Monthly Recurring Revenue (MRR) provides a snapshot of predictable income generated every month, helping businesses track short-term growth and cash flow. Annual Recurring Revenue (ARR) aggregates this figure over a year, offering a broader perspective on long-term financial health and stability. Comparing MRR and ARR allows companies to assess revenue consistency and make informed decisions about budgeting and scaling.

Table of Comparison

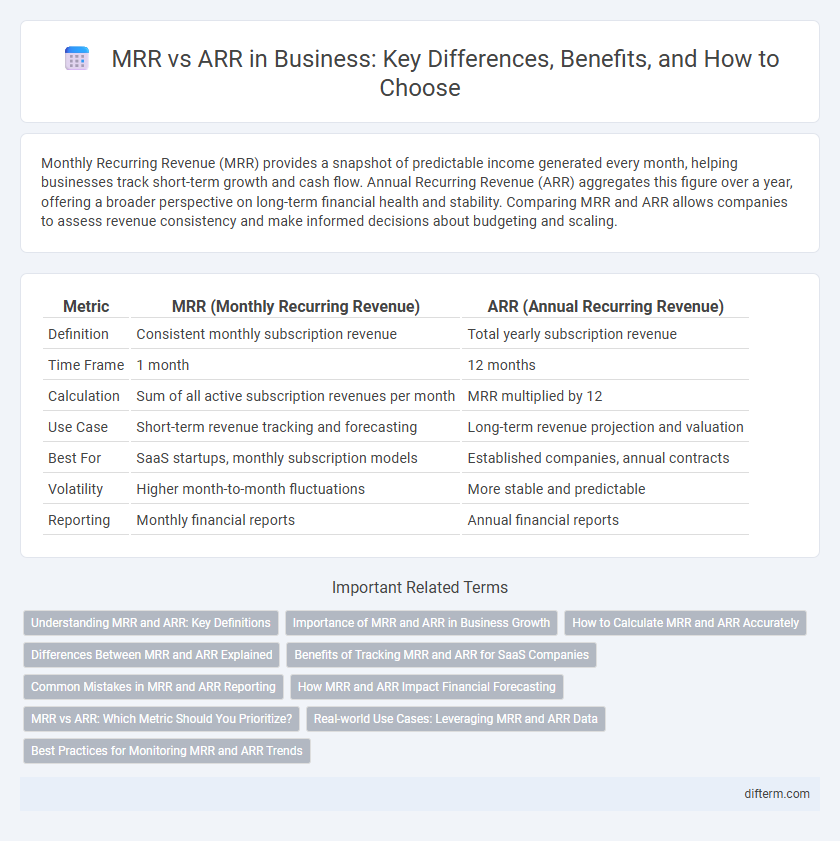

| Metric | MRR (Monthly Recurring Revenue) | ARR (Annual Recurring Revenue) |

|---|---|---|

| Definition | Consistent monthly subscription revenue | Total yearly subscription revenue |

| Time Frame | 1 month | 12 months |

| Calculation | Sum of all active subscription revenues per month | MRR multiplied by 12 |

| Use Case | Short-term revenue tracking and forecasting | Long-term revenue projection and valuation |

| Best For | SaaS startups, monthly subscription models | Established companies, annual contracts |

| Volatility | Higher month-to-month fluctuations | More stable and predictable |

| Reporting | Monthly financial reports | Annual financial reports |

Understanding MRR and ARR: Key Definitions

Monthly Recurring Revenue (MRR) represents the predictable revenue a business expects each month from its subscription-based customers, providing a snapshot of short-term income streams. Annual Recurring Revenue (ARR) aggregates this data over a year, offering a comprehensive overview of long-term financial health and growth potential. Understanding the distinction between MRR and ARR is crucial for accurate forecasting, strategic planning, and assessing customer retention in subscription-based business models.

Importance of MRR and ARR in Business Growth

Monthly Recurring Revenue (MRR) provides businesses with a precise measure of short-term financial health, enabling timely adjustments to sales and marketing strategies for sustained cash flow. Annual Recurring Revenue (ARR) offers a comprehensive view of long-term business performance, essential for forecasting, budgeting, and attracting investors. Together, MRR and ARR deliver critical insights into revenue stability and growth trajectories, facilitating data-driven decision-making for scalable business expansion.

How to Calculate MRR and ARR Accurately

To calculate Monthly Recurring Revenue (MRR) accurately, sum all subscription revenues normalized to a monthly amount, including new subscriptions, upgrades, downgrades, and churn impact within the month. Annual Recurring Revenue (ARR) is derived by multiplying the MRR by 12 or by summing all contract values standardized on an annual basis, adjusting for billing cycles and one-time fees. Precise MRR and ARR calculations require consistent data tracking in billing systems and clear definitions of recurring versus non-recurring revenues to reflect true business performance.

Differences Between MRR and ARR Explained

Monthly Recurring Revenue (MRR) measures the predictable revenue a business earns each month from subscriptions or contracts, providing a snapshot of short-term financial health. Annual Recurring Revenue (ARR), on the other hand, aggregates this data over a year to offer a long-term revenue forecast, essential for strategic planning and investor relations. MRR is ideal for tracking monthly growth fluctuations, while ARR emphasizes stability and scalability across fiscal periods.

Benefits of Tracking MRR and ARR for SaaS Companies

Tracking Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) provides SaaS companies with critical insights into revenue stability and growth trends, enabling accurate forecasting and budgeting. MRR offers a detailed view of month-to-month performance, facilitating quick responses to churn or expansion, while ARR highlights long-term financial health and investor appeal. These metrics drive data-informed decisions that enhance customer retention strategies and optimize pricing models.

Common Mistakes in MRR and ARR Reporting

Confusing MRR (Monthly Recurring Revenue) with ARR (Annual Recurring Revenue) often leads to inaccurate financial forecasts due to differences in their reporting periods. Misreporting one-time or non-recurring revenues as part of MRR or ARR inflates the true subscription value, skewing business performance metrics. Failure to adjust for churn and contract expansions causes inconsistent tracking and misleads stakeholders on the company's growth trajectory.

How MRR and ARR Impact Financial Forecasting

Monthly Recurring Revenue (MRR) provides granular insights into short-term cash flow trends, enabling businesses to adjust strategies quickly and improve monthly financial forecasting accuracy. Annual Recurring Revenue (ARR) offers a broader view of long-term revenue stability, supporting strategic planning and investment decisions by projecting yearly performance. Combining MRR and ARR data allows companies to optimize their financial forecasts, balance immediate operational needs with future growth projections, and manage subscription-based revenue more effectively.

MRR vs ARR: Which Metric Should You Prioritize?

Monthly Recurring Revenue (MRR) provides granular insights into short-term cash flow and customer growth trends, making it ideal for startups and businesses seeking rapid iteration. Annual Recurring Revenue (ARR) offers a broader perspective on long-term revenue stability and investor appeal, often favored by mature enterprises and SaaS companies targeting sustainable growth. Prioritizing MRR or ARR depends on your business stage and strategic goals, with MRR suited for operational agility and ARR essential for forecasting and securing funding.

Real-world Use Cases: Leveraging MRR and ARR Data

MRR (Monthly Recurring Revenue) enables businesses to track short-term revenue trends and optimize cash flow management while ARR (Annual Recurring Revenue) provides a long-term revenue forecast critical for strategic planning and investor relations. SaaS companies leverage MRR data to identify churn rates and upsell opportunities monthly, whereas ARR data helps in setting annual growth targets and budgeting for product development. Combining insights from both MRR and ARR allows businesses to refine customer acquisition strategies and maximize lifetime value efficiently.

Best Practices for Monitoring MRR and ARR Trends

Regularly tracking Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) provides critical insights into a business's growth trajectory and customer retention. Implementing automated analytics tools ensures accurate, real-time monitoring of subscription-based revenue streams and highlights fluctuations caused by customer churn, upgrades, or downgrades. Comparing MRR and ARR trends over time enables proactive decision-making to optimize pricing strategies and forecast long-term financial stability.

MRR vs ARR Infographic

difterm.com

difterm.com