Percentage lease agreements tie rent payments to a portion of the tenant's sales revenue, aligning landlord and tenant interests in retail and commercial properties. Fixed lease agreements establish a predetermined rent amount regardless of the tenant's business performance, offering predictable income for landlords. Choosing between percentage and fixed leases depends on the property's location, tenant type, and market conditions to optimize revenue and risk management.

Table of Comparison

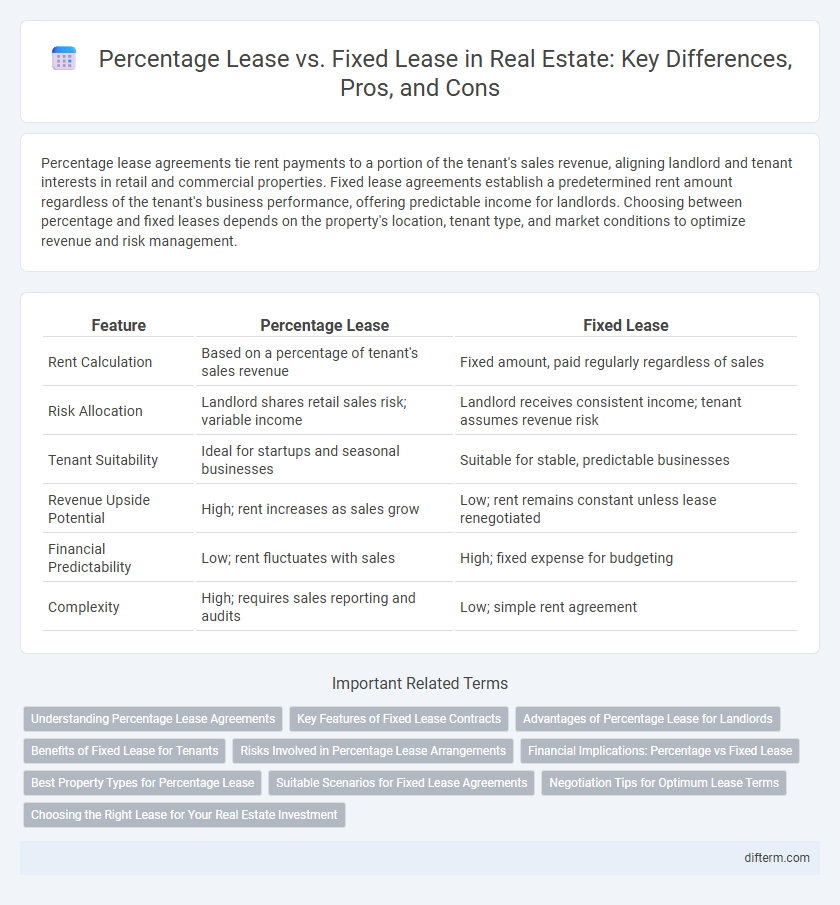

| Feature | Percentage Lease | Fixed Lease |

|---|---|---|

| Rent Calculation | Based on a percentage of tenant's sales revenue | Fixed amount, paid regularly regardless of sales |

| Risk Allocation | Landlord shares retail sales risk; variable income | Landlord receives consistent income; tenant assumes revenue risk |

| Tenant Suitability | Ideal for startups and seasonal businesses | Suitable for stable, predictable businesses |

| Revenue Upside Potential | High; rent increases as sales grow | Low; rent remains constant unless lease renegotiated |

| Financial Predictability | Low; rent fluctuates with sales | High; fixed expense for budgeting |

| Complexity | High; requires sales reporting and audits | Low; simple rent agreement |

Understanding Percentage Lease Agreements

Percentage lease agreements in real estate allow landlords to receive rental income based on a percentage of the tenant's gross sales, aligning landlord and tenant interests in the property's commercial success. This leasing model is commonly used in retail spaces where tenant sales fluctuate, providing landlords with potential upside during high revenue periods and tenants with lower base rent during slow sales. Understanding the specific percentage rate, breakpoint sales volume, and base rent structure is essential for negotiating favorable terms and ensuring predictable cash flow.

Key Features of Fixed Lease Contracts

Fixed lease contracts in real estate establish a predetermined rent amount that remains constant throughout the lease term, providing tenants with predictable expenses and landlords with stable income. These contracts typically have a set duration, often ranging from one to several years, with specified terms for renewal or termination. Fixed leases minimize financial risk by avoiding fluctuations tied to property income or sales performance, making them distinct from percentage lease agreements that base rent on sales revenue.

Advantages of Percentage Lease for Landlords

Percentage leases offer landlords the advantage of earning rental income that fluctuates with the tenant's sales performance, aligning landlord profits with business success. This lease structure incentivizes landlords to maintain and promote property value, as higher tenant revenue directly increases rental payments. It also reduces the risk of receiving low fixed rent during economic downturns, providing a more flexible and potentially lucrative income stream.

Benefits of Fixed Lease for Tenants

Fixed leases provide tenants with predictable monthly payments, simplifying budgeting and financial planning by eliminating rent fluctuations. This stability helps tenants avoid unexpected cost increases associated with percentage leases, which tie rent to sales performance. Furthermore, fixed leases offer greater security and reduced risk, allowing tenants to focus on business growth without the pressure of variable rent expenses.

Risks Involved in Percentage Lease Arrangements

Percentage lease agreements expose landlords to revenue volatility, as rental income fluctuates based on tenant sales performance. Tenants face the risk of unpredictable rent payments during market downturns or seasonal slumps, impacting cash flow and budgeting. Both parties may encounter disputes over sales reporting accuracy, necessitating clear audit rights and transparent accounting practices.

Financial Implications: Percentage vs Fixed Lease

Percentage leases align tenant rent with business performance by charging a base rent plus a percentage of gross sales, reducing financial risk during low revenue periods and potentially increasing tenant profitability. Fixed leases provide predictable, consistent rental income for landlords, simplifying budgeting but transferring all financial risk to tenants regardless of sales fluctuations. Choosing between percentage and fixed leases impacts cash flow stability, risk distribution, and long-term financial planning for both parties in commercial real estate agreements.

Best Property Types for Percentage Lease

Percentage leases are best suited for retail properties and shopping centers where tenant sales directly correlate with rent payments, allowing landlords to benefit from higher revenues during peak business periods. Restaurants, boutiques, and specialty stores commonly adopt percentage leases to align rent with business performance, reducing tenant risk in slower months. Fixed leases, in contrast, are more appropriate for office buildings and industrial spaces where consistent rental income is preferred regardless of tenant revenue fluctuations.

Suitable Scenarios for Fixed Lease Agreements

Fixed lease agreements are ideal for tenants and landlords seeking predictable, consistent rental payments regardless of business performance or market fluctuations. These leases are particularly suitable for residential properties, office spaces, and long-term commercial arrangements where stable cash flow simplifies budgeting and financial planning. Businesses with low seasonal variability or stable revenue streams often prefer fixed leases to avoid rent uncertainty.

Negotiation Tips for Optimum Lease Terms

Negotiating percentage lease versus fixed lease terms requires a clear understanding of revenue projections and market trends to align landlord and tenant interests effectively. Emphasize data-driven clauses that balance risk and reward, such as establishing realistic breakpoint figures in percentage leases or incorporating escalation clauses in fixed leases based on inflation or market indices. Careful negotiation of these terms can optimize cash flow stability while providing flexibility for business growth and changing economic conditions.

Choosing the Right Lease for Your Real Estate Investment

Selecting the right lease type significantly impacts real estate investment returns, with percentage leases aligning tenant rent payments to a portion of sales, ideal for retail properties expecting variable foot traffic. Fixed leases offer predictable, stable income by charging a set rent amount regardless of business performance, suitable for long-term, low-risk investments. Evaluating property type, tenant business model, and market volatility ensures choosing between percentage and fixed leases maximizes investment profitability and minimizes financial uncertainties.

Percentage Lease vs Fixed Lease Infographic

difterm.com

difterm.com