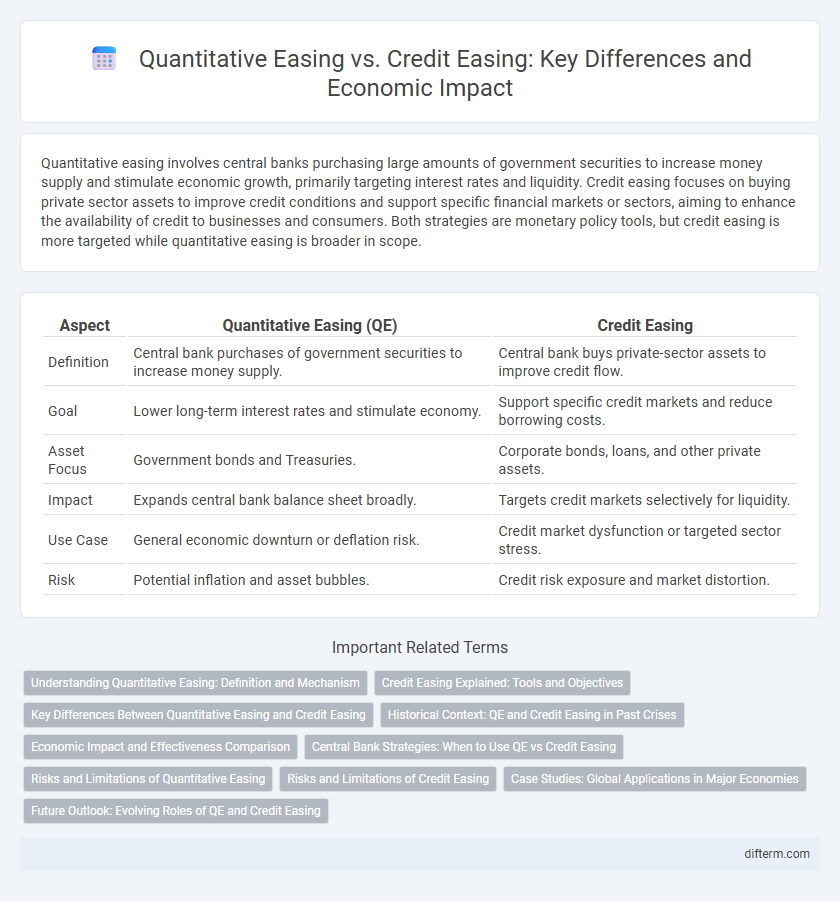

Quantitative easing involves central banks purchasing large amounts of government securities to increase money supply and stimulate economic growth, primarily targeting interest rates and liquidity. Credit easing focuses on buying private sector assets to improve credit conditions and support specific financial markets or sectors, aiming to enhance the availability of credit to businesses and consumers. Both strategies are monetary policy tools, but credit easing is more targeted while quantitative easing is broader in scope.

Table of Comparison

| Aspect | Quantitative Easing (QE) | Credit Easing |

|---|---|---|

| Definition | Central bank purchases of government securities to increase money supply. | Central bank buys private-sector assets to improve credit flow. |

| Goal | Lower long-term interest rates and stimulate economy. | Support specific credit markets and reduce borrowing costs. |

| Asset Focus | Government bonds and Treasuries. | Corporate bonds, loans, and other private assets. |

| Impact | Expands central bank balance sheet broadly. | Targets credit markets selectively for liquidity. |

| Use Case | General economic downturn or deflation risk. | Credit market dysfunction or targeted sector stress. |

| Risk | Potential inflation and asset bubbles. | Credit risk exposure and market distortion. |

Understanding Quantitative Easing: Definition and Mechanism

Quantitative easing (QE) is a monetary policy tool used by central banks to stimulate the economy by purchasing long-term securities, thereby increasing the money supply and lowering interest rates. This mechanism enhances liquidity and encourages borrowing and investment when traditional policy rates are near zero. Unlike credit easing, which targets specific credit markets or asset classes to improve credit flow, QE focuses broadly on expanding overall financial conditions.

Credit Easing Explained: Tools and Objectives

Credit easing involves central banks purchasing specific types of financial assets, such as corporate bonds or mortgage-backed securities, to improve liquidity and stimulate targeted credit markets. Unlike broad quantitative easing, credit easing targets the credit conditions of particular sectors to enhance lending and economic stability. Key tools include asset purchases and support for financial institutions to promote credit flow and reduce borrowing costs in stressed markets.

Key Differences Between Quantitative Easing and Credit Easing

Quantitative easing involves central banks purchasing large volumes of government bonds to increase money supply and lower interest rates across the economy. Credit easing targets specific credit markets by buying private sector assets like corporate bonds or mortgage-backed securities to improve liquidity in troubled areas. The key difference lies in quantitative easing's broad market impact versus credit easing's focused approach on credit conditions and financial stability.

Historical Context: QE and Credit Easing in Past Crises

Quantitative easing (QE) was extensively employed during the 2008 global financial crisis, where central banks like the Federal Reserve purchased large-scale government securities to inject liquidity and stabilize financial markets. Credit easing, a more targeted approach, focused on purchasing private sector assets to improve credit flow to specific sectors, as seen during Japan's prolonged stagnation in the 1990s. Both strategies emerged as unconventional monetary policies in response to limited interest rate policy effectiveness during severe economic downturns.

Economic Impact and Effectiveness Comparison

Quantitative easing (QE) involves large-scale asset purchases to increase money supply and lower long-term interest rates, stimulating economic growth during recessions. Credit easing targets specific credit markets by purchasing particular assets, improving liquidity and credit flow in struggling sectors without drastically increasing overall monetary base. QE broadly boosts aggregate demand, while credit easing offers more precise interventions, with effectiveness depending on the financial system's condition and credit market dysfunction severity.

Central Bank Strategies: When to Use QE vs Credit Easing

Quantitative easing (QE) involves large-scale asset purchases by central banks to inject liquidity and stimulate broad economic activity during periods of severe downturn or deflationary pressure. Credit easing targets specific credit markets by purchasing particular types of assets to improve liquidity and credit flow in stressed sectors without expanding the overall money supply as aggressively as QE. Central banks deploy QE during systemic crises to stabilize the financial system broadly, whereas credit easing is used in sector-specific distress to support credit market functioning and encourage targeted lending.

Risks and Limitations of Quantitative Easing

Quantitative easing (QE) poses risks such as asset bubbles, increased income inequality, and excessive risk-taking by investors due to prolonged low interest rates. Its limitations include diminishing returns over time and difficulty in directly stimulating lending to the real economy, as banks may hoard reserves instead of extending credit. Unlike credit easing, which targets specific credit markets to improve liquidity, QE's broad approach can lead to distorted financial markets and challenges in unwinding large central bank balance sheets.

Risks and Limitations of Credit Easing

Credit easing involves central banks purchasing private sector assets to improve liquidity, but it carries risks such as asset price inflation and potential market distortions. Unlike quantitative easing, its impact may be limited by the difficulty of targeting specific credit markets and the risk of misallocating capital. Persistent reliance on credit easing can also undermine financial stability by encouraging excessive risk-taking and reducing incentives for structural reforms.

Case Studies: Global Applications in Major Economies

Quantitative easing (QE) and credit easing have been pivotal in stabilizing major economies like the United States, Eurozone, and Japan during financial crises by expanding central bank balance sheets to inject liquidity. In the U.S., QE involved large-scale purchases of Treasury securities and mortgage-backed assets to lower long-term interest rates, while Japan's credit easing targeted specific private-sector credit markets to revive credit flows. The European Central Bank combined both strategies by purchasing sovereign bonds and targeted corporate bonds to address fragmented credit markets and stimulate economic growth across the Eurozone.

Future Outlook: Evolving Roles of QE and Credit Easing

Quantitative easing (QE) and credit easing will increasingly diverge in central bank strategies as economies face varied recovery paths and inflation pressures. QE is expected to taper as inflation targets stabilize, while credit easing will gain prominence to support specific sectors and liquidity constraints in financial markets. The future outlook highlights a shift toward targeted interventions, leveraging credit easing tools to enhance economic resilience and credit flow efficiency.

Quantitative easing vs Credit easing Infographic

difterm.com

difterm.com