The cash flow statement provides a clear view of the actual cash generated and spent by a business, highlighting liquidity and operational efficiency, while the profit and loss statement focuses on the company's revenues and expenses to determine net profit or loss over a period. Understanding the differences between these financial reports is essential for managing business finances and making informed investment decisions. Cash flow statements emphasize cash movements, whereas profit and loss statements reflect accounting earnings, which may include non-cash items.

Table of Comparison

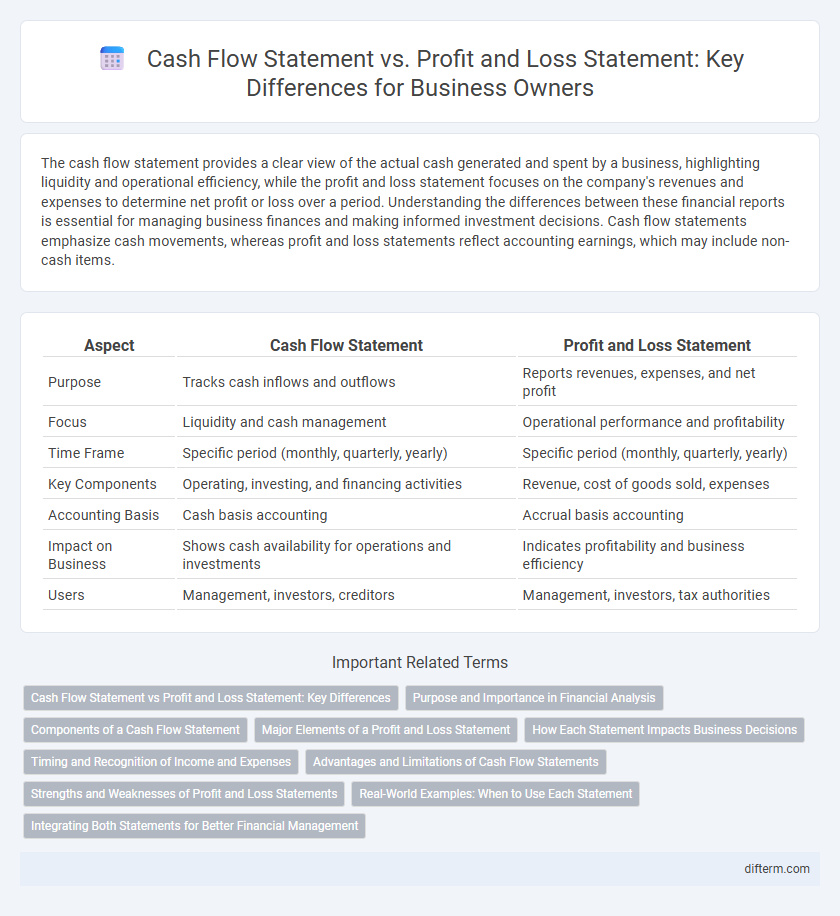

| Aspect | Cash Flow Statement | Profit and Loss Statement |

|---|---|---|

| Purpose | Tracks cash inflows and outflows | Reports revenues, expenses, and net profit |

| Focus | Liquidity and cash management | Operational performance and profitability |

| Time Frame | Specific period (monthly, quarterly, yearly) | Specific period (monthly, quarterly, yearly) |

| Key Components | Operating, investing, and financing activities | Revenue, cost of goods sold, expenses |

| Accounting Basis | Cash basis accounting | Accrual basis accounting |

| Impact on Business | Shows cash availability for operations and investments | Indicates profitability and business efficiency |

| Users | Management, investors, creditors | Management, investors, tax authorities |

Cash Flow Statement vs Profit and Loss Statement: Key Differences

The Cash Flow Statement highlights the actual inflows and outflows of cash within a business, emphasizing liquidity and the ability to sustain operations, whereas the Profit and Loss Statement records revenues and expenses to show net profit or loss over a period. Unlike the Profit and Loss Statement, which includes non-cash items like depreciation and accounts receivable, the Cash Flow Statement provides a direct view of cash generated or used from operating, investing, and financing activities. Understanding these key differences aids stakeholders in evaluating both profitability and financial health through complementary perspectives.

Purpose and Importance in Financial Analysis

The Cash Flow Statement provides detailed insight into the actual liquidity movements within a business, revealing how well the company generates and manages cash to meet operational needs, invest, and finance activities. The Profit and Loss Statement, or Income Statement, focuses on recording revenues and expenses over a specific period, highlighting profitability and operational efficiency. Together, these statements are crucial for comprehensive financial analysis, enabling stakeholders to assess both short-term liquidity and long-term profitability.

Components of a Cash Flow Statement

The components of a cash flow statement include operating activities, investing activities, and financing activities, each reflecting different cash inflows and outflows. Operating activities report cash generated or spent in core business operations, investing activities track cash used for purchasing or selling assets, and financing activities show cash flow from borrowing or equity transactions. These components provide a clear view of a company's liquidity and financial flexibility, distinct from the profit and loss statement which focuses on revenues and expenses over a period.

Major Elements of a Profit and Loss Statement

A Profit and Loss Statement primarily includes major elements such as revenues, cost of goods sold (COGS), gross profit, operating expenses, and net income. Revenues represent total earnings from sales, while COGS accounts for direct costs associated with producing goods or services. Operating expenses encompass administrative and selling costs, and net income reflects the company's profitability after all expenses are deducted.

How Each Statement Impacts Business Decisions

The cash flow statement provides detailed insights into a company's liquidity by tracking inflows and outflows of cash, directly influencing short-term financial planning and operational decisions. The profit and loss statement highlights overall profitability by summarizing revenues, expenses, and net income, guiding strategic decisions on investment, cost control, and growth opportunities. Understanding both statements allows businesses to balance profitability with cash availability, ensuring sustainable financial health and informed decision-making.

Timing and Recognition of Income and Expenses

The Cash Flow Statement records the timing of actual cash inflows and outflows, reflecting when cash is received or paid, while the Profit and Loss Statement recognizes income and expenses based on the accrual accounting principle, matching revenues to the period they are earned regardless of cash movement. Revenue from sales is recorded in the Profit and Loss Statement when earned, even if cash is received later, whereas the Cash Flow Statement records the receipt of cash when it occurs. This difference in timing and recognition affects how liquidity and profitability are reported and analyzed in the financial health of a business.

Advantages and Limitations of Cash Flow Statements

Cash flow statements provide clear insights into a company's liquidity by tracking inflows and outflows of cash, enabling better short-term financial management compared to profit and loss statements. They highlight the actual cash available for operations, investments, and financing, which profit and loss statements may obscure due to accrual accounting. However, cash flow statements do not reflect non-cash expenses or revenue recognition, limiting their ability to measure overall profitability.

Strengths and Weaknesses of Profit and Loss Statements

Profit and Loss Statements provide a clear overview of a company's revenues and expenses, allowing stakeholders to gauge profitability over a specific period. However, they do not capture cash inflows and outflows, which can mask liquidity problems despite reported profits. This limitation makes the Profit and Loss Statement less effective for assessing real-time cash availability compared to the Cash Flow Statement.

Real-World Examples: When to Use Each Statement

Cash flow statements provide insights into a company's liquidity by tracking actual cash inflows and outflows, essential for managing daily operations and ensuring sufficient funds for expenses, such as payroll or inventory purchases. Profit and loss statements focus on profitability over a period, highlighting revenues earned and expenses incurred, which helps investors assess overall business performance and long-term viability. Real-world examples include startups relying on cash flow statements to monitor survival during early stages, while established companies use profit and loss statements to guide strategic decisions and measure growth.

Integrating Both Statements for Better Financial Management

Integrating the Cash Flow Statement with the Profit and Loss Statement provides a comprehensive view of a company's financial health by linking profitability with liquidity. This approach enhances financial management by enabling accurate cash forecasting, identifying potential cash shortfalls, and supporting strategic planning. Firms that synchronize both statements can better optimize working capital, improve investment decisions, and sustain operational stability.

Cash Flow Statement vs Profit and Loss Statement Infographic

difterm.com

difterm.com