Underwriting evaluates the financial risk of a real estate transaction by verifying borrower credentials, income, and creditworthiness to ensure loan eligibility. Appraisal determines the property's market value through a professional assessment, influencing loan amount and terms. Both processes are essential for mitigating risk and establishing fair lending decisions.

Table of Comparison

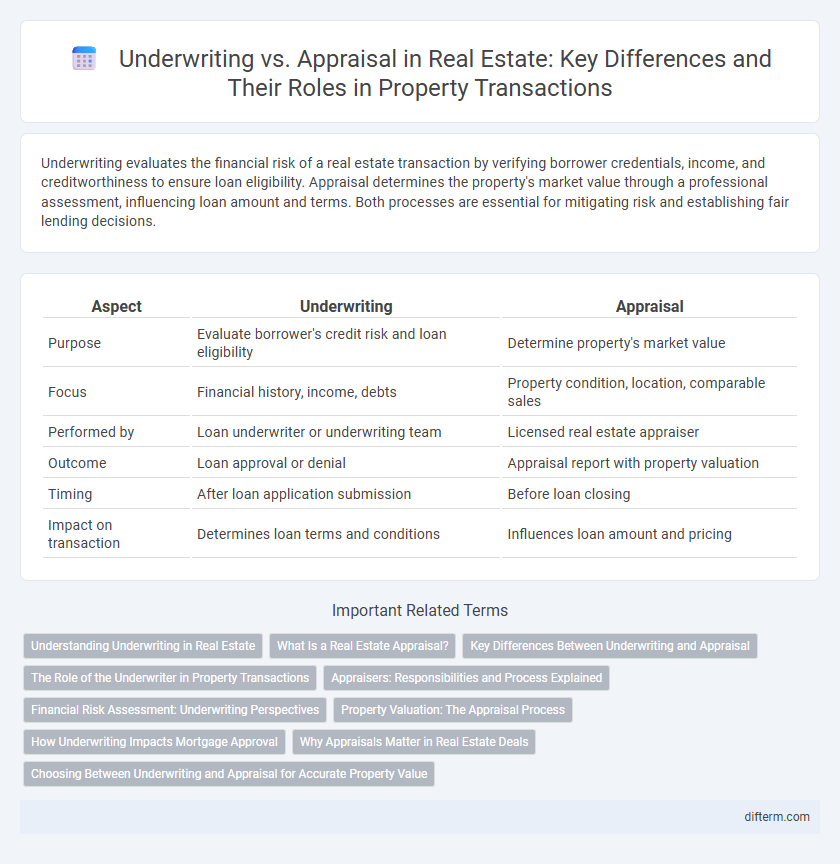

| Aspect | Underwriting | Appraisal |

|---|---|---|

| Purpose | Evaluate borrower's credit risk and loan eligibility | Determine property's market value |

| Focus | Financial history, income, debts | Property condition, location, comparable sales |

| Performed by | Loan underwriter or underwriting team | Licensed real estate appraiser |

| Outcome | Loan approval or denial | Appraisal report with property valuation |

| Timing | After loan application submission | Before loan closing |

| Impact on transaction | Determines loan terms and conditions | Influences loan amount and pricing |

Understanding Underwriting in Real Estate

Underwriting in real estate involves evaluating the risk and financial viability of a mortgage loan application by analyzing the borrower's credit history, income, assets, and the property's value. This process ensures the loan meets lender guidelines and regulatory requirements, reducing the chance of default. Unlike appraisal, which solely assesses the property's market value, underwriting provides a comprehensive assessment of the overall loan risk.

What Is a Real Estate Appraisal?

A real estate appraisal is a professional assessment of a property's market value conducted by a licensed appraiser to ensure accurate pricing during a sale or financing process. It involves analyzing comparable property sales, property condition, location, and market trends to provide an unbiased valuation. Appraisals are critical for lenders to mitigate risk by confirming the property's worth aligns with the loan amount requested.

Key Differences Between Underwriting and Appraisal

Underwriting in real estate focuses on assessing the borrower's creditworthiness, financial stability, and risk factors to approve or deny a loan, while appraisal determines the property's market value through comparative analysis and inspection. Key differences include underwriting's emphasis on loan eligibility criteria versus appraisal's role in verifying property value to protect lender interests. Underwriting influences loan terms and conditions, whereas appraisal directly impacts the loan amount based on property valuation.

The Role of the Underwriter in Property Transactions

The underwriter in property transactions evaluates the financial risk by analyzing the borrower's creditworthiness, income stability, and the property's value to ensure loan eligibility. Their role includes verifying documentation, assessing market conditions, and confirming compliance with lending guidelines to minimize default risk. Unlike the appraisal, which strictly determines the property's fair market value, underwriting integrates multiple factors to approve or deny loan applications.

Appraisers: Responsibilities and Process Explained

Appraisers play a critical role in the real estate transaction by providing an unbiased estimate of a property's fair market value based on comprehensive analysis of comparable sales, property condition, and local market trends. Their responsibilities include conducting onsite inspections, documenting physical features, and compiling detailed reports that lenders use to assess loan risk. The appraisal process ensures transparency and helps protect both buyers and lenders from overpaying or extending credit on overvalued properties.

Financial Risk Assessment: Underwriting Perspectives

Underwriting in real estate rigorously evaluates financial risk by analyzing borrower creditworthiness, income stability, and debt-to-income ratio to ensure loan repayment capability. Appraisal focuses on property value assessment, estimating market value to secure collateral adequacy but does not directly assess borrower financial risk. Underwriting integrates appraisal results with comprehensive financial analysis to mitigate lending risks and protect investment stability.

Property Valuation: The Appraisal Process

The appraisal process in real estate involves a licensed appraiser conducting a detailed evaluation of a property's market value based on factors like location, condition, and comparable sales. This independent assessment ensures an objective estimate, which lenders rely on to mitigate risk in mortgage underwriting. Unlike underwriting, which incorporates credit and financial analysis, the appraisal focuses exclusively on accurate property valuation to determine loan eligibility.

How Underwriting Impacts Mortgage Approval

Underwriting significantly impacts mortgage approval by assessing the borrower's creditworthiness, income stability, and debt-to-income ratio to determine loan eligibility and risk. This process evaluates documentation and financial history to ensure compliance with lender guidelines, directly influencing the loan terms and approval decision. Accurate underwriting mitigates default risk and establishes the foundation for a secure mortgage agreement.

Why Appraisals Matter in Real Estate Deals

Appraisals matter in real estate deals because they provide an unbiased market value assessment of the property, ensuring buyers and lenders make informed decisions. Underwriting relies on these appraisals to verify the property's worth aligns with the loan amount, reducing financial risk. Accurate appraisals protect all parties by preventing overpaying or lending more than the property's true value.

Choosing Between Underwriting and Appraisal for Accurate Property Value

Underwriting evaluates property value by analyzing financial risk factors and borrower credit, ensuring loan eligibility aligns with market conditions. Appraisal provides an independent, professional assessment of the property's current market value based on physical inspection and comparable sales data. Selecting underwriting for risk assessment or appraisal for market precision depends on whether loan qualification or exact property valuation is prioritized in real estate transactions.

Underwriting vs Appraisal Infographic

difterm.com

difterm.com