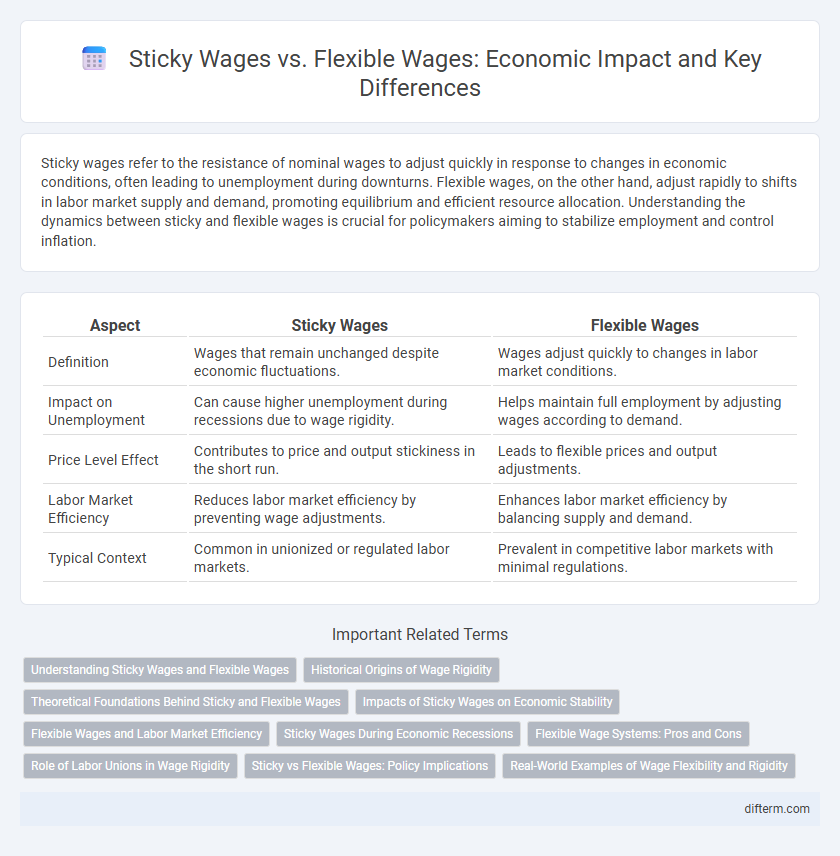

Sticky wages refer to the resistance of nominal wages to adjust quickly in response to changes in economic conditions, often leading to unemployment during downturns. Flexible wages, on the other hand, adjust rapidly to shifts in labor market supply and demand, promoting equilibrium and efficient resource allocation. Understanding the dynamics between sticky and flexible wages is crucial for policymakers aiming to stabilize employment and control inflation.

Table of Comparison

| Aspect | Sticky Wages | Flexible Wages |

|---|---|---|

| Definition | Wages that remain unchanged despite economic fluctuations. | Wages adjust quickly to changes in labor market conditions. |

| Impact on Unemployment | Can cause higher unemployment during recessions due to wage rigidity. | Helps maintain full employment by adjusting wages according to demand. |

| Price Level Effect | Contributes to price and output stickiness in the short run. | Leads to flexible prices and output adjustments. |

| Labor Market Efficiency | Reduces labor market efficiency by preventing wage adjustments. | Enhances labor market efficiency by balancing supply and demand. |

| Typical Context | Common in unionized or regulated labor markets. | Prevalent in competitive labor markets with minimal regulations. |

Understanding Sticky Wages and Flexible Wages

Sticky wages refer to wage rates that are slow to adjust in response to changes in labor market conditions, often due to contracts, minimum wage laws, or social norms, causing unemployment or labor market inefficiencies during economic fluctuations. Flexible wages fluctuate readily based on supply and demand, allowing labor markets to clear more efficiently and reduce unemployment during economic shifts. Understanding the differences highlights the impact of wage rigidity on monetary policy effectiveness and labor market dynamics.

Historical Origins of Wage Rigidity

Wage rigidity, evident in sticky wages, has origins tracing back to early 20th-century labor market structures shaped by unionization and long-term employment contracts, which limited wage adjustments despite economic fluctuations. Flexible wages emerged later, influenced by market liberalization and technological advancements promoting real-time wage responsiveness to supply and demand. Historical wage rigidity underpinned many Keynesian economic models explaining unemployment persistence during recessions.

Theoretical Foundations Behind Sticky and Flexible Wages

Sticky wages arise from contracts, long-term employment agreements, and institutional factors that prevent wages from adjusting quickly to economic fluctuations, causing labor market rigidities. Flexible wages, often emphasized in classical economic models, adjust rapidly based on supply and demand dynamics, enabling quicker labor market equilibrium. Theoretical foundations blend Keynesian perspectives highlighting wage rigidity with neoclassical models advocating wage flexibility for optimal resource allocation.

Impacts of Sticky Wages on Economic Stability

Sticky wages often hinder labor market adjustments during economic fluctuations, leading to prolonged unemployment and reduced overall economic efficiency. This rigidity in wage structures can exacerbate recessions by limiting firms' ability to reduce costs and retain employees, which slows down the recovery process. Persistent wage stickiness contributes to economic instability by creating mismatches between labor demand and supply, affecting inflation dynamics and productivity growth.

Flexible Wages and Labor Market Efficiency

Flexible wages enhance labor market efficiency by allowing wages to adjust according to supply and demand, reducing unemployment and mismatches between job seekers and vacancies. This wage flexibility enables businesses to respond swiftly to economic fluctuations, optimizing resource allocation and promoting competitive compensation aligned with productivity. Empirical studies demonstrate that labor markets with flexible wage structures typically exhibit higher employment levels and faster recovery from economic shocks.

Sticky Wages During Economic Recessions

Sticky wages refer to the resistance of nominal wages to adjust downward during economic recessions, causing prolonged unemployment and reduced labor market efficiency. This wage rigidity occurs due to long-term contracts, minimum wage laws, and worker morale concerns, which prevent wages from decreasing despite falling demand. As a result, sticky wages exacerbate recessions by limiting firms' ability to reduce labor costs and maintain employment levels.

Flexible Wage Systems: Pros and Cons

Flexible wage systems enable companies to adjust employee pay based on market conditions, boosting competitiveness and aligning labor costs with business performance. They promote workforce adaptability, incentivize productivity, and can attract talent by offering performance-based rewards. However, such systems may lead to income uncertainty for workers, potentially reducing job satisfaction and increasing turnover rates.

Role of Labor Unions in Wage Rigidity

Labor unions play a significant role in creating sticky wages by negotiating collective bargaining agreements that set minimum wage levels and limit wage reductions, thereby maintaining wage rigidity even during economic downturns. This wage stickiness can protect workers' income but may reduce labor market flexibility, potentially leading to higher unemployment rates when firms cannot adjust wages downward. Empirical studies indicate that unionized sectors often exhibit more pronounced wage rigidity compared to non-unionized sectors, influencing overall macroeconomic wage dynamics.

Sticky vs Flexible Wages: Policy Implications

Sticky wages limit labor market adjustments during economic fluctuations, often leading to prolonged unemployment and reduced output after shocks. Flexible wages enable quicker adaptations by allowing wages to adjust according to supply and demand, promoting employment stability and economic resilience. Policymakers should consider wage flexibility mechanisms, such as variable pay structures or targeted subsidies, to enhance labor market responsiveness and stimulate recovery in downturns.

Real-World Examples of Wage Flexibility and Rigidity

Japan exemplifies wage rigidity, where long-term employment contracts and seniority-based pay limit wage adjustments despite economic fluctuations, contributing to prolonged periods of low inflation. In contrast, the United States demonstrates wage flexibility, with market-driven compensation changes reflecting labor demand and productivity shifts, as seen during post-recession recoveries where wages adapt quickly to economic conditions. Germany's dual system combines elements of rigidity and flexibility, maintaining collective bargaining agreements that set wage floors while allowing firms some discretion in adjusting pay based on local economic circumstances.

Sticky wages vs Flexible wages Infographic

difterm.com

difterm.com