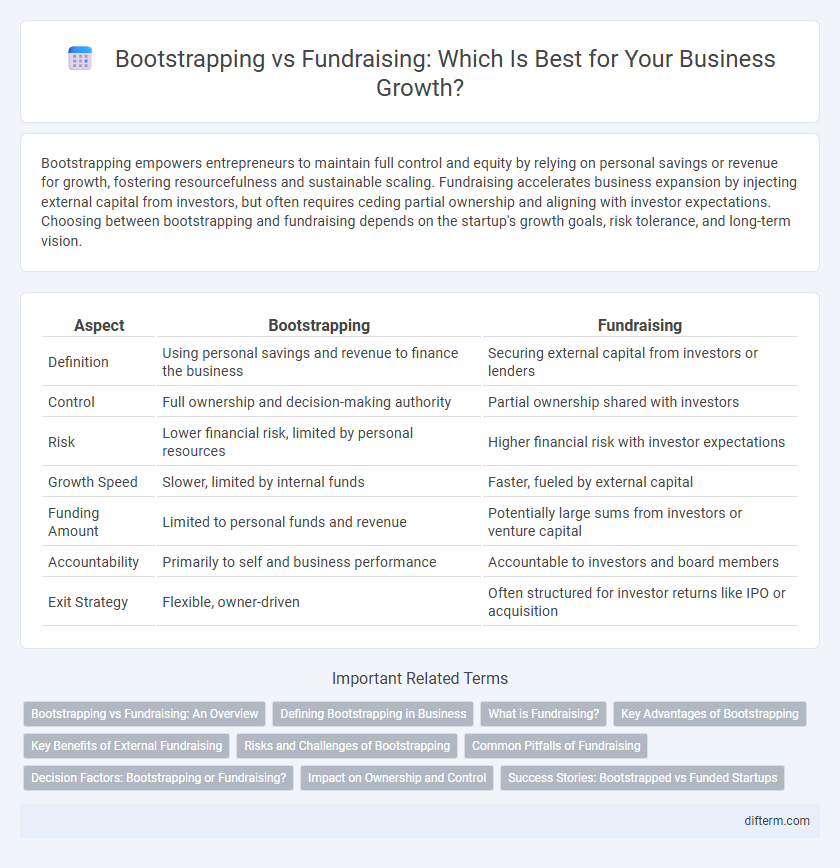

Bootstrapping empowers entrepreneurs to maintain full control and equity by relying on personal savings or revenue for growth, fostering resourcefulness and sustainable scaling. Fundraising accelerates business expansion by injecting external capital from investors, but often requires ceding partial ownership and aligning with investor expectations. Choosing between bootstrapping and fundraising depends on the startup's growth goals, risk tolerance, and long-term vision.

Table of Comparison

| Aspect | Bootstrapping | Fundraising |

|---|---|---|

| Definition | Using personal savings and revenue to finance the business | Securing external capital from investors or lenders |

| Control | Full ownership and decision-making authority | Partial ownership shared with investors |

| Risk | Lower financial risk, limited by personal resources | Higher financial risk with investor expectations |

| Growth Speed | Slower, limited by internal funds | Faster, fueled by external capital |

| Funding Amount | Limited to personal funds and revenue | Potentially large sums from investors or venture capital |

| Accountability | Primarily to self and business performance | Accountable to investors and board members |

| Exit Strategy | Flexible, owner-driven | Often structured for investor returns like IPO or acquisition |

Bootstrapping vs Fundraising: An Overview

Bootstrapping involves using personal savings and revenue to grow a business, maintaining full ownership and control without external debt or equity investment. Fundraising entails seeking capital from investors or institutions, which can accelerate growth but often requires giving up partial ownership and decision-making power. Choosing between bootstrapping and fundraising depends on growth goals, risk tolerance, and the need for operational autonomy.

Defining Bootstrapping in Business

Bootstrapping in business refers to the process of starting and growing a company using personal savings, revenue generated from operations, and minimal external funding. Entrepreneurs rely on careful financial management, reinvesting profits, and maintaining lean operations to achieve sustainable growth. This approach minimizes debt and equity dilution, allowing founders to retain full control over their venture.

What is Fundraising?

Fundraising is the process of securing capital for a business by attracting investments from external sources such as venture capitalists, angel investors, or crowdfunding platforms. It enables companies to access larger sums of money quickly, supporting rapid growth and scaling operations without relying solely on internal cash flow. Effective fundraising involves pitching a compelling value proposition, demonstrating market potential, and negotiating equity or debt terms with investors.

Key Advantages of Bootstrapping

Bootstrapping in business offers the key advantage of maintaining full ownership and control without diluting equity, enabling entrepreneurs to make decisions independently. It encourages disciplined financial management and fosters innovation by maximizing limited resources. This method also helps build a sustainable and scalable business foundation by focusing on profitability from the outset.

Key Benefits of External Fundraising

External fundraising provides access to substantial capital that accelerates business growth and scalability. It enables startups to leverage investor expertise, networks, and credibility, enhancing market positioning and operational capabilities. Moreover, fundraising mitigates personal financial risk by distributing ownership and financial responsibility among multiple stakeholders.

Risks and Challenges of Bootstrapping

Bootstrapping poses significant risks including limited access to capital, which can constrain growth and slow product development. Entrepreneurs may face cash flow challenges and personal financial strain due to reliance on personal funds or revenue reinvestment. The lack of external investors also limits strategic advice and networking opportunities vital for scaling the business efficiently.

Common Pitfalls of Fundraising

Fundraising often leads to diluted ownership and increased pressure from investors demanding rapid growth and high returns. Entrepreneurs may also face challenging valuation negotiations, resulting in unfavorable deal terms that restrict future flexibility. Moreover, the reliance on external capital can divert focus from building a sustainable, customer-driven business model.

Decision Factors: Bootstrapping or Fundraising?

Choosing between bootstrapping and fundraising depends on factors such as control over equity, growth speed, and financial risk tolerance. Bootstrapping prioritizes maintaining full ownership and operational independence but may limit capital availability and scalability. Fundraising enables rapid expansion and access to resources but requires equity dilution and alignment with investor expectations.

Impact on Ownership and Control

Bootstrapping allows entrepreneurs to maintain full ownership and control of their business, as funding comes from personal savings or revenue without external investors. Fundraising often requires giving equity, which dilutes ownership and subjects the business to investor influence or board decision-making. The choice between bootstrapping and fundraising significantly affects the founder's autonomy and long-term control over company decisions.

Success Stories: Bootstrapped vs Funded Startups

Bootstrapped startups like Mailchimp and Spanx showcase how sustained revenue generation and lean operations drive long-term success without external funding. Funded companies such as Airbnb and Uber leveraged venture capital to scale rapidly, tapping into expansive markets and aggressive growth strategies. Both paths illustrate that success hinges on strategic resource management and market timing rather than the funding model alone.

Bootstrapping vs Fundraising Infographic

difterm.com

difterm.com