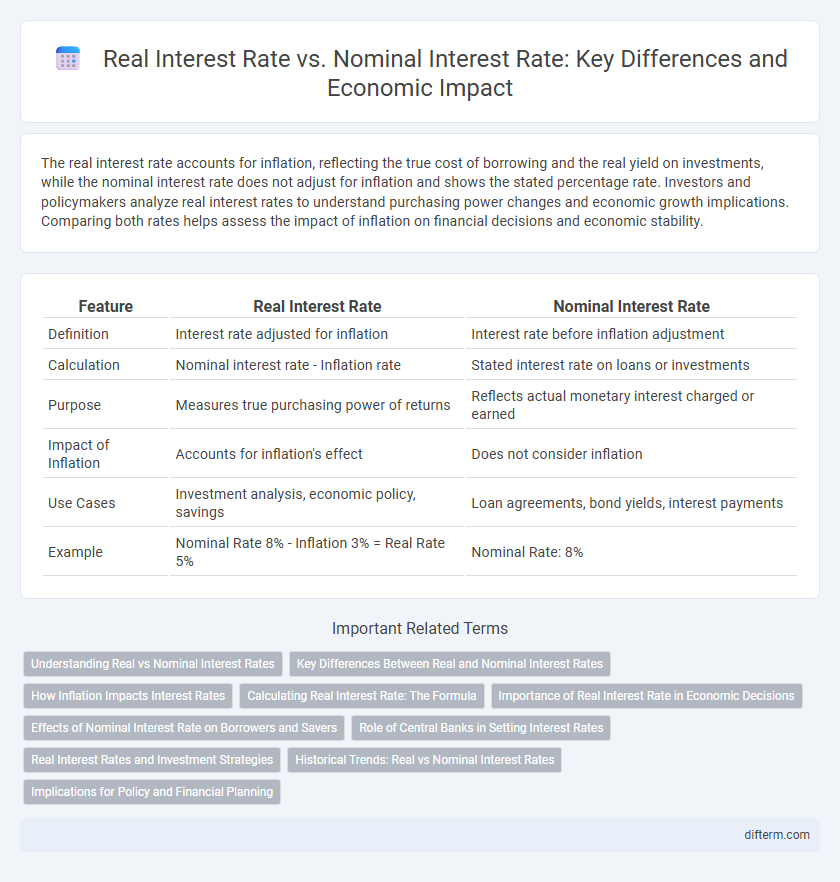

The real interest rate accounts for inflation, reflecting the true cost of borrowing and the real yield on investments, while the nominal interest rate does not adjust for inflation and shows the stated percentage rate. Investors and policymakers analyze real interest rates to understand purchasing power changes and economic growth implications. Comparing both rates helps assess the impact of inflation on financial decisions and economic stability.

Table of Comparison

| Feature | Real Interest Rate | Nominal Interest Rate |

|---|---|---|

| Definition | Interest rate adjusted for inflation | Interest rate before inflation adjustment |

| Calculation | Nominal interest rate - Inflation rate | Stated interest rate on loans or investments |

| Purpose | Measures true purchasing power of returns | Reflects actual monetary interest charged or earned |

| Impact of Inflation | Accounts for inflation's effect | Does not consider inflation |

| Use Cases | Investment analysis, economic policy, savings | Loan agreements, bond yields, interest payments |

| Example | Nominal Rate 8% - Inflation 3% = Real Rate 5% | Nominal Rate: 8% |

Understanding Real vs Nominal Interest Rates

Real interest rates reflect the true cost of borrowing by adjusting nominal rates for inflation, providing a more accurate measure of purchasing power gain or loss over time. Nominal interest rates represent the stated rate without accounting for inflation, often leading to misleading perceptions of investment returns or loan costs. Understanding the distinction is crucial for investors, borrowers, and policymakers to make informed economic decisions based on the actual value of money.

Key Differences Between Real and Nominal Interest Rates

Real interest rates account for inflation by reflecting the true purchasing power of interest earned or paid, whereas nominal interest rates represent the stated percentage without adjusting for inflation. The key difference lies in how inflation impacts their value: real rates provide a more accurate measure of economic benefit or cost, while nominal rates are often higher due to inflation premiums. Investors and policymakers rely on real interest rates for informed decisions regarding savings, investments, and monetary policy effectiveness.

How Inflation Impacts Interest Rates

Inflation directly reduces the real interest rate by eroding the purchasing power of nominal returns, making the nominal interest rate a key indicator of anticipated inflation. Central banks adjust nominal interest rates to control inflation, influencing borrowing costs and economic growth. Understanding the difference between nominal and real interest rates helps investors and policymakers gauge the true cost of loans and the real yield on savings in an inflationary environment.

Calculating Real Interest Rate: The Formula

The real interest rate is calculated by subtracting the inflation rate from the nominal interest rate, expressed as Real Interest Rate = Nominal Interest Rate - Inflation Rate. This formula adjusts the nominal rate to reflect the purchasing power of money over time, providing a more accurate measure of the cost of borrowing or the yield on investments. Understanding the real interest rate is crucial for evaluating economic policies, investment returns, and the true cost of credit.

Importance of Real Interest Rate in Economic Decisions

The real interest rate, adjusted for inflation, provides a more accurate measure of the true cost of borrowing and the real yield on investments compared to the nominal interest rate. It influences consumer spending, business investment decisions, and monetary policy effectiveness by reflecting the actual purchasing power of interest earnings. Understanding the real interest rate is crucial for investors and policymakers to assess economic conditions and make informed financial choices.

Effects of Nominal Interest Rate on Borrowers and Savers

Nominal interest rates directly impact borrowers by determining the actual amount of interest paid on loans, influencing borrowing costs and consumer spending. For savers, nominal rates affect the immediate return on deposits or fixed-income investments, though inflation can erode real value. The difference between nominal and real interest rates is crucial for understanding true purchasing power changes for both groups in an economy.

Role of Central Banks in Setting Interest Rates

Central banks influence the real interest rate by adjusting nominal interest rates to control inflation and stabilize economic growth. Through monetary policy tools such as open market operations and the policy rate, central banks directly affect borrowing costs and investment decisions. The gap between nominal and real interest rates reflects expected inflation, guiding central banks in balancing price stability with economic expansion.

Real Interest Rates and Investment Strategies

Real interest rates, which adjust nominal rates for inflation, provide a more accurate measure of the true cost of borrowing and the real yield on investments. Investors rely on real interest rates to evaluate the profitability of long-term projects, as they reflect the actual purchasing power gained or lost over time. Understanding fluctuations in real interest rates helps optimize investment strategies by aligning portfolio choices with inflation-adjusted returns.

Historical Trends: Real vs Nominal Interest Rates

Historical trends reveal that nominal interest rates tend to be higher than real interest rates due to the inclusion of expected inflation. Over the past century, nominal rates have fluctuated widely, peaking during high inflation periods such as the 1970s, while real interest rates have remained relatively stable or even negative during inflation surges. The divergence between nominal and real rates provides critical insights into inflation expectations and monetary policy effectiveness over time.

Implications for Policy and Financial Planning

Real interest rates, adjusted for inflation, provide a more accurate measure of the true cost of borrowing and the real yield on investments compared to nominal interest rates. Policymakers rely on real rates to assess the effectiveness of monetary policy, aiming to stimulate or cool the economy without being misled by inflation distortions. For financial planning, understanding real interest rates helps investors and borrowers make informed decisions about savings, loans, and portfolio returns in an inflation-adjusted context.

Real interest rate vs Nominal interest rate Infographic

difterm.com

difterm.com