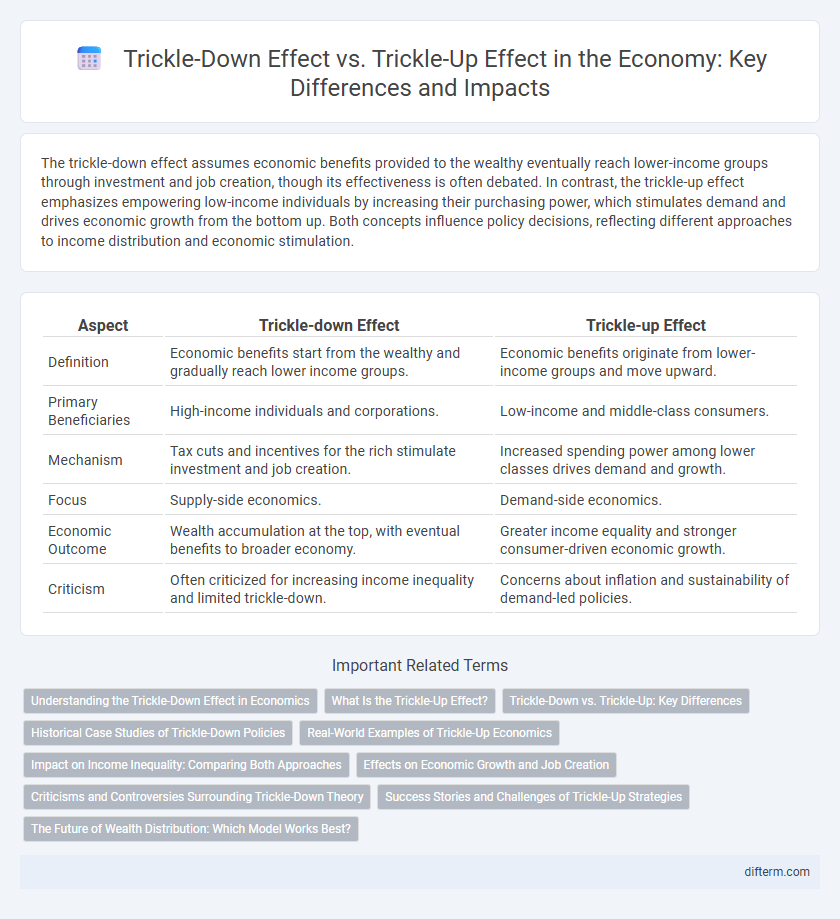

The trickle-down effect assumes economic benefits provided to the wealthy eventually reach lower-income groups through investment and job creation, though its effectiveness is often debated. In contrast, the trickle-up effect emphasizes empowering low-income individuals by increasing their purchasing power, which stimulates demand and drives economic growth from the bottom up. Both concepts influence policy decisions, reflecting different approaches to income distribution and economic stimulation.

Table of Comparison

| Aspect | Trickle-down Effect | Trickle-up Effect |

|---|---|---|

| Definition | Economic benefits start from the wealthy and gradually reach lower income groups. | Economic benefits originate from lower-income groups and move upward. |

| Primary Beneficiaries | High-income individuals and corporations. | Low-income and middle-class consumers. |

| Mechanism | Tax cuts and incentives for the rich stimulate investment and job creation. | Increased spending power among lower classes drives demand and growth. |

| Focus | Supply-side economics. | Demand-side economics. |

| Economic Outcome | Wealth accumulation at the top, with eventual benefits to broader economy. | Greater income equality and stronger consumer-driven economic growth. |

| Criticism | Often criticized for increasing income inequality and limited trickle-down. | Concerns about inflation and sustainability of demand-led policies. |

Understanding the Trickle-Down Effect in Economics

The trickle-down effect in economics posits that benefits provided to the wealthy or businesses, such as tax cuts or subsidies, will eventually stimulate economic growth and benefit lower-income individuals through job creation and increased spending. Critics argue that this effect often leads to wealth concentration at the top without significant improvements for the broader population. Empirical studies on GDP growth, employment rates, and income distribution frequently debate the actual impact and efficacy of trickle-down policies.

What Is the Trickle-Up Effect?

The trickle-up effect describes economic growth driven by increased spending and investment from lower- and middle-income individuals, which subsequently stimulates demand for goods and services throughout the economy. This approach contrasts with the trickle-down effect by emphasizing how improved financial conditions at the base of the economic pyramid can generate broader economic benefits. Empirical studies highlight that boosting wages and purchasing power for lower-income groups can lead to higher overall consumption, fueling business expansion and job creation.

Trickle-Down vs. Trickle-Up: Key Differences

Trickle-down economics emphasizes tax cuts and benefits for the wealthy and businesses, aiming to stimulate investment and job creation that eventually benefits lower-income groups. Trickle-up economics focuses on boosting the purchasing power of lower- and middle-income individuals through direct financial support, wage increases, and social programs, driving demand and economic growth from the bottom up. The key difference lies in the target beneficiary group and the mechanism by which economic benefits are expected to cascade through the economy.

Historical Case Studies of Trickle-Down Policies

Historical case studies of trickle-down policies, such as the Reaganomics era in the 1980s and the Bush tax cuts in the early 2000s, demonstrate varied economic outcomes where tax reductions for the wealthy aimed to stimulate investment and job creation. Evidence indicates that while some sectors experienced growth, income inequality often widened, limiting broad-based economic benefits. Empirical analyses of these policies reveal mixed effects on GDP growth and job markets, challenging the universal efficacy of trickle-down economics.

Real-World Examples of Trickle-Up Economics

Trickle-up economics emphasizes boosting the purchasing power of lower and middle-income households to stimulate demand and economic growth, as seen in the American Recovery and Reinvestment Act of 2009, which increased consumer spending through direct aid and tax credits. In contrast to trickle-down policies favoring tax cuts for the wealthy, Mexico's Progresa/Oportunidades program demonstrated success by providing conditional cash transfers to poor families, resulting in improved education, health outcomes, and economic mobility. These examples highlight how targeted support for lower-income groups can generate sustainable growth and reduce income inequality in real-world economies.

Impact on Income Inequality: Comparing Both Approaches

The trickle-down effect posits that benefits to the wealthy lead to broader economic growth, but it often results in increased income inequality as gains concentrate at the top. In contrast, the trickle-up effect involves bolstering lower-income groups, which can reduce income disparity by enhancing purchasing power and stimulating demand in the economy. Empirical studies show that policies prioritizing the trickle-up approach tend to foster more equitable wealth distribution compared to the limited benefits trickle-down economics provides for lower-income populations.

Effects on Economic Growth and Job Creation

The trickle-down effect posits that tax cuts and benefits for the wealthy stimulate investment and business expansion, boosting economic growth and job creation primarily in capital-intensive sectors. In contrast, the trickle-up effect emphasizes increasing wages and spending power for lower-income groups, driving demand-led growth and generating jobs across consumer-driven industries. Empirical studies suggest that the trickle-up approach more directly enhances aggregate demand, leading to sustained employment growth and broader economic development.

Criticisms and Controversies Surrounding Trickle-Down Theory

Trickle-down theory faces significant criticism for disproportionately benefiting the wealthy while failing to generate sustainable economic growth for lower-income groups, often exacerbating income inequality. Critics argue the supposed benefits do not effectively "trickle down" to the broader population, leading to minimal improvements in wages or employment opportunities for working-class individuals. Empirical studies highlight that tax cuts and subsidies favoring corporations and rich individuals frequently result in wealth accumulation at the top, rather than stimulating widespread economic expansion.

Success Stories and Challenges of Trickle-Up Strategies

Trickle-up economic strategies have demonstrated success by empowering low-income individuals through microfinance initiatives, boosting entrepreneurship, and fostering local businesses that stimulate broader economic growth. Challenges include limited access to capital, infrastructural deficits, and the slow pace of wealth redistribution compared to traditional trickle-down models. Success stories from countries like Bangladesh and Kenya highlight how grassroots financial inclusion can drive sustainable development and reduce poverty levels effectively.

The Future of Wealth Distribution: Which Model Works Best?

The future of wealth distribution hinges on evaluating the efficacy of the trickle-down effect, where benefits to the wealthy are expected to stimulate broader economic growth, versus the trickle-up effect, which emphasizes empowering lower-income groups to drive demand and innovation. Research indicates that trickle-up approaches, including targeted social investments and wage growth, tend to promote more equitable and sustainable economic development. Policymakers increasingly favor models prioritizing income redistribution and inclusive growth to address widening wealth disparities and ensure long-term economic stability.

Trickle-down effect vs Trickle-up effect Infographic

difterm.com

difterm.com