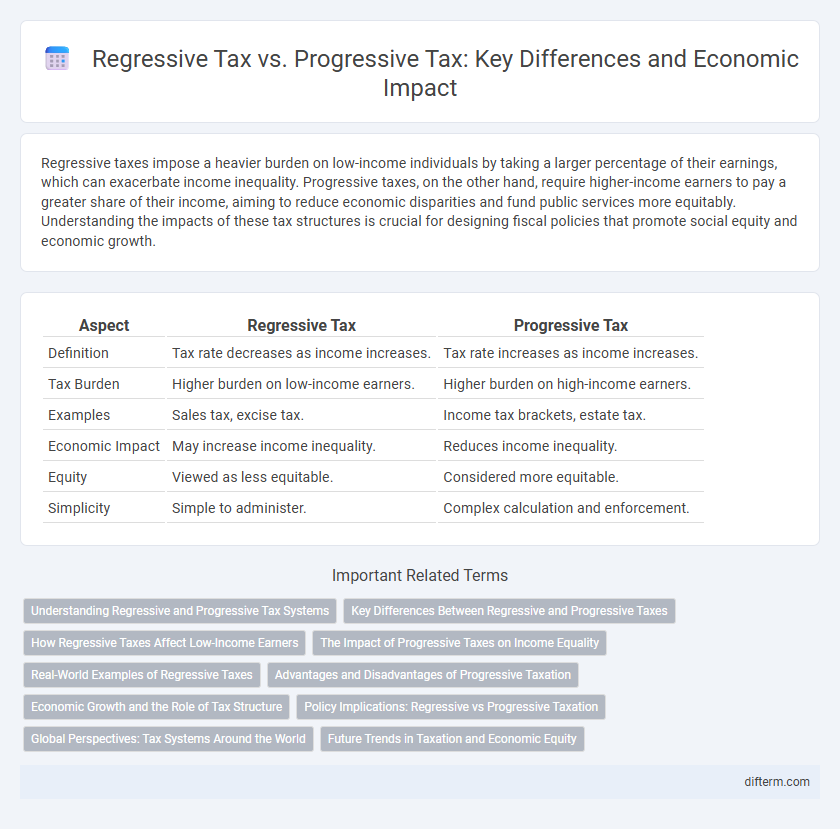

Regressive taxes impose a heavier burden on low-income individuals by taking a larger percentage of their earnings, which can exacerbate income inequality. Progressive taxes, on the other hand, require higher-income earners to pay a greater share of their income, aiming to reduce economic disparities and fund public services more equitably. Understanding the impacts of these tax structures is crucial for designing fiscal policies that promote social equity and economic growth.

Table of Comparison

| Aspect | Regressive Tax | Progressive Tax |

|---|---|---|

| Definition | Tax rate decreases as income increases. | Tax rate increases as income increases. |

| Tax Burden | Higher burden on low-income earners. | Higher burden on high-income earners. |

| Examples | Sales tax, excise tax. | Income tax brackets, estate tax. |

| Economic Impact | May increase income inequality. | Reduces income inequality. |

| Equity | Viewed as less equitable. | Considered more equitable. |

| Simplicity | Simple to administer. | Complex calculation and enforcement. |

Understanding Regressive and Progressive Tax Systems

Regressive tax systems impose a higher relative burden on lower-income individuals by taxing a smaller percentage of income as earnings increase, often through sales taxes or fixed fees. Progressive tax systems allocate a larger tax percentage to higher-income earners, typically via graduated income taxes, aiming to reduce income inequality and fund public services. Understanding the distinctions between regressive and progressive taxes is crucial for evaluating tax policies and their impact on economic equity and social welfare.

Key Differences Between Regressive and Progressive Taxes

Regressive taxes impose a higher burden on low-income earners by taxing a smaller percentage as income rises, while progressive taxes increase the tax rate as income increases, placing a greater burden on higher earners. Key differences include the equity impact, with regressive taxes often exacerbating income inequality, and progressive taxes promoting redistribution of wealth. Examples of regressive taxes are sales taxes and excise taxes, whereas income tax systems typically implement progressive tax rates.

How Regressive Taxes Affect Low-Income Earners

Regressive taxes, such as sales taxes and excise duties, disproportionately burden low-income earners by consuming a larger share of their limited income compared to wealthier individuals. This tax structure exacerbates economic inequality by reducing disposable income for essential needs, hindering savings and investment opportunities among lower-income households. Consequently, regressive taxation limits social mobility and undermines efforts to alleviate poverty within the economy.

The Impact of Progressive Taxes on Income Equality

Progressive taxes significantly reduce income inequality by imposing higher tax rates on top earners, which redistributes wealth more equitably across society. Data from OECD countries show that progressive tax systems lower the Gini coefficient, a measure of income inequality, by as much as 20 to 30 percent. This redistribution funds social programs and public services that disproportionately benefit lower-income households, enhancing overall economic fairness.

Real-World Examples of Regressive Taxes

Sales taxes on essential goods, such as groceries and gasoline, serve as common real-world examples of regressive taxes because they take a larger percentage of income from low-income households than from high-income earners. Payroll taxes, including Social Security contributions in the United States, also exhibit regressive characteristics since they are capped at a certain income level, resulting in higher effective rates for lower earners. These tax structures disproportionately impact lower-income individuals, reducing their discretionary income and exacerbating economic inequality.

Advantages and Disadvantages of Progressive Taxation

Progressive taxation benefits economic equity by taxing higher incomes at increasing rates, which helps reduce income inequality and funds public services effectively. However, it may discourage high earners from investing or working harder due to higher marginal tax rates, potentially slowing economic growth. Critics argue that complex progressive tax systems can increase administrative costs and create loopholes that some taxpayers exploit.

Economic Growth and the Role of Tax Structure

Regressive taxes, which impose a higher burden on lower-income individuals, can hinder economic growth by reducing disposable income and consumer spending, key drivers of demand. Progressive tax structures, by taxing higher incomes at increased rates, enable wealth redistribution and support public investments that stimulate growth and enhance social equity. The optimal tax system balances revenue generation with incentives for productivity, innovation, and consumption, fostering sustainable economic expansion.

Policy Implications: Regressive vs Progressive Taxation

Regressive taxation disproportionately impacts lower-income households, potentially exacerbating income inequality and reducing overall economic mobility. Progressive tax policies, by taxing higher incomes at greater rates, aim to promote redistributive effects that can fund social programs and public services, enhancing economic equity. Policymakers must balance revenue generation with social welfare goals, considering how tax structures influence consumption, investment, and economic growth.

Global Perspectives: Tax Systems Around the World

Regressive tax systems, commonly found in developing countries, place a higher relative burden on low-income earners through consumption taxes like VAT, exacerbating income inequality. Progressive tax models, prevalent in many developed nations such as Sweden and Canada, impose higher rates on wealthier individuals to promote economic equity and fund comprehensive social programs. Global tax policies reflect diverse economic structures and social goals, influencing wealth distribution and public service financing worldwide.

Future Trends in Taxation and Economic Equity

Future trends in taxation increasingly emphasize progressive tax structures that aim to reduce economic inequality by imposing higher rates on wealthier individuals and corporations. Advances in data analytics and digital reporting enhance the efficiency and transparency of tax systems, enabling more targeted enforcement and dynamic adjustment of tax brackets. Policymakers are exploring hybrid models combining elements of regressive taxes, like consumption taxes, with progressive mechanisms to balance revenue generation and equitable wealth distribution.

Regressive tax vs Progressive tax Infographic

difterm.com

difterm.com