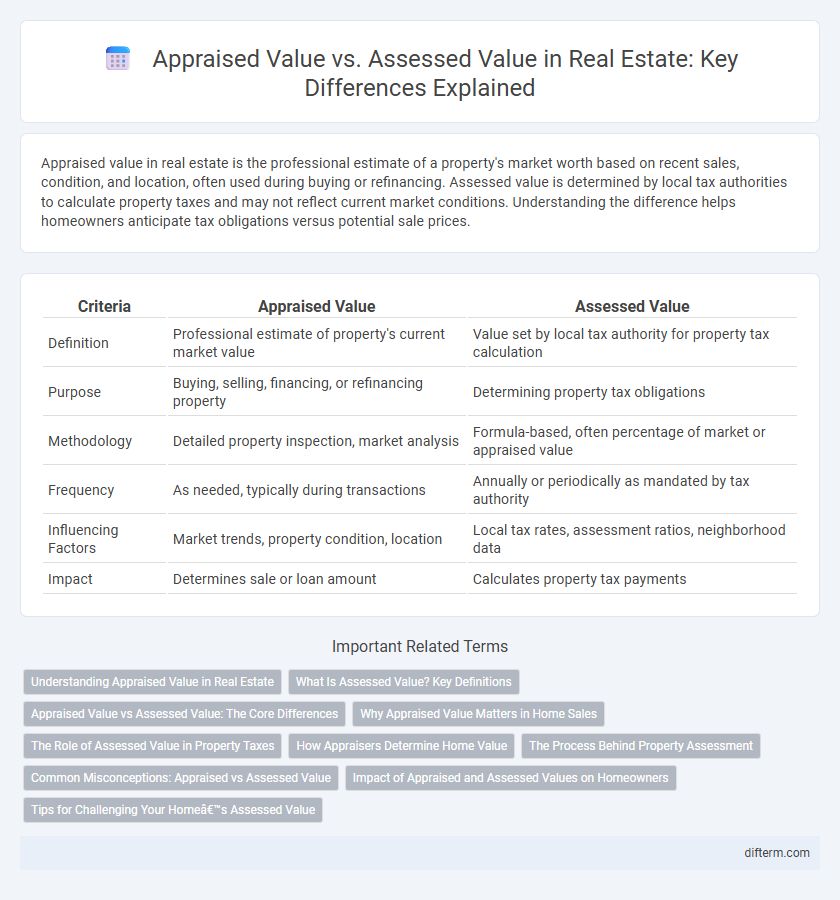

Appraised value in real estate is the professional estimate of a property's market worth based on recent sales, condition, and location, often used during buying or refinancing. Assessed value is determined by local tax authorities to calculate property taxes and may not reflect current market conditions. Understanding the difference helps homeowners anticipate tax obligations versus potential sale prices.

Table of Comparison

| Criteria | Appraised Value | Assessed Value |

|---|---|---|

| Definition | Professional estimate of property's current market value | Value set by local tax authority for property tax calculation |

| Purpose | Buying, selling, financing, or refinancing property | Determining property tax obligations |

| Methodology | Detailed property inspection, market analysis | Formula-based, often percentage of market or appraised value |

| Frequency | As needed, typically during transactions | Annually or periodically as mandated by tax authority |

| Influencing Factors | Market trends, property condition, location | Local tax rates, assessment ratios, neighborhood data |

| Impact | Determines sale or loan amount | Calculates property tax payments |

Understanding Appraised Value in Real Estate

Appraised value in real estate represents an expert's unbiased estimate of a property's market worth based on recent sales, property condition, and location. This valuation is crucial for buyers, sellers, and lenders to determine a fair price during transactions or mortgage approvals. Unlike assessed value, which is used primarily for tax purposes, the appraised value directly reflects current market conditions and property-specific factors.

What Is Assessed Value? Key Definitions

Assessed value in real estate refers to the dollar value assigned to a property by a local tax assessor for the purpose of calculating property taxes. It is typically a percentage of the appraised value and may vary based on jurisdictional regulations and assessment cycles. Understanding assessed value is crucial for homeowners as it directly impacts the amount of property tax owed, separate from market price or appraisal value.

Appraised Value vs Assessed Value: The Core Differences

Appraised value reflects the market-driven estimate determined by a licensed appraiser, considering current property conditions, comparable sales, and local market trends. Assessed value, used primarily for tax purposes, is calculated by local government assessors based on standardized formulas and often lags behind true market fluctuations. Understanding the core differences between appraised and assessed values is crucial for buyers and sellers to navigate real estate transactions and property tax obligations effectively.

Why Appraised Value Matters in Home Sales

Appraised value determines a property's fair market price based on expert evaluation of condition, location, and recent sales, directly influencing mortgage approval and sale negotiations. It provides an accurate reflection of a home's worth, ensuring buyers and sellers engage in transparent, informed transactions. Unlike assessed value, used primarily for tax calculations, appraised value is critical for securing financing and finalizing real estate deals.

The Role of Assessed Value in Property Taxes

Assessed value serves as the basis for calculating property taxes and is determined by local tax authorities, often representing a percentage of the appraised value. While the appraised value reflects the current market worth of a property conducted by a professional appraiser, the assessed value is typically lower to align with tax regulations. Understanding the assessed value is crucial for homeowners to anticipate their property tax liabilities and participate in appeals if discrepancies arise.

How Appraisers Determine Home Value

Appraisers determine home value by conducting a detailed analysis of comparable sales, current market trends, and the property's condition, size, and location. They also consider improvements, upgrades, and unique features to estimate a fair market value that reflects what buyers are willing to pay. Unlike assessed value used for tax purposes, appraised value offers a precise and current valuation based on professional standards and local real estate data.

The Process Behind Property Assessment

The property assessment process involves a licensed appraiser evaluating a property's market value through factors like recent sales, location, size, and condition. Appraised value reflects the estimated market price determined during this professional analysis, while assessed value is the percentage set by the tax authority based on the appraised value to calculate property taxes. Understanding this distinction helps homeowners anticipate tax liabilities and navigate real estate transactions effectively.

Common Misconceptions: Appraised vs Assessed Value

Appraised value is determined by a licensed appraiser based on market conditions and comparable sales, reflecting the property's fair market price. Assessed value is set by the local tax assessor to calculate property taxes and often represents a percentage of the appraised value, which can vary significantly by jurisdiction. Many homeowners mistakenly believe both values are equal, but understanding their distinct purposes is crucial for accurate real estate decisions.

Impact of Appraised and Assessed Values on Homeowners

Appraised value determines a home's market price based on a professional evaluation, directly influencing mortgage approval and sale potential. Assessed value is used by local governments to calculate property taxes, affecting homeowners' annual tax liabilities. Discrepancies between these values can significantly impact a homeowner's financial planning and long-term investment in real estate.

Tips for Challenging Your Home’s Assessed Value

Review your property's appraised value and compare it carefully with the assessed value listed by the local tax assessor to identify discrepancies. Gather recent sales data of comparable homes in your neighborhood, along with current market trends, to build a solid evidence-based appeal. Submit a formal appeal request with supporting documentation to the assessor's office and prepare to attend a hearing to present your case effectively.

appraised value vs assessed value Infographic

difterm.com

difterm.com