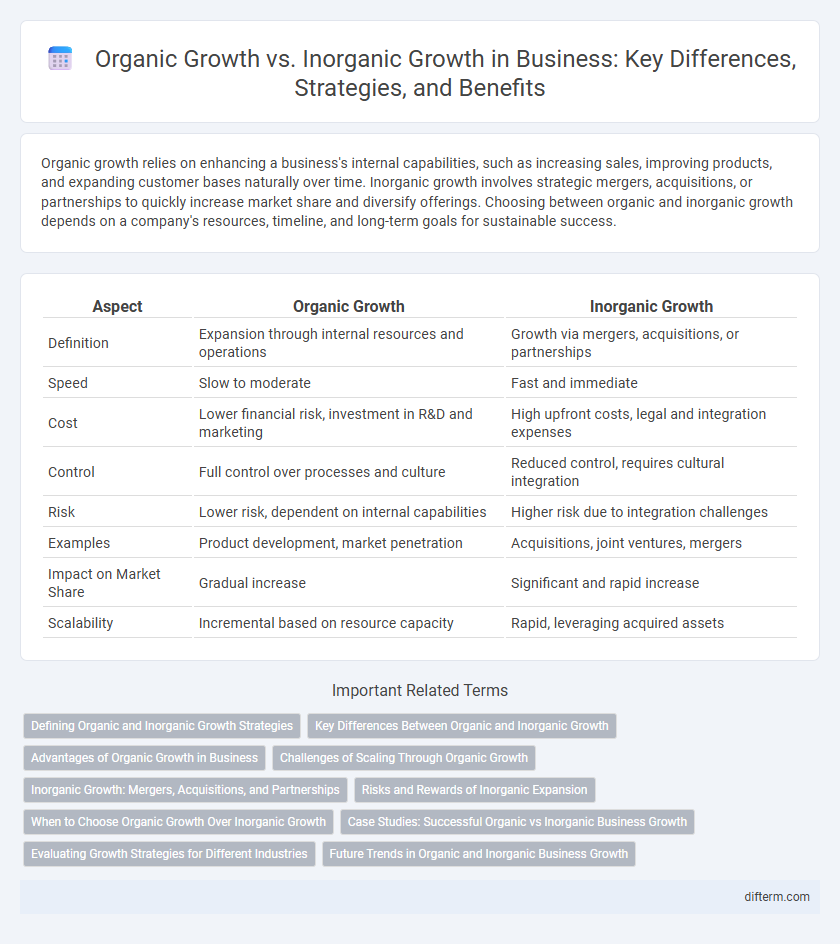

Organic growth relies on enhancing a business's internal capabilities, such as increasing sales, improving products, and expanding customer bases naturally over time. Inorganic growth involves strategic mergers, acquisitions, or partnerships to quickly increase market share and diversify offerings. Choosing between organic and inorganic growth depends on a company's resources, timeline, and long-term goals for sustainable success.

Table of Comparison

| Aspect | Organic Growth | Inorganic Growth |

|---|---|---|

| Definition | Expansion through internal resources and operations | Growth via mergers, acquisitions, or partnerships |

| Speed | Slow to moderate | Fast and immediate |

| Cost | Lower financial risk, investment in R&D and marketing | High upfront costs, legal and integration expenses |

| Control | Full control over processes and culture | Reduced control, requires cultural integration |

| Risk | Lower risk, dependent on internal capabilities | Higher risk due to integration challenges |

| Examples | Product development, market penetration | Acquisitions, joint ventures, mergers |

| Impact on Market Share | Gradual increase | Significant and rapid increase |

| Scalability | Incremental based on resource capacity | Rapid, leveraging acquired assets |

Defining Organic and Inorganic Growth Strategies

Organic growth strategies involve expanding a business through internal efforts such as increasing sales, enhancing product development, and improving operational efficiency. Inorganic growth strategies focus on external methods like mergers, acquisitions, and strategic partnerships to accelerate market share and revenue. Both approaches require careful alignment with company goals to optimize long-term value creation and competitive advantage.

Key Differences Between Organic and Inorganic Growth

Organic growth stems from internal business activities such as increasing output, enhancing sales, and improving employee productivity, relying on resources within the company. Inorganic growth involves expansion through mergers, acquisitions, joint ventures, or strategic alliances, leveraging external resources and market opportunities. Key differences lie in integration complexity, speed of growth, and investment scale, with organic growth typically slower but more sustainable and inorganic growth offering rapid market access but higher risk.

Advantages of Organic Growth in Business

Organic growth in business leverages internal resources and capabilities, fostering sustainable expansion through increased sales, customer base, and product development. It enhances brand loyalty and market reputation by focusing on long-term customer relationships and consistent quality improvements. This growth strategy minimizes dependency on external financing and acquisitions, reducing financial risks and integration challenges.

Challenges of Scaling Through Organic Growth

Scaling through organic growth presents challenges such as limited access to capital, slower market penetration, and increased operational strain on existing resources. Companies often face difficulties in maintaining consistent innovation and managing workforce expansion while preserving company culture. These factors can impede rapid scaling compared to inorganic growth strategies like mergers or acquisitions.

Inorganic Growth: Mergers, Acquisitions, and Partnerships

Inorganic growth accelerates business expansion through strategic mergers, acquisitions, and partnerships, enabling companies to quickly enter new markets and access advanced technologies. This growth strategy often leads to increased market share, enhanced competitive advantage, and diversified product portfolios by leveraging the strengths of combined entities. Effective integration and due diligence are critical to maximizing synergies and ensuring long-term value creation in inorganic growth initiatives.

Risks and Rewards of Inorganic Expansion

Inorganic growth, achieved through mergers, acquisitions, or partnerships, offers rapid market expansion and diversification but carries risks such as integration challenges, cultural clashes, and high capital expenditure. The rewards include immediate access to new technologies, customer bases, and competitive advantages that can outpace organic growth timelines. However, poor due diligence or overvaluation can lead to failed synergies and financial strain, making strategic planning and risk management crucial for sustainable success.

When to Choose Organic Growth Over Inorganic Growth

Choosing organic growth is advisable when a company aims to build sustainable competitive advantage through internal capabilities such as product development, customer retention, and operational efficiency. This approach is preferred in stable markets where long-term value creation depends on innovation and deepening customer relationships. Organic growth minimizes financial risk and integration challenges common with mergers and acquisitions, making it suitable for businesses prioritizing steady, controlled expansion.

Case Studies: Successful Organic vs Inorganic Business Growth

Case studies reveal that companies like Amazon exemplify organic growth by expanding through innovation and customer-centric strategies, leveraging internal resources to increase market share. Contrastingly, inorganic growth is showcased by Facebook's acquisition of Instagram, rapidly entering new markets and eliminating competition through strategic mergers and acquisitions. Both growth strategies demonstrate distinct advantages: organic growth fosters sustainable development, while inorganic growth accelerates market expansion via external partnerships.

Evaluating Growth Strategies for Different Industries

Evaluating growth strategies requires understanding that organic growth, driven by internal development such as expanding product lines or increasing sales, is often more sustainable for industries like technology and consumer goods due to innovation cycles and brand loyalty. Inorganic growth through mergers, acquisitions, or partnerships provides rapid market entry and scale, benefiting sectors like pharmaceuticals and finance where regulatory complexities and capital intensity demand strategic alliances. Analyzing industry-specific factors such as market dynamics, competitive landscape, and resource availability optimizes the choice between organic and inorganic growth pathways.

Future Trends in Organic and Inorganic Business Growth

Future trends in organic business growth emphasize leveraging digital transformation and customer-centric innovation to enhance market adaptability and sustainable revenue streams. Inorganic growth is poised to accelerate through strategic mergers, acquisitions, and partnerships enabled by evolving regulatory frameworks and cross-industry collaborations. Data-driven decision-making and artificial intelligence integration will increasingly optimize both organic and inorganic growth strategies, fostering competitive advantage in dynamic markets.

Organic Growth vs Inorganic Growth Infographic

difterm.com

difterm.com