A triple-net lease requires the tenant to pay property taxes, insurance, and maintenance costs on top of rent, transferring significant financial responsibilities from the landlord. An absolute net lease goes further by assigning all risks, including structural repairs and damages caused by disasters, entirely to the tenant. Understanding the distinctions between these lease types is crucial for investors seeking predictable income streams and risk management in commercial real estate.

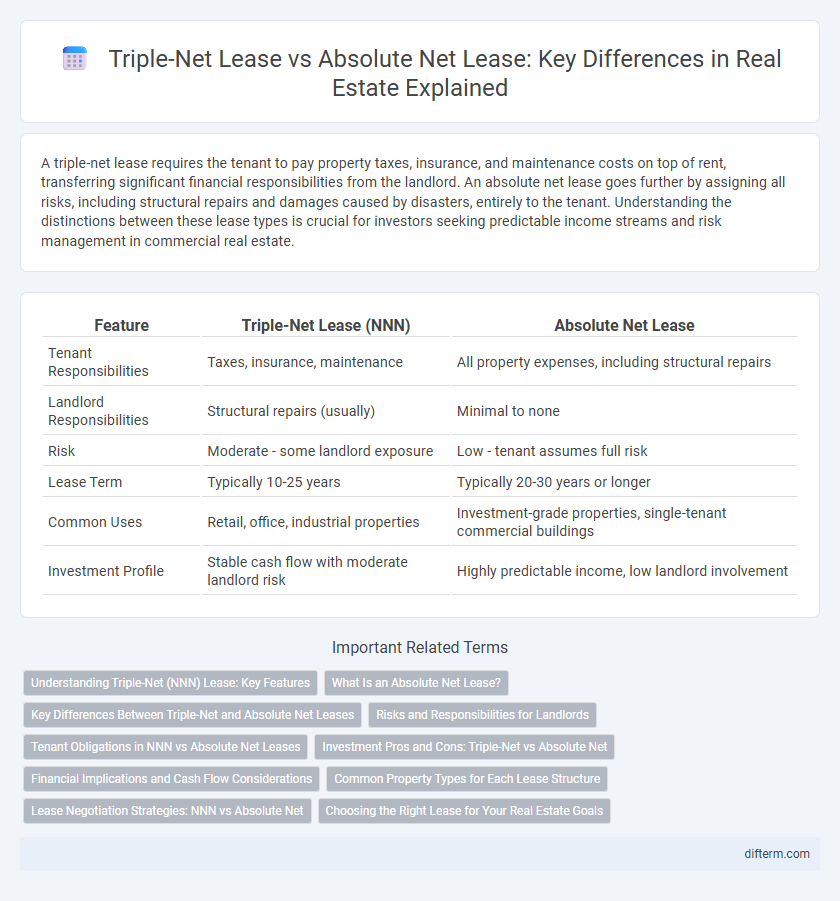

Table of Comparison

| Feature | Triple-Net Lease (NNN) | Absolute Net Lease |

|---|---|---|

| Tenant Responsibilities | Taxes, insurance, maintenance | All property expenses, including structural repairs |

| Landlord Responsibilities | Structural repairs (usually) | Minimal to none |

| Risk | Moderate - some landlord exposure | Low - tenant assumes full risk |

| Lease Term | Typically 10-25 years | Typically 20-30 years or longer |

| Common Uses | Retail, office, industrial properties | Investment-grade properties, single-tenant commercial buildings |

| Investment Profile | Stable cash flow with moderate landlord risk | Highly predictable income, low landlord involvement |

Understanding Triple-Net (NNN) Lease: Key Features

A Triple-Net (NNN) lease requires tenants to pay property taxes, insurance, and maintenance costs in addition to rent, transferring most expenses to the tenant and reducing landlord responsibilities. This lease structure is common in commercial real estate, offering predictable income streams for landlords while tenants assume greater financial risk. Understanding the distinction between triple-net and absolute net leases involves recognizing that absolute net leases impose even more stringent tenant obligations, often including structural repairs and replacements.

What Is an Absolute Net Lease?

An absolute net lease is a type of commercial real estate lease where the tenant assumes responsibility for all property-related expenses, including taxes, insurance, maintenance, and structural repairs, without any landlord obligations. This lease structure minimizes the landlord's financial risk by transferring nearly all expenses and liabilities to the tenant. Absolute net leases are commonly used in single-tenant freestanding properties such as retail stores, industrial buildings, and office spaces.

Key Differences Between Triple-Net and Absolute Net Leases

Triple-net leases require tenants to pay property taxes, insurance, and maintenance expenses, while absolute net leases place all financial responsibilities, including structural repairs and liabilities, solely on the tenant. Triple-net leases typically involve some landlord responsibility for major repairs or structural issues, whereas absolute net leases shift complete risk to the tenant. Understanding these distinctions is crucial for investors and tenants to assess long-term financial obligations and property risk exposure.

Risks and Responsibilities for Landlords

In triple-net leases, landlords transfer most property-related financial responsibilities, including taxes, insurance, and maintenance, to tenants, significantly reducing landlord risk and management duties. Absolute net leases further intensify these obligations by obligating tenants to cover structural repairs and liabilities, placing nearly all property-related risks on tenants while providing landlords with minimal financial exposure. Landlords benefit from predictable income streams and lower operational costs under both lease types, but absolute net leases offer the highest risk mitigation by minimizing landlord involvement in property upkeep and liabilities.

Tenant Obligations in NNN vs Absolute Net Leases

In a triple-net lease (NNN), the tenant is responsible for property taxes, insurance, and maintenance expenses, transferring most operating costs from the landlord to the tenant. Absolute net leases extend tenant obligations even further, often including structural repairs and all potential liabilities without landlord interference, commonly used in single-tenant properties like corporate headquarters. Understanding the scope of tenant obligations in NNN versus absolute net leases is crucial for investors to assess risk allocation and long-term property management costs.

Investment Pros and Cons: Triple-Net vs Absolute Net

Triple-net leases (NNN) require tenants to cover property taxes, insurance, and maintenance, providing investors with predictable cash flow and reduced management responsibilities but exposing them to variable costs if tenant defaults occur. Absolute net leases shift nearly all risks and expenses, including structural repairs, to the tenant, offering investors minimal expense risk and maximum income stability but potentially higher vacancy risk due to tenant burden. Investors must balance the higher security and lower management involvement of absolute net leases against the more common but moderately riskier triple-net lease structures when optimizing their real estate portfolio.

Financial Implications and Cash Flow Considerations

Triple-net leases require tenants to cover property taxes, insurance, and maintenance costs, resulting in predictable and steady cash flow for landlords with reduced operational expenses. Absolute net leases extend tenant responsibilities to structural repairs and replacements, significantly lowering landlord financial risks but potentially leading to variable cash flow depending on tenant maintenance performance. Understanding these differences aids investors in aligning lease structures with their risk tolerance and desired income stability.

Common Property Types for Each Lease Structure

Triple-net leases are frequently utilized in retail properties, industrial buildings, and office spaces where tenants assume responsibility for property taxes, insurance, and maintenance costs. Absolute net leases, commonly found in single-tenant net lease properties and freestanding commercial buildings, impose even more comprehensive obligations on tenants, including structural repairs and replacement costs. Retail strips, medical offices, and manufacturing facilities typically favor triple-net leases for balanced risk-sharing, while national credit tenants in standalone properties prefer absolute net leases for maximum landlord predictability.

Lease Negotiation Strategies: NNN vs Absolute Net

In lease negotiation strategies, understanding the distinctions between triple-net (NNN) leases and absolute net leases is critical for maximizing investment security and tenant responsibilities. A triple-net lease requires tenants to cover property taxes, insurance, and maintenance, while an absolute net lease imposes even broader obligations, including structural repairs and liabilities, shifting nearly all risks to the tenant. Landlords and tenants must leverage these differences to negotiate terms that balance financial exposure and long-term property management in commercial real estate transactions.

Choosing the Right Lease for Your Real Estate Goals

Choosing between a triple-net lease and an absolute net lease depends on your risk tolerance and investment objectives in real estate. Triple-net leases require tenants to cover property taxes, insurance, and maintenance, offering predictable income with moderate landlord responsibilities. Absolute net leases transfer virtually all property risks and expenses to the tenant, providing minimal landlord involvement but higher risk exposure, ideal for investors seeking passive income with less operational oversight.

Triple-net lease vs absolute net lease Infographic

difterm.com

difterm.com