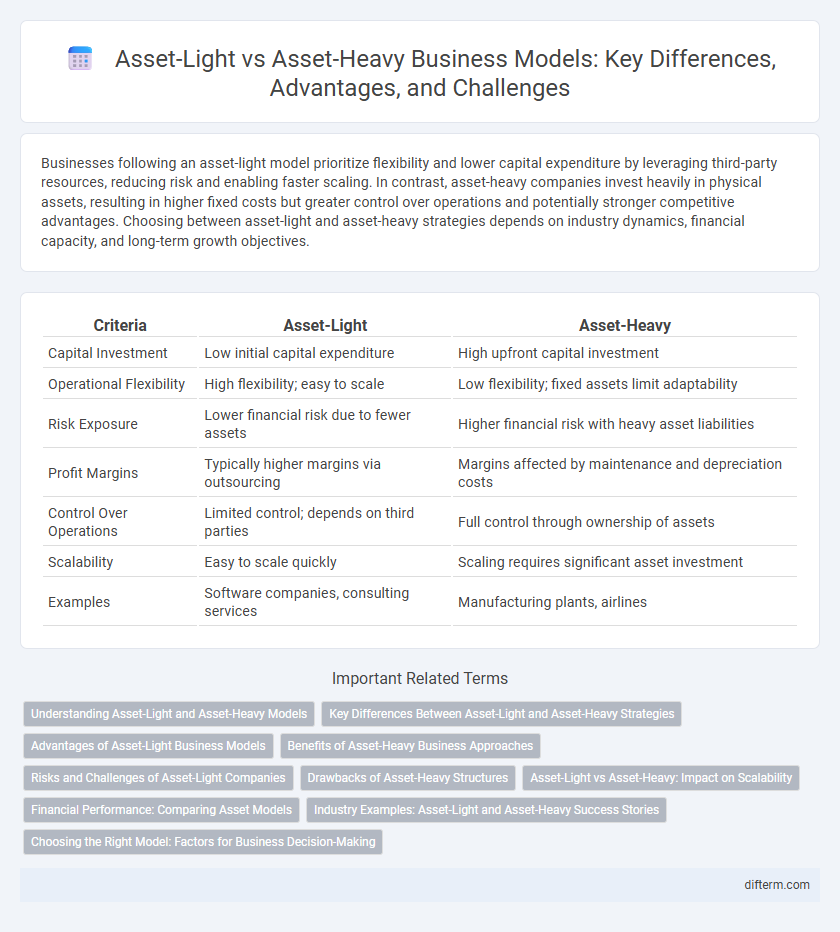

Businesses following an asset-light model prioritize flexibility and lower capital expenditure by leveraging third-party resources, reducing risk and enabling faster scaling. In contrast, asset-heavy companies invest heavily in physical assets, resulting in higher fixed costs but greater control over operations and potentially stronger competitive advantages. Choosing between asset-light and asset-heavy strategies depends on industry dynamics, financial capacity, and long-term growth objectives.

Table of Comparison

| Criteria | Asset-Light | Asset-Heavy |

|---|---|---|

| Capital Investment | Low initial capital expenditure | High upfront capital investment |

| Operational Flexibility | High flexibility; easy to scale | Low flexibility; fixed assets limit adaptability |

| Risk Exposure | Lower financial risk due to fewer assets | Higher financial risk with heavy asset liabilities |

| Profit Margins | Typically higher margins via outsourcing | Margins affected by maintenance and depreciation costs |

| Control Over Operations | Limited control; depends on third parties | Full control through ownership of assets |

| Scalability | Easy to scale quickly | Scaling requires significant asset investment |

| Examples | Software companies, consulting services | Manufacturing plants, airlines |

Understanding Asset-Light and Asset-Heavy Models

Asset-light business models prioritize minimizing ownership of physical assets, leveraging outsourcing and partnerships to reduce capital expenditure and improve agility. Conversely, asset-heavy models require substantial investment in tangible assets like manufacturing plants and equipment, providing greater control over production and potentially higher barriers to entry. Companies choose between these models based on strategic goals, risk tolerance, and the need for operational control versus scalability.

Key Differences Between Asset-Light and Asset-Heavy Strategies

Asset-light strategies prioritize minimal ownership of physical assets, focusing on outsourcing and leveraging technological platforms to drive scalability and flexibility. Asset-heavy strategies involve significant investment in physical infrastructure and capital-intensive resources, promoting control and operational stability. The choice between these approaches impacts cost structure, risk exposure, and growth potential in diverse business environments.

Advantages of Asset-Light Business Models

Asset-light business models offer significant advantages such as lower capital expenditures and increased operational flexibility, enabling companies to scale rapidly without heavy investments in physical assets. This approach reduces fixed costs and financial risk, allowing businesses to allocate resources more efficiently toward innovation and market expansion. Companies like Airbnb and Uber leverage asset-light strategies to optimize asset utilization and maximize profitability through platform-based operations.

Benefits of Asset-Heavy Business Approaches

Asset-heavy business models offer enhanced control over operations and quality by owning key production assets, enabling companies to tailor processes and maintain high standards. These models can lead to greater long-term profitability through asset appreciation and reduced dependency on third-party suppliers or partners. Additionally, asset-heavy approaches provide barriers to entry for competitors, strengthening market position and fostering sustainable competitive advantages.

Risks and Challenges of Asset-Light Companies

Asset-light companies face risks including dependency on third-party providers, which can lead to supply chain disruptions and quality control issues. Limited ownership of physical assets may cause difficulties in scaling operations quickly and managing costs during demand fluctuations. These challenges require robust contract management and strategic partnerships to mitigate exposure and maintain competitive advantage.

Drawbacks of Asset-Heavy Structures

Asset-heavy business structures often face significant drawbacks such as high fixed costs, reduced operational flexibility, and increased vulnerability to market downturns due to heavy investments in physical assets. These capital-intensive models can limit a company's ability to quickly adapt to changing market demands or technological advancements. Additionally, asset-heavy firms may experience lower return on assets (ROA) compared to asset-light competitors, impacting overall profitability and scalability.

Asset-Light vs Asset-Heavy: Impact on Scalability

Asset-light models enhance scalability by minimizing capital expenditure and leveraging third-party resources, enabling rapid expansion without heavy asset investments. In contrast, asset-heavy models require substantial upfront investment in physical assets, which can limit flexibility and slow down scaling processes. Companies adopting an asset-light approach benefit from increased operational agility, faster market entry, and reduced financial risk compared to asset-heavy counterparts.

Financial Performance: Comparing Asset Models

Asset-light business models typically exhibit higher return on assets (ROA) and improved operational efficiency due to lower capital expenditures and reduced maintenance costs. Asset-heavy companies often face greater depreciation expenses and fixed costs, which can compress profit margins despite potentially higher revenues. Financial performance analysis reveals that asset-light firms tend to generate stronger cash flow and flexibility, enhancing their ability to adapt to market fluctuations and invest strategically.

Industry Examples: Asset-Light and Asset-Heavy Success Stories

Asset-light companies like Uber leverage digital platforms without owning physical assets, enabling rapid scalability and reduced capital expenditure, exemplifying success in the transportation industry. In contrast, asset-heavy firms such as General Electric invest heavily in manufacturing facilities and equipment, driving innovation and control in industrial sectors. Both models demonstrate strategic value: asset-light approaches excel in flexibility and lower risk, while asset-heavy businesses benefit from operational control and long-term asset appreciation.

Choosing the Right Model: Factors for Business Decision-Making

Choosing the right business model between asset-light and asset-heavy depends on factors such as capital investment capacity, scalability objectives, and risk tolerance. Asset-light models emphasize outsourcing and intangible assets, enabling faster market entry and flexibility, while asset-heavy models involve substantial investments in physical assets, granting greater operational control and long-term stability. Evaluating industry dynamics, cash flow requirements, and competitive advantages is crucial for optimizing profitability and sustainable growth.

asset-light vs asset-heavy Infographic

difterm.com

difterm.com