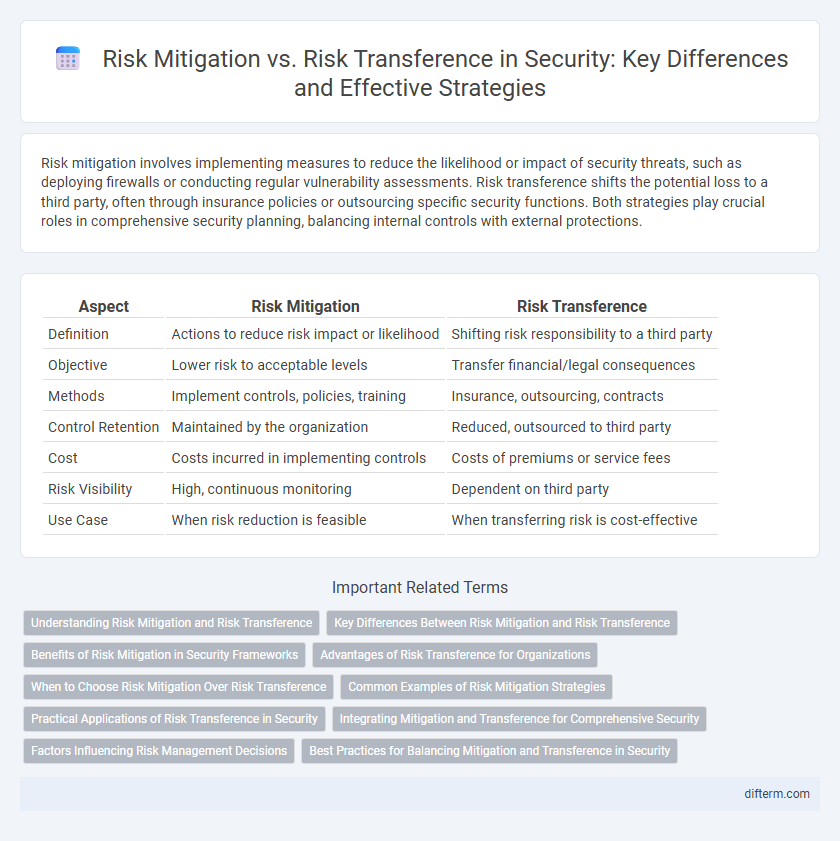

Risk mitigation involves implementing measures to reduce the likelihood or impact of security threats, such as deploying firewalls or conducting regular vulnerability assessments. Risk transference shifts the potential loss to a third party, often through insurance policies or outsourcing specific security functions. Both strategies play crucial roles in comprehensive security planning, balancing internal controls with external protections.

Table of Comparison

| Aspect | Risk Mitigation | Risk Transference |

|---|---|---|

| Definition | Actions to reduce risk impact or likelihood | Shifting risk responsibility to a third party |

| Objective | Lower risk to acceptable levels | Transfer financial/legal consequences |

| Methods | Implement controls, policies, training | Insurance, outsourcing, contracts |

| Control Retention | Maintained by the organization | Reduced, outsourced to third party |

| Cost | Costs incurred in implementing controls | Costs of premiums or service fees |

| Risk Visibility | High, continuous monitoring | Dependent on third party |

| Use Case | When risk reduction is feasible | When transferring risk is cost-effective |

Understanding Risk Mitigation and Risk Transference

Risk mitigation involves implementing strategies and controls to reduce the likelihood or impact of security threats, such as deploying firewalls, encryption, and regular security audits. Risk transference shifts the potential impact of risks to third parties through mechanisms like insurance policies or outsourcing critical functions to specialized security providers. Understanding these approaches helps organizations balance internal control efforts with external commitments to manage security risks effectively.

Key Differences Between Risk Mitigation and Risk Transference

Risk mitigation involves implementing measures to reduce the likelihood or impact of security threats by strengthening defenses, while risk transference shifts the potential loss to a third party, such as through insurance or outsourcing. Risk mitigation requires ongoing management and control adjustments, whereas risk transference relies on contractual agreements to manage liability. Key differences include control retention, cost implication, and the direct handling of risk consequences between these two strategies.

Benefits of Risk Mitigation in Security Frameworks

Risk mitigation enhances security frameworks by proactively identifying and addressing vulnerabilities, reducing the likelihood and impact of potential threats through tailored controls and continuous monitoring. It strengthens an organization's resilience by minimizing exposure to security incidents and fostering a culture of risk awareness and prevention. Effective risk mitigation supports compliance with regulatory requirements and improves trust among stakeholders by demonstrating a commitment to safeguarding critical assets.

Advantages of Risk Transference for Organizations

Risk transference allows organizations to shift financial liabilities and potential losses to third parties, such as insurance companies or outsourcing vendors, reducing direct exposure to risks. This approach enhances financial predictability by converting uncertain risks into fixed costs, improving budgeting and resource allocation. Leveraging specialized expertise of external partners also increases organizational resilience and operational focus on core activities.

When to Choose Risk Mitigation Over Risk Transference

Risk mitigation is preferred over risk transference when an organization has sufficient resources and control to directly reduce vulnerabilities and potential impacts. Choosing mitigation is crucial when the risk is high-impact but manageable through internal policies, technological controls, or employee training. Risk mitigation ensures sustained operational security by minimizing exposure rather than shifting responsibility to third parties, which may introduce new uncertainties.

Common Examples of Risk Mitigation Strategies

Risk mitigation strategies commonly include implementing firewalls, encryption, and multi-factor authentication to reduce the likelihood and impact of cyber threats. Regular security training and awareness programs for employees decrease human error, which is a significant risk factor for data breaches. Physical security measures like access controls and surveillance systems are also key components in mitigating risks by limiting unauthorized access.

Practical Applications of Risk Transference in Security

Risk transference in security involves shifting potential losses to third parties through mechanisms such as insurance policies, outsourcing cybersecurity functions, or entering contractual agreements with vendors who assume liability. Practical applications include purchasing cyber insurance to cover financial impacts of data breaches and delegating network monitoring to specialized managed security service providers (MSSPs) who absorb operational risks. These strategies reduce organizational exposure by allocating specific threats to external entities better equipped to manage or absorb the consequences.

Integrating Mitigation and Transference for Comprehensive Security

Integrating risk mitigation and risk transference creates a comprehensive security strategy by balancing direct control with outsourced management of threats. Risk mitigation involves implementing controls and safeguards to reduce vulnerability, while risk transference shifts potential impact through insurance or contractual agreements. Combining these approaches ensures both proactive defense measures and financial protection against residual risks.

Factors Influencing Risk Management Decisions

Risk mitigation and risk transference are shaped by factors such as organizational risk tolerance, regulatory compliance requirements, and available resources. The decision to mitigate risks through controls or transfer them via insurance or outsourcing depends heavily on cost-benefit analysis and potential impact severity. Strategic alignment with business objectives and ongoing risk assessments also influence whether an entity prioritizes reducing risk exposure internally or shifting responsibility externally.

Best Practices for Balancing Mitigation and Transference in Security

Implementing a balanced security strategy involves integrating risk mitigation techniques such as firewalls, encryption, and employee training with risk transference mechanisms like cyber insurance and outsourcing to specialized vendors. Best practices emphasize continuous risk assessment to identify vulnerabilities suited for mitigation and those better managed through transference agreements, ensuring optimal resource allocation. Leveraging frameworks like NIST and ISO 27001 supports organizations in aligning security controls with risk appetite and regulatory compliance requirements.

Risk mitigation vs Risk transference Infographic

difterm.com

difterm.com