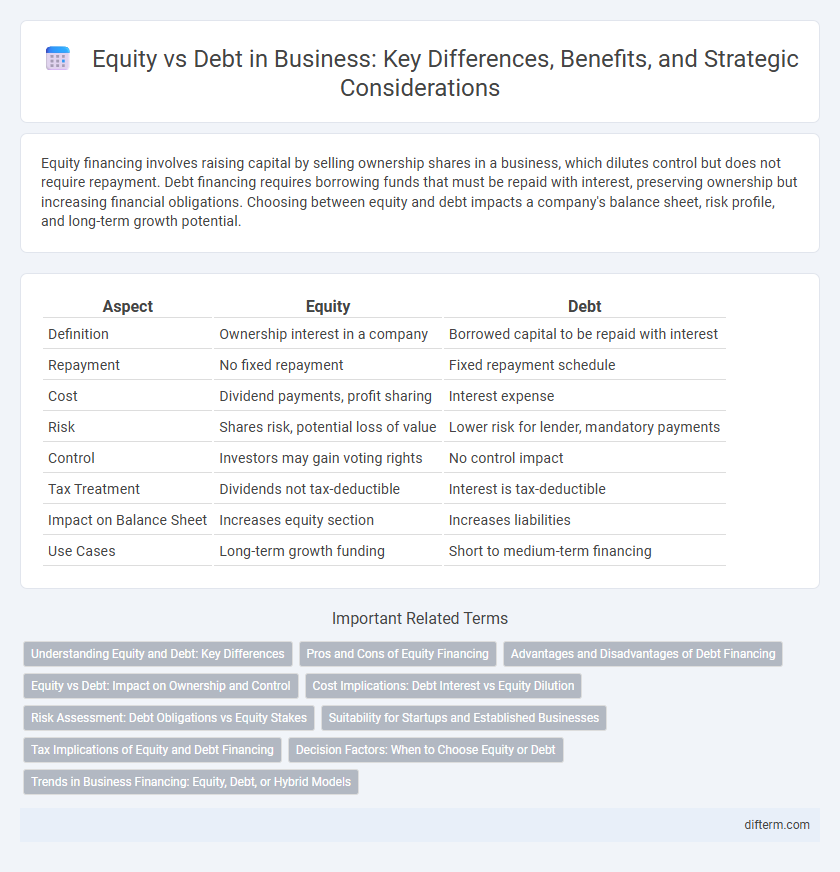

Equity financing involves raising capital by selling ownership shares in a business, which dilutes control but does not require repayment. Debt financing requires borrowing funds that must be repaid with interest, preserving ownership but increasing financial obligations. Choosing between equity and debt impacts a company's balance sheet, risk profile, and long-term growth potential.

Table of Comparison

| Aspect | Equity | Debt |

|---|---|---|

| Definition | Ownership interest in a company | Borrowed capital to be repaid with interest |

| Repayment | No fixed repayment | Fixed repayment schedule |

| Cost | Dividend payments, profit sharing | Interest expense |

| Risk | Shares risk, potential loss of value | Lower risk for lender, mandatory payments |

| Control | Investors may gain voting rights | No control impact |

| Tax Treatment | Dividends not tax-deductible | Interest is tax-deductible |

| Impact on Balance Sheet | Increases equity section | Increases liabilities |

| Use Cases | Long-term growth funding | Short to medium-term financing |

Understanding Equity and Debt: Key Differences

Equity represents ownership in a company, giving shareholders voting rights and a claim on profits through dividends, while debt is a loan that requires regular interest payments and repayment of principal without ownership stake. Equity financing dilutes ownership but does not obligate the company to fixed payments, contrasting with debt financing which prioritizes repayment obligations and impacts cash flow. Understanding these differences is crucial for businesses to balance risk, control, and financial flexibility in their capital structure.

Pros and Cons of Equity Financing

Equity financing provides access to capital without immediate repayment obligations or interest expenses, allowing businesses to preserve cash flow and share financial risk with investors. However, it often results in ownership dilution and potential loss of control or decision-making power as equity holders gain influence. While equity can improve a company's credit profile by reducing leverage, it typically requires sharing future profits and may involve extensive regulatory compliance and reporting.

Advantages and Disadvantages of Debt Financing

Debt financing offers businesses immediate capital without diluting ownership, enabling control retention and potential tax benefits due to interest expense deductions. However, it imposes fixed repayment obligations that can strain cash flow, especially during downturns, increasing financial risk and potential insolvency. Lenders may also impose restrictive covenants, limiting operational flexibility and growth strategies.

Equity vs Debt: Impact on Ownership and Control

Equity financing involves selling ownership stakes in a company, diluting existing shareholders' control but avoiding mandatory repayments. Debt financing maintains full ownership and decision-making authority but requires regular interest payments and principal repayment, increasing financial risk. Business leaders must balance the trade-off between giving up ownership and maintaining control versus the obligation and risk associated with borrowing.

Cost Implications: Debt Interest vs Equity Dilution

Debt financing often incurs fixed interest costs, reducing taxable income through interest tax shields but increasing financial risk due to mandatory repayments. Equity financing avoids interest payments and preserves cash flow but results in ownership dilution, potentially lowering earnings per share and control for existing shareholders. Evaluating the cost implications requires balancing the tax advantages of debt against the dilution and potential market valuation effects of issuing new equity.

Risk Assessment: Debt Obligations vs Equity Stakes

Debt obligations present fixed repayment schedules that increase financial risk during cash flow volatility, whereas equity stakes distribute risk among shareholders without mandatory repayments. Creditors prioritize stable cash flows and collateral to mitigate default risk, while equity investors accept higher uncertainty in exchange for potential dividends and capital gains. Understanding these differences is crucial for businesses in optimizing capital structure and balancing financial flexibility with risk tolerance.

Suitability for Startups and Established Businesses

Equity financing is often more suitable for startups due to its ability to provide capital without immediate repayment obligations, while allowing investors to share in the company's growth potential. Established businesses typically prefer debt financing to leverage tax advantages and maintain ownership control without diluting equity. Choosing between equity and debt depends on factors such as the company's stage, cash flow stability, and risk tolerance.

Tax Implications of Equity and Debt Financing

Equity financing does not provide tax-deductible interest payments, resulting in no direct tax shield benefit for businesses. Debt financing offers tax advantages through deductible interest expenses, lowering taxable income and reducing overall tax liability. Companies often weigh these tax implications to optimize their capital structure and minimize tax burdens.

Decision Factors: When to Choose Equity or Debt

Choosing between equity and debt financing depends on factors such as the company's current cash flow stability, growth potential, and risk tolerance. Equity is advantageous for businesses seeking to share risk and avoid immediate repayment obligations, especially during early stages or high growth periods. Debt is preferable when a company has predictable cash flows and wants to retain full ownership while leveraging tax benefits from interest payments.

Trends in Business Financing: Equity, Debt, or Hybrid Models

Business financing is increasingly shifting toward hybrid models that combine equity and debt to balance risk and control. Equity financing attracts startups seeking capital without immediate repayment, while debt financing remains popular for established companies aiming to leverage tax advantages and maintain ownership. Emerging trends show investors favoring flexible funding structures that adapt to market volatility and company growth trajectories.

Equity vs Debt Infographic

difterm.com

difterm.com