Short-run aggregate supply (SRAS) reflects production levels when some input prices, such as wages, are sticky and do not adjust immediately to economic changes, leading to fluctuations in output and employment. Long-run aggregate supply (LRAS), in contrast, represents the economy's full productive capacity when all prices and wages are flexible, resulting in output determined solely by factors like technology, labor, and capital. Understanding the distinction between SRAS and LRAS is crucial for analyzing economic policies and their impact on inflation and growth.

Table of Comparison

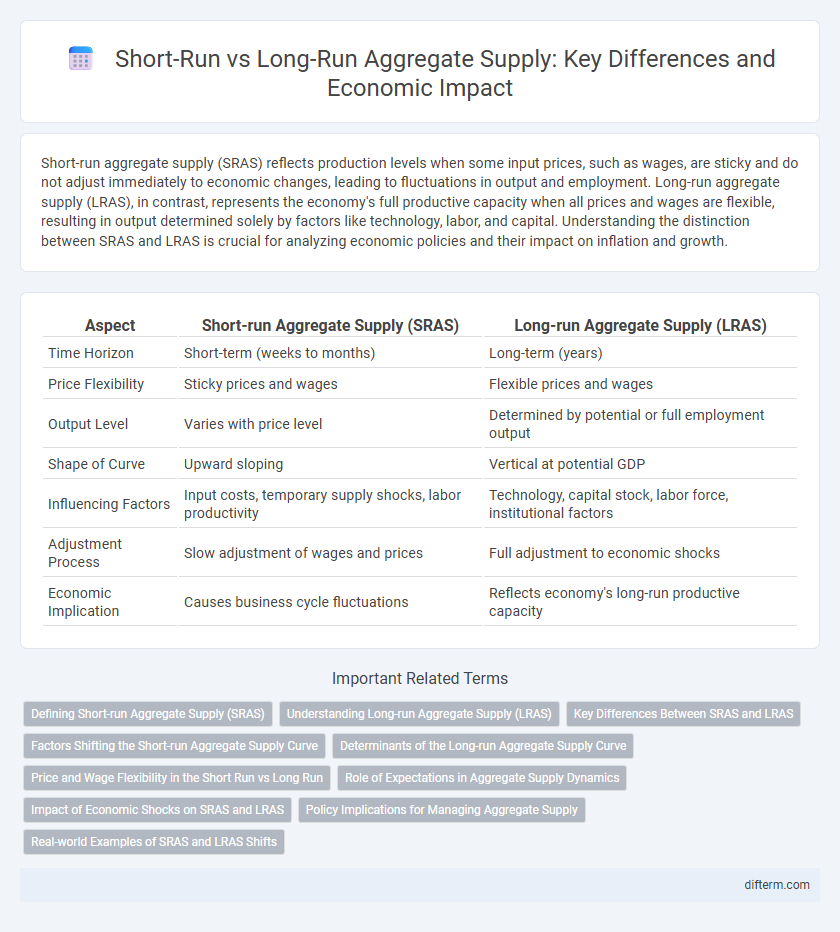

| Aspect | Short-run Aggregate Supply (SRAS) | Long-run Aggregate Supply (LRAS) |

|---|---|---|

| Time Horizon | Short-term (weeks to months) | Long-term (years) |

| Price Flexibility | Sticky prices and wages | Flexible prices and wages |

| Output Level | Varies with price level | Determined by potential or full employment output |

| Shape of Curve | Upward sloping | Vertical at potential GDP |

| Influencing Factors | Input costs, temporary supply shocks, labor productivity | Technology, capital stock, labor force, institutional factors |

| Adjustment Process | Slow adjustment of wages and prices | Full adjustment to economic shocks |

| Economic Implication | Causes business cycle fluctuations | Reflects economy's long-run productive capacity |

Defining Short-run Aggregate Supply (SRAS)

Short-run Aggregate Supply (SRAS) represents the total quantity of goods and services that firms in an economy are willing to produce at different price levels while some input prices remain fixed. In the short run, resource prices like wages and raw materials are sticky, causing SRAS to slope upward as higher prices increase profitability and output. This contrasts with Long-run Aggregate Supply (LRAS), where all input prices are variable, leading to a vertical supply curve reflecting the economy's maximum sustainable output.

Understanding Long-run Aggregate Supply (LRAS)

Long-run Aggregate Supply (LRAS) represents the total output an economy can produce when utilizing all resources efficiently at natural employment levels, independent of price changes. LRAS is vertical on the aggregate supply curve graph, indicating that in the long run, production depends on factors like technology, capital stock, labor force, and institutional structures rather than price levels. Understanding LRAS is crucial for analyzing economic growth potential, supply-side policies, and the long-term impacts of productivity improvements.

Key Differences Between SRAS and LRAS

Short-run aggregate supply (SRAS) is upward sloping because input prices, particularly wages, are sticky and do not adjust immediately to changes in the price level, leading to changes in output when demand shifts. In contrast, long-run aggregate supply (LRAS) is vertical at the economy's full employment output, reflecting the idea that in the long term, output is determined by factors like technology, capital stock, and labor force rather than price levels. The key difference lies in price flexibility and resource utilization: SRAS shows how output reacts to price changes with some input rigidity, while LRAS represents an economy's maximum sustainable output independent of price fluctuations.

Factors Shifting the Short-run Aggregate Supply Curve

Factors shifting the short-run aggregate supply (SRAS) curve include changes in input prices, such as wages and raw materials, which directly affect production costs. Supply shocks, like sudden increases in oil prices or natural disasters, disrupt production capacity and shift the SRAS curve leftward. Technological advancements and improvements in productivity reduce costs, shifting the SRAS curve to the right and increasing output in the short run.

Determinants of the Long-run Aggregate Supply Curve

The long-run aggregate supply (LRAS) curve is determined by factors that influence the economy's productive capacity, including technology advancements, labor force size and skills, capital stock, and institutional structures such as property rights and regulatory environment. Unlike the short-run aggregate supply (SRAS), which is influenced by price and wage rigidities, the LRAS reflects the economy's maximum sustainable output when all resources are fully employed. Improvements in human capital, innovation, and capital investment shift the LRAS curve outward, signaling economic growth potential independent of price level changes.

Price and Wage Flexibility in the Short Run vs Long Run

Short-run aggregate supply (SRAS) curves are upward sloping because wages and prices are sticky, causing output to vary with price levels when firms adjust production in response to demand changes. In contrast, long-run aggregate supply (LRAS) is vertical since wages and prices are fully flexible, allowing the economy to operate at full employment output regardless of price level fluctuations. Wage rigidity in the short run leads to temporary deviations from potential GDP, whereas price and wage flexibility in the long run restore equilibrium and natural output levels.

Role of Expectations in Aggregate Supply Dynamics

Short-run aggregate supply (SRAS) is influenced by price expectations, as firms adjust output when actual prices deviate from expected price levels, leading to temporary supply shifts. In contrast, long-run aggregate supply (LRAS) reflects the economy's potential output, where expectations fully adjust, and output is determined by factors like technology and resources rather than price levels. Adaptive and rational expectations shape the speed at which SRAS converges to LRAS, affecting inflation dynamics and wage setting in the macroeconomic environment.

Impact of Economic Shocks on SRAS and LRAS

Economic shocks cause immediate shifts in Short-run Aggregate Supply (SRAS) due to price and wage rigidities, affecting output and inflation temporarily. In the Long-run Aggregate Supply (LRAS), the economy adjusts through changes in resource allocation, technology, and capital stock, restoring output to its potential level. Persistent shocks can alter LRAS by influencing productivity and the economy's capacity for growth.

Policy Implications for Managing Aggregate Supply

Short-run Aggregate Supply (SRAS) is influenced by nominal wage rigidity and input price fluctuations, requiring policies that stabilize wages and control costs to manage inflation and output effectively. Long-run Aggregate Supply (LRAS) reflects the economy's productive capacity determined by factors such as technology, labor, and capital, emphasizing supply-side policies like investment in infrastructure, education, and innovation to enhance growth potential. Policymakers must balance demand management with structural reforms to ensure sustainable output and price stability over time.

Real-world Examples of SRAS and LRAS Shifts

Short-run aggregate supply (SRAS) shifts can be observed during events like oil price shocks in the 1970s, which caused sudden increases in production costs and moved the SRAS curve leftward, resulting in stagflation. In contrast, long-run aggregate supply (LRAS) shifts occur due to fundamental changes such as technological innovations or increases in labor productivity, exemplified by the post-World War II economic boom driven by advancements in manufacturing processes. These real-world examples highlight how SRAS is influenced by temporary supply constraints, while LRAS reflects the economy's sustainable productive capacity.

Short-run Aggregate Supply vs Long-run Aggregate Supply Infographic

difterm.com

difterm.com