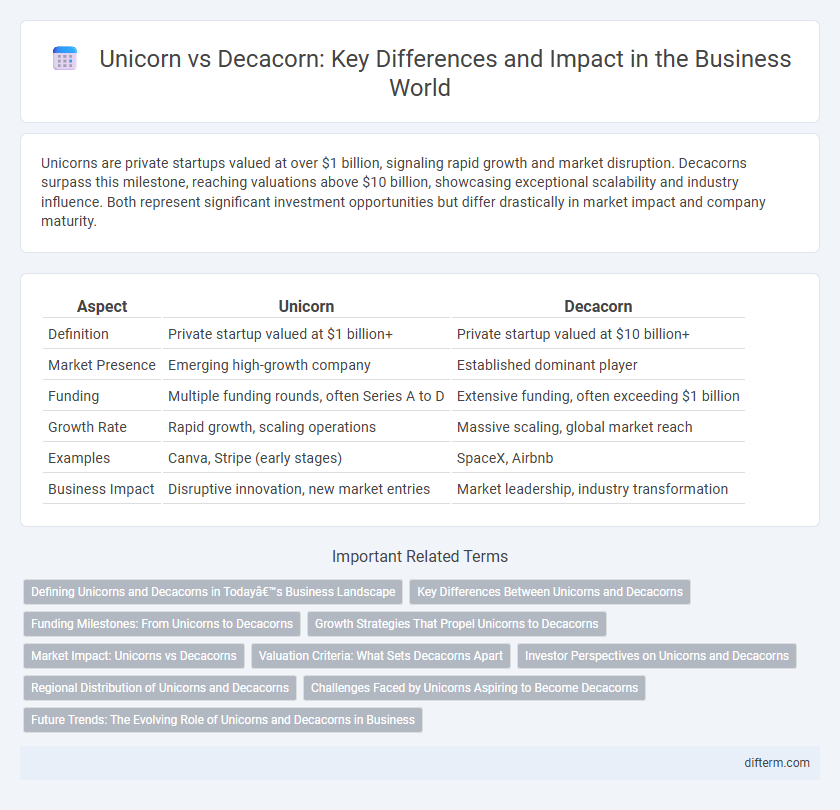

Unicorns are private startups valued at over $1 billion, signaling rapid growth and market disruption. Decacorns surpass this milestone, reaching valuations above $10 billion, showcasing exceptional scalability and industry influence. Both represent significant investment opportunities but differ drastically in market impact and company maturity.

Table of Comparison

| Aspect | Unicorn | Decacorn |

|---|---|---|

| Definition | Private startup valued at $1 billion+ | Private startup valued at $10 billion+ |

| Market Presence | Emerging high-growth company | Established dominant player |

| Funding | Multiple funding rounds, often Series A to D | Extensive funding, often exceeding $1 billion |

| Growth Rate | Rapid growth, scaling operations | Massive scaling, global market reach |

| Examples | Canva, Stripe (early stages) | SpaceX, Airbnb |

| Business Impact | Disruptive innovation, new market entries | Market leadership, industry transformation |

Defining Unicorns and Decacorns in Today’s Business Landscape

Unicorns are privately held startup companies valued at over $1 billion, representing significant innovation and growth potential in various industries. Decacorns elevate this benchmark, with valuations exceeding $10 billion, indicating a higher level of market influence and scalability. Both entities serve as critical indicators of emerging market leaders and investor confidence in today's competitive business landscape.

Key Differences Between Unicorns and Decacorns

Unicorns are privately held startups valued at $1 billion or more, while decacorns exceed $10 billion in valuation, marking a significant scale difference. Unicorns often indicate early market disruption, whereas decacorns demonstrate sustained growth, market dominance, and investor confidence. Key differences also include funding rounds size, revenue generation, and global expansion strategies.

Funding Milestones: From Unicorns to Decacorns

Unicorns, startups valued at over $1 billion, mark a significant funding milestone attracting substantial venture capital investment. Decacorns surpass this benchmark with valuations exceeding $10 billion, reflecting accelerated growth and market dominance. The progression from unicorn to decacorn involves strategic scaling, larger funding rounds, and often participation from global investors driving expansive market penetration.

Growth Strategies That Propel Unicorns to Decacorns

Unicorns transition to decacorns by scaling their business models through aggressive market expansion, securing strategic partnerships, and investing heavily in technology innovation. Leveraging data analytics and customer-centric approaches enhances product differentiation and operational efficiency, driving sustainable revenue growth. Access to substantial capital funding enables these companies to dominate global markets and achieve valuations exceeding $10 billion.

Market Impact: Unicorns vs Decacorns

Unicorns generate significant market disruption with valuations reaching $1 billion, often serving as innovation hubs within their industries. Decacorns, valued at over $10 billion, exert a more profound market influence by reshaping entire sectors and attracting substantial investment flows. The broader scale and fundraising capacity of decacorns enable faster scaling and long-term dominance compared to unicorns.

Valuation Criteria: What Sets Decacorns Apart

Decacorns distinguish themselves from unicorns primarily through their exceptional valuations, surpassing $10 billion compared to the $1 billion benchmark for unicorns. This elevated valuation is driven by factors such as sustained revenue growth, diversified global market presence, and robust competitive moats in technology or business models. Investors assess metrics like total addressable market size, scalability potential, and profitability trajectories, which collectively set decacorns apart in valuation criteria within the business ecosystem.

Investor Perspectives on Unicorns and Decacorns

Investors view unicorns--startups valued at $1 billion or more--as promising opportunities for high growth and innovation, often representing the next market disruptors. Decacorns, valued at $10 billion or more, attract greater interest due to their proven scalability, market dominance, and increased likelihood of delivering substantial returns. The rarity and maturity of decacorns signal lower risk and enhanced competitive advantages, making them highly sought after in venture capital portfolios.

Regional Distribution of Unicorns and Decacorns

The regional distribution of unicorns and decacorns highlights a concentration of high-value startups in North America, particularly the United States, followed by significant hubs in China and Europe. Asia is rapidly closing the gap with notable growth in India and Southeast Asia, driving the emergence of new decacorns in fintech and e-commerce sectors. Europe remains a strong contender with key cities like London, Berlin, and Paris fostering unicorn ecosystems through tech innovation and venture capital investments.

Challenges Faced by Unicorns Aspiring to Become Decacorns

Unicorn startups, valued at over $1 billion, face significant challenges when aspiring to reach decacorn status with valuations exceeding $10 billion, including scaling operations rapidly without compromising quality and managing increased market competition. Securing continuous funding becomes more complex due to heightened investor expectations for sustainable revenue growth and profitability. Furthermore, maintaining innovation while navigating regulatory hurdles and attracting top-tier talent remains critical to achieving long-term market dominance.

Future Trends: The Evolving Role of Unicorns and Decacorns in Business

Unicorns and decacorns will increasingly shape the future of business innovation by driving large-scale investments and technological advancements across industries. Decacorns, valued at over $10 billion, are expected to influence global markets significantly through expansive product diversification and international growth strategies. The evolving role of these entities highlights a trend toward greater market consolidation and disruption, positioning them as key players in shaping economic landscapes over the next decade.

unicorn vs decacorn Infographic

difterm.com

difterm.com