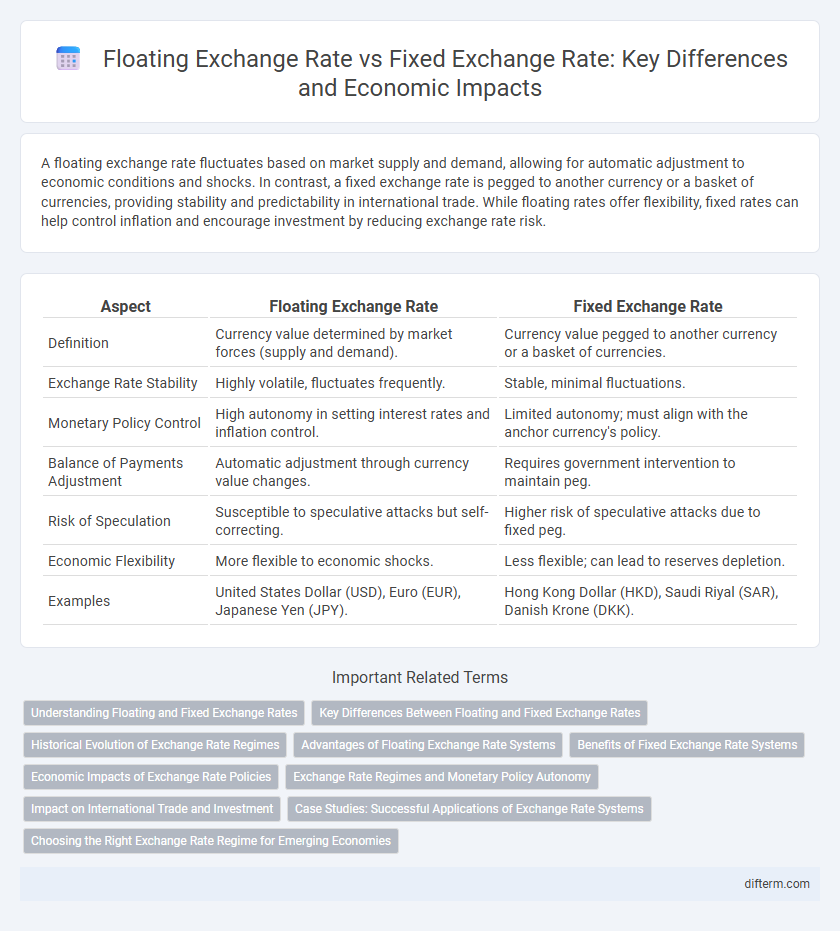

A floating exchange rate fluctuates based on market supply and demand, allowing for automatic adjustment to economic conditions and shocks. In contrast, a fixed exchange rate is pegged to another currency or a basket of currencies, providing stability and predictability in international trade. While floating rates offer flexibility, fixed rates can help control inflation and encourage investment by reducing exchange rate risk.

Table of Comparison

| Aspect | Floating Exchange Rate | Fixed Exchange Rate |

|---|---|---|

| Definition | Currency value determined by market forces (supply and demand). | Currency value pegged to another currency or a basket of currencies. |

| Exchange Rate Stability | Highly volatile, fluctuates frequently. | Stable, minimal fluctuations. |

| Monetary Policy Control | High autonomy in setting interest rates and inflation control. | Limited autonomy; must align with the anchor currency's policy. |

| Balance of Payments Adjustment | Automatic adjustment through currency value changes. | Requires government intervention to maintain peg. |

| Risk of Speculation | Susceptible to speculative attacks but self-correcting. | Higher risk of speculative attacks due to fixed peg. |

| Economic Flexibility | More flexible to economic shocks. | Less flexible; can lead to reserves depletion. |

| Examples | United States Dollar (USD), Euro (EUR), Japanese Yen (JPY). | Hong Kong Dollar (HKD), Saudi Riyal (SAR), Danish Krone (DKK). |

Understanding Floating and Fixed Exchange Rates

Floating exchange rates fluctuate based on market supply and demand, allowing currency values to adjust dynamically with economic conditions. Fixed exchange rates are pegged to another currency or basket of currencies, providing stability but requiring central bank intervention to maintain the peg. Understanding these regimes involves analyzing their impact on trade balance, inflation control, and monetary policy autonomy.

Key Differences Between Floating and Fixed Exchange Rates

Floating exchange rates adjust continuously based on supply and demand in the foreign exchange market, allowing automatic stabilization of trade imbalances and monetary policy flexibility. Fixed exchange rates are pegged to a specific value, typically a major currency or commodity like gold, providing currency stability and predictability but requiring substantial foreign reserves to maintain the peg. The choice between floating and fixed exchange rate regimes influences inflation control, exchange rate volatility, and a country's ability to respond to external economic shocks.

Historical Evolution of Exchange Rate Regimes

The historical evolution of exchange rate regimes reveals a transition from the gold standard in the 19th century to the Bretton Woods system's fixed exchange rates post-World War II, followed by the widespread adoption of floating exchange rates after the 1971 collapse of Bretton Woods. Fixed exchange rate systems historically promoted stability in international trade and investment but struggled with maintaining equilibrium during economic shocks, leading to periodic realignments or collapses. Floating exchange rates gained prominence due to their flexibility in adjusting currency values based on market forces, allowing countries greater autonomy in monetary policy and better responses to external economic fluctuations.

Advantages of Floating Exchange Rate Systems

Floating exchange rate systems offer advantage in automatically adjusting currency values according to market demand, which helps absorb external economic shocks and maintain balance of payments equilibrium. They provide monetary policy independence, allowing countries to implement policies tailored to domestic economic conditions without being constrained by maintaining a fixed exchange rate. Currency flexibility under floating regimes facilitates competitiveness in international trade by reflecting real economic fundamentals and preventing prolonged misalignment.

Benefits of Fixed Exchange Rate Systems

Fixed exchange rate systems provide economic stability by minimizing exchange rate volatility, which encourages international trade and investment. They help maintain low inflation by anchoring a country's currency to a stable foreign currency, creating predictability for businesses and consumers. Governments can foster investor confidence and reduce currency speculation through consistent exchange rate policies under fixed regimes.

Economic Impacts of Exchange Rate Policies

Floating exchange rate systems allow currencies to fluctuate based on market forces, enhancing a country's ability to respond to external economic shocks and maintain monetary policy autonomy. Fixed exchange rate regimes provide exchange rate stability, which can reduce inflation uncertainty and promote international trade and investment by eliminating currency risk. However, fixed rates require substantial foreign exchange reserves to defend the peg, and misalignments can lead to balance of payments crises or loss of monetary policy independence.

Exchange Rate Regimes and Monetary Policy Autonomy

Floating exchange rate regimes allow currencies to fluctuate according to market forces, providing countries greater monetary policy autonomy to adjust interest rates and control inflation without defending a fixed rate. Fixed exchange rate regimes peg a country's currency to another currency or basket, reducing exchange rate volatility but constraining monetary policy since central banks must maintain the peg through currency interventions. Exchange rate flexibility in floating systems facilitates independent monetary policy, while fixed systems prioritize exchange rate stability at the cost of reduced policy autonomy.

Impact on International Trade and Investment

Floating exchange rates provide flexibility in currency valuation, allowing markets to adjust naturally to economic conditions, which can promote international trade by reducing the risk of persistent misalignments. Fixed exchange rates offer stability and predictability for investors and traders, encouraging long-term contracts and foreign direct investment by minimizing currency risk. However, fixed regimes may lead to imbalances and speculative attacks, potentially disrupting trade and investment if adjustments become necessary.

Case Studies: Successful Applications of Exchange Rate Systems

The successful application of floating exchange rates is exemplified by the United States since the 1970s, where market-driven currency valuation has promoted flexibility and economic resilience. In contrast, Hong Kong's fixed exchange rate system has maintained currency stability through a linked exchange rate mechanism, supporting investor confidence and low inflation. These cases demonstrate how tailored exchange rate regimes can stabilize economies and foster growth by aligning monetary policy with specific national economic goals.

Choosing the Right Exchange Rate Regime for Emerging Economies

Emerging economies must balance economic stability and flexibility when choosing between floating and fixed exchange rate regimes. Floating exchange rates offer automatic adjustment to external shocks, enhancing monetary policy autonomy but may lead to higher volatility and uncertainty for trade and investment. Fixed exchange rates provide exchange rate stability and can attract foreign investment but require substantial foreign reserves and limit independent monetary policy, increasing vulnerability to external shocks.

Floating exchange rate vs Fixed exchange rate Infographic

difterm.com

difterm.com