Bootstrapping a business allows founders to maintain full control and ownership while growing steadily using personal resources and revenue reinvestment. Venture capital offers significant funding to accelerate growth but often requires giving up equity and some decision-making power to investors. Choosing between bootstrapping and venture capital depends on the desired pace, control level, and long-term vision for the business.

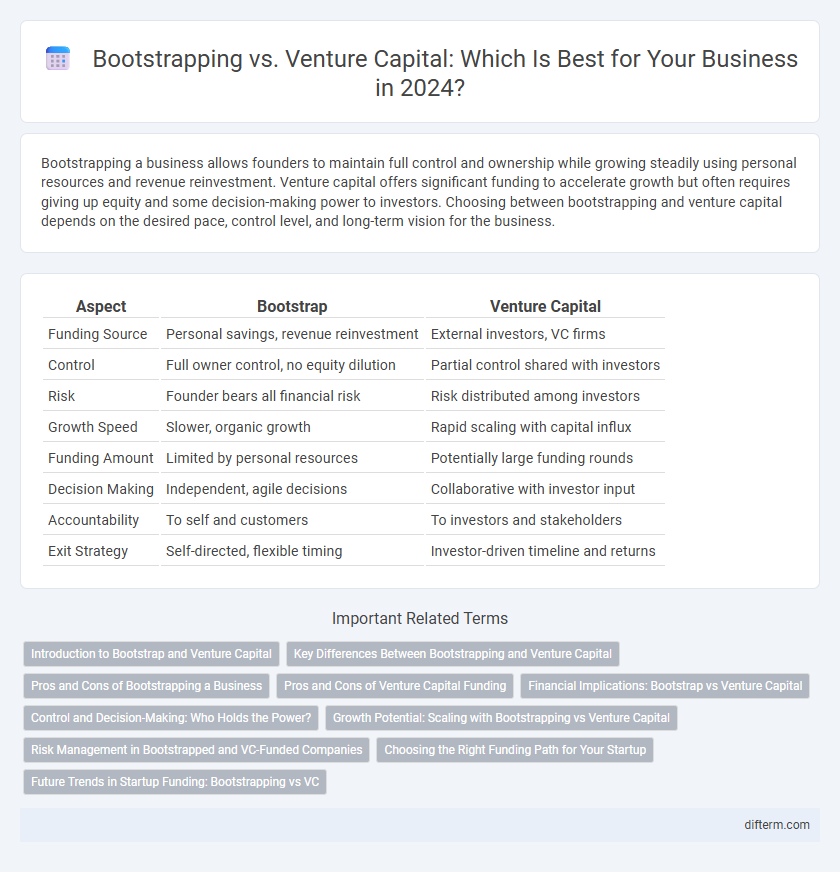

Table of Comparison

| Aspect | Bootstrap | Venture Capital |

|---|---|---|

| Funding Source | Personal savings, revenue reinvestment | External investors, VC firms |

| Control | Full owner control, no equity dilution | Partial control shared with investors |

| Risk | Founder bears all financial risk | Risk distributed among investors |

| Growth Speed | Slower, organic growth | Rapid scaling with capital influx |

| Funding Amount | Limited by personal resources | Potentially large funding rounds |

| Decision Making | Independent, agile decisions | Collaborative with investor input |

| Accountability | To self and customers | To investors and stakeholders |

| Exit Strategy | Self-directed, flexible timing | Investor-driven timeline and returns |

Introduction to Bootstrap and Venture Capital

Bootstrap refers to building a business using personal savings and revenue generated from the company without external funding, allowing founders to maintain full control and equity. Venture capital involves raising funds from investors or firms that provide capital in exchange for equity, enabling rapid scaling but often resulting in shared decision-making power. Understanding the dynamics of bootstrap versus venture capital is crucial for entrepreneurs to align funding strategies with their growth objectives and risk tolerance.

Key Differences Between Bootstrapping and Venture Capital

Bootstrapping relies on self-funding and reinvestment of profits, allowing entrepreneurs to retain full control and ownership, while venture capital involves external investors providing significant funds in exchange for equity and decision-making influence. Bootstrapped startups often experience slower growth due to limited capital, whereas venture-backed companies can scale rapidly but face pressure to meet aggressive performance targets and potential dilution of founder equity. The choice between bootstrapping and venture capital depends on the startup's growth goals, risk tolerance, and desire for control over business operations.

Pros and Cons of Bootstrapping a Business

Bootstrapping a business allows entrepreneurs to maintain full ownership and control, reducing reliance on external investors and avoiding equity dilution. Limited financial resources, however, can restrict growth potential and slow product development compared to venture capital-funded startups. This self-funding approach fosters financial discipline but may increase risk due to personal capital exposure and limited access to strategic guidance from seasoned investors.

Pros and Cons of Venture Capital Funding

Venture capital funding provides significant financial resources and strategic support, enabling rapid business growth and access to expert networks. However, it often requires giving up equity and control, which can limit the founder's decision-making power and impose high expectations for quick returns. The pressure to scale and meet investor demands may also shift the company's focus away from long-term sustainability toward short-term performance metrics.

Financial Implications: Bootstrap vs Venture Capital

Bootstrapping preserves full ownership and control, enabling entrepreneurs to avoid equity dilution but often limits available capital and slows growth. Venture capital provides significant funding that accelerates scaling but requires giving up partial ownership and influence, impacting long-term financial returns. The choice between bootstrapping and venture capital hinges on balancing financial risk, control preferences, and growth ambitions.

Control and Decision-Making: Who Holds the Power?

Bootstrap founders retain full control and decision-making power over their business, allowing swift strategic pivots without external approval. Venture capital investors often require board seats and influence, leading to shared control and potential conflicts over business direction. The balance of power in venture capital-funded companies shifts toward investors, impacting founders' autonomy in critical decisions.

Growth Potential: Scaling with Bootstrapping vs Venture Capital

Bootstrapping limits growth potential due to constrained financial resources, often resulting in slower scaling but maintaining full ownership and control. Venture capital provides substantial funding that accelerates expansion and market penetration, enabling rapid scaling through strategic investments and expert mentorship. Companies backed by venture capital typically achieve faster growth trajectories but must balance this with diluted equity and increased investor influence.

Risk Management in Bootstrapped and VC-Funded Companies

Bootstrapped companies typically exhibit lower financial risk as they rely on internal funds, reducing dependency on external stakeholders and minimizing dilution of control. In contrast, VC-funded companies face higher risk exposure due to the obligation to meet investors' aggressive growth expectations and potential loss of managerial autonomy. Effective risk management in bootstrapped firms centers on conservative cash flow management, while VC-backed firms prioritize scaling risks and market validation to satisfy investor demands.

Choosing the Right Funding Path for Your Startup

Bootstrapping offers startups complete control and equity retention by relying on personal savings and revenue, ideal for businesses prioritizing independence and sustainable growth. Venture capital provides access to substantial funds and strategic mentorship, suited for startups with high growth potential seeking rapid market expansion. Choosing between bootstrapping and venture capital depends on your startup's scalability needs, risk tolerance, and long-term vision.

Future Trends in Startup Funding: Bootstrapping vs VC

Future trends in startup funding indicate a growing preference for bootstrapping as entrepreneurs seek greater control and sustainable growth without diluting equity. Venture capital remains essential for scaling rapidly and accessing strategic networks, especially in high-growth tech sectors. Hybrid funding models combining initial bootstrapping with later-stage venture capital are emerging as a balanced approach to mitigate risks and maximize long-term value.

bootstrap vs venture capital Infographic

difterm.com

difterm.com