recognizing signs of conversion in real estate deals involves identifying unauthorized use or misappropriation of client funds, such as escrow accounts being accessed for personal expenses or transactions outside agreed terms. Unexplained delays in funds disbursement and inconsistent financial records frequently indicate potential conversion. Prompt audits and transparent accounting practices are essential in detecting and preventing commingling from escalating into conversion fraud.

Impact on Clients and Trust Accounts

Commingling client funds with a licensee's personal or business accounts breaches fiduciary duties and jeopardizes trust account integrity, risking severe legal penalties and loss of client confidence. Conversion, the unauthorized use or misappropriation of client funds, directly harms clients' financial interests and often results in regulatory sanctions, restitution orders, and damaged professional reputations. Maintaining strict separation and accurate accounting of trust accounts is essential to uphold client trust, ensure compliance with real estate laws, and protect licensees from significant legal and financial consequences.

State Regulations on Commingling and Conversion

State regulations on commingling and conversion in real estate strictly prohibit mixing client funds with personal or business accounts to protect fiduciary duties. Real estate professionals must maintain separate escrow or trust accounts as mandated by regulatory bodies like state real estate commissions to ensure transparent handling of client monies. Violations of these laws can result in severe penalties, including license suspension, fines, and criminal charges for misappropriation of funds.

Best Practices for Safeguarding Client Funds

Maintaining separate escrow accounts for client funds is essential for preventing commingling, ensuring that real estate professionals do not mix client monies with personal or business funds. Implementing strict accounting procedures, regular audits, and clear documentation further protect against conversion risks by providing transparency and accountability. Adopting robust software solutions designed for trust fund management enhances tracking accuracy and helps safeguard client assets in compliance with real estate regulatory standards.

commingling vs conversion Infographic

difterm.com

difterm.com