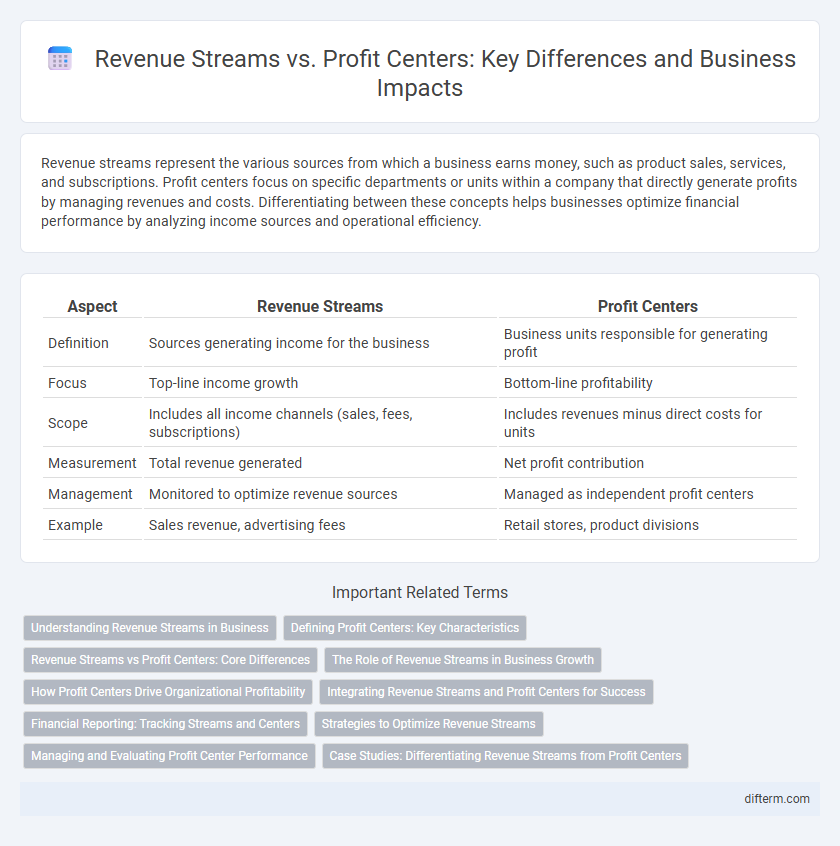

Revenue streams represent the various sources from which a business earns money, such as product sales, services, and subscriptions. Profit centers focus on specific departments or units within a company that directly generate profits by managing revenues and costs. Differentiating between these concepts helps businesses optimize financial performance by analyzing income sources and operational efficiency.

Table of Comparison

| Aspect | Revenue Streams | Profit Centers |

|---|---|---|

| Definition | Sources generating income for the business | Business units responsible for generating profit |

| Focus | Top-line income growth | Bottom-line profitability |

| Scope | Includes all income channels (sales, fees, subscriptions) | Includes revenues minus direct costs for units |

| Measurement | Total revenue generated | Net profit contribution |

| Management | Monitored to optimize revenue sources | Managed as independent profit centers |

| Example | Sales revenue, advertising fees | Retail stores, product divisions |

Understanding Revenue Streams in Business

Revenue streams represent the various sources from which a business earns money through the sale of products or services, forming the foundation of the company's income model. Identifying and diversifying these revenue streams enables businesses to minimize risks and capitalize on multiple market opportunities for sustained growth. Analyzing customer segments, pricing models, and delivery channels helps optimize each revenue stream's contribution to overall financial performance.

Defining Profit Centers: Key Characteristics

Profit centers are distinct units within a business responsible for generating both revenue and controlling costs, directly impacting overall profitability. Key characteristics of profit centers include autonomous decision-making authority, accountability for income and expenses, and the ability to measure performance based on contribution to net profit. These centers enable businesses to identify high-performing areas, optimize resource allocation, and enhance strategic growth initiatives.

Revenue Streams vs Profit Centers: Core Differences

Revenue streams represent the various sources from which a business generates income, including sales of products, services, subscriptions, or licensing fees. Profit centers are specific divisions or units within an organization responsible for generating revenue and controlling costs to contribute positively to overall profitability. Understanding the core differences highlights that revenue streams focus on the inflow of money, while profit centers emphasize both revenue generation and expense management to maximize net profit.

The Role of Revenue Streams in Business Growth

Revenue streams are crucial for sustaining business growth by providing consistent cash flow and enabling reinvestment in innovation and market expansion. Diverse revenue streams reduce dependency on a single source, increasing financial stability and resilience against market fluctuations. Effective management of these streams directly influences profitability and long-term competitive advantage.

How Profit Centers Drive Organizational Profitability

Profit centers directly influence organizational profitability by managing both revenues and costs to maximize net income, unlike revenue streams which solely focus on generating income. By treating business units as independent profit centers, organizations gain enhanced accountability and clearer performance metrics, fostering efficient resource allocation and strategic growth. This approach enables companies to identify high-performing segments, optimize operations, and drive sustainable profitability across the enterprise.

Integrating Revenue Streams and Profit Centers for Success

Integrating revenue streams and profit centers enables businesses to optimize financial performance by aligning diverse income sources with accountable units. This strategic alignment enhances resource allocation, drives operational efficiency, and improves overall profitability through targeted management. Effective integration supports scalable growth and sustained competitive advantage by leveraging synergies across revenue generation and cost control mechanisms.

Financial Reporting: Tracking Streams and Centers

Revenue streams represent the various sources of income generated by a business, such as product sales, service fees, and subscriptions, while profit centers are specific divisions or units responsible for both generating revenue and controlling costs. Effective financial reporting requires distinct tracking mechanisms for each revenue stream and profit center to accurately assess profitability, allocate resources, and support strategic decision-making. Employing detailed revenue recognition practices alongside cost accounting enables organizations to identify high-performing areas and optimize overall financial performance.

Strategies to Optimize Revenue Streams

Optimizing revenue streams involves identifying diverse sources such as product sales, service fees, subscription models, and licensing agreements to maximize income. Implementing targeted pricing strategies, enhancing customer segmentation, and leveraging data analytics can increase revenue efficiency and reduce churn rates. Businesses that integrate scalable digital platforms and strategic partnerships often experience sustained growth and improved profit margins.

Managing and Evaluating Profit Center Performance

Managing and evaluating profit center performance requires tracking both revenue streams and cost structures to assess true profitability. Effective profit centers generate sustainable revenue while controlling expenses, making regular financial analysis and performance metrics essential for identifying growth opportunities and inefficiencies. Utilizing key performance indicators (KPIs) such as gross margin, return on investment (ROI), and cost variances helps managers optimize resource allocation and enhance overall business profitability.

Case Studies: Differentiating Revenue Streams from Profit Centers

Case studies reveal that revenue streams represent various sources of income, such as product sales, subscription fees, or licensing, while profit centers are specific business units responsible for generating net profit after accounting for costs. For example, a technology company may have multiple revenue streams including hardware sales and software subscriptions, but its profit centers are individual departments managing expenses and profitability. These case studies emphasize analyzing financial reports to distinguish pure revenue generation from comprehensive profit accountability within organizational structures.

Revenue Streams vs Profit Centers Infographic

difterm.com

difterm.com