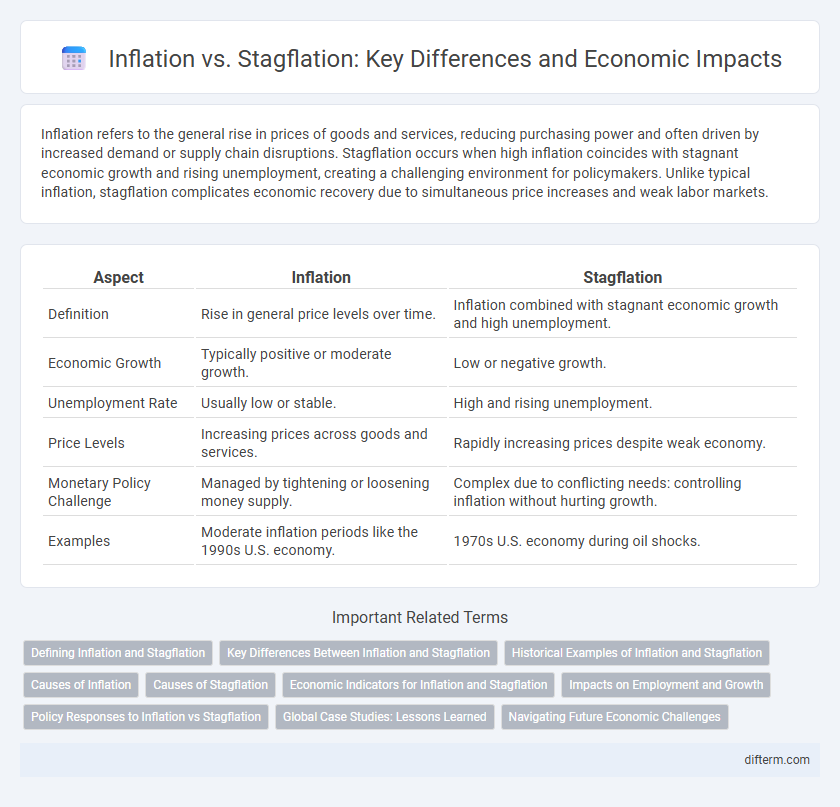

Inflation refers to the general rise in prices of goods and services, reducing purchasing power and often driven by increased demand or supply chain disruptions. Stagflation occurs when high inflation coincides with stagnant economic growth and rising unemployment, creating a challenging environment for policymakers. Unlike typical inflation, stagflation complicates economic recovery due to simultaneous price increases and weak labor markets.

Table of Comparison

| Aspect | Inflation | Stagflation |

|---|---|---|

| Definition | Rise in general price levels over time. | Inflation combined with stagnant economic growth and high unemployment. |

| Economic Growth | Typically positive or moderate growth. | Low or negative growth. |

| Unemployment Rate | Usually low or stable. | High and rising unemployment. |

| Price Levels | Increasing prices across goods and services. | Rapidly increasing prices despite weak economy. |

| Monetary Policy Challenge | Managed by tightening or loosening money supply. | Complex due to conflicting needs: controlling inflation without hurting growth. |

| Examples | Moderate inflation periods like the 1990s U.S. economy. | 1970s U.S. economy during oil shocks. |

Defining Inflation and Stagflation

Inflation represents a sustained increase in the general price level of goods and services, reducing purchasing power over time. Stagflation combines stagnant economic growth, high unemployment, and persistent inflation, creating a challenging environment for policymakers. While inflation typically occurs during economic expansion, stagflation arises when inflation persists despite economic stagnation or recession.

Key Differences Between Inflation and Stagflation

Inflation refers to the general increase in prices and decline in purchasing power, driven primarily by demand-pull or cost-push factors. Stagflation, a more severe economic condition, combines persistent high inflation with stagnant economic growth and rising unemployment, creating a challenging policy dilemma. Key differences include inflation's usual association with economic expansion versus stagflation's concurrent economic stagnation and deteriorating labor markets.

Historical Examples of Inflation and Stagflation

The 1970s U.S. economy exemplifies stagflation, marked by high inflation rates around 10% and stagnant economic growth due to oil price shocks and restrictive monetary policies. In contrast, the Weimar Republic in the 1920s experienced hyperinflation, with monthly inflation rates exceeding billions percent, leading to currency devaluation and economic collapse. These historical examples highlight distinct economic challenges: inflation eroding purchasing power and stagflation combining inflation with unemployment and slowed growth.

Causes of Inflation

Inflation primarily arises from demand-pull factors, where increased consumer spending outpaces supply, and cost-push factors, such as rising production expenses driven by higher wages or raw material prices. Monetary expansion, including excessive money supply growth by central banks, also fuels inflation by devaluing currency purchasing power. Supply chain disruptions and geopolitical tensions exacerbate cost pressures, further intensifying inflationary trends in the economy.

Causes of Stagflation

Stagflation arises when an economy experiences stagnant growth, high unemployment, and rising inflation simultaneously, often triggered by supply shocks such as sharp increases in oil prices. Cost-push inflation, driven by escalating wages and production costs, exacerbates stagflation by reducing aggregate supply. Monetary policies that excessively expand the money supply during supply constraints also contribute to the onset of stagflation.

Economic Indicators for Inflation and Stagflation

Inflation is indicated by rising consumer price index (CPI), increased wages, and higher demand-pull factors, reflecting overall economic growth. Stagflation combines high inflation with stagnant GDP growth and high unemployment rates, signaling a dysfunctional economy with supply-side shocks. Key economic indicators for stagflation include persistent inflation above 5%, unemployment rates exceeding 6%, and negative or zero percent GDP growth.

Impacts on Employment and Growth

Inflation typically erodes purchasing power, leading central banks to tighten monetary policy, which can slow economic growth but often preserves employment levels. Stagflation combines stagnant economic growth with high inflation, resulting in rising unemployment and reduced real wages, creating a challenging environment for policymakers. This dual pressure on both employment and growth undermines consumer confidence and investment, prolonging economic recovery.

Policy Responses to Inflation vs Stagflation

Monetary policy tightening, such as raising interest rates, effectively curbs inflation by slowing demand but risks exacerbating unemployment during stagflation. Fiscal stimulus designed to boost growth can worsen inflationary pressures, making it less suitable for stagflation scenarios. Targeted supply-side reforms and structural policies address stagflation by improving productivity and reducing bottlenecks without intensifying inflation.

Global Case Studies: Lessons Learned

Global case studies on inflation reveal that rapid price increases, when coupled with steady economic growth, often allow central banks to adjust monetary policies effectively. Stagflation, characterized by simultaneous high inflation and stagnant economic output as seen in the 1970s U.S. and recent crises in Zimbabwe and Venezuela, highlights the challenge of combating inflation without worsening unemployment. Lessons learned emphasize the importance of balanced fiscal policies and structural reforms to break the cycle of stagflation and restore sustainable growth.

Navigating Future Economic Challenges

Inflation signifies a general rise in prices fueled by increased demand or rising production costs, whereas stagflation combines persistent inflation with stagnant economic growth and high unemployment, posing complex challenges for policymakers. Navigating future economic challenges requires strategic monetary policies that balance inflation control without stifling growth, alongside targeted fiscal measures to stimulate productivity and employment. Understanding these distinctions helps governments and central banks design resilient frameworks to maintain economic stability amidst volatile global conditions.

Inflation vs Stagflation Infographic

difterm.com

difterm.com