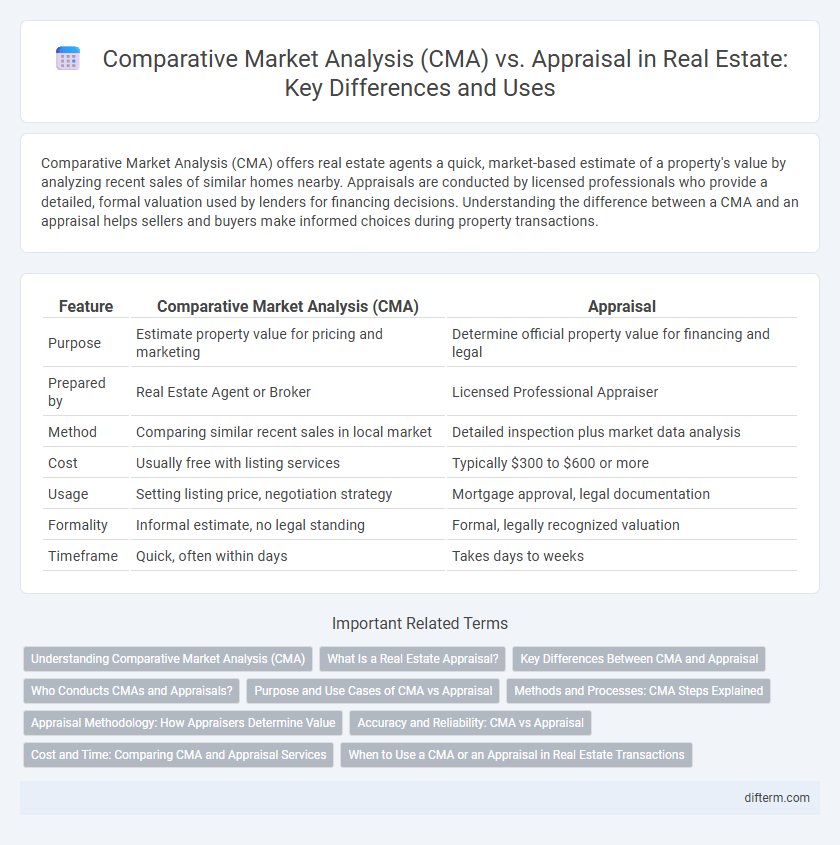

Comparative Market Analysis (CMA) offers real estate agents a quick, market-based estimate of a property's value by analyzing recent sales of similar homes nearby. Appraisals are conducted by licensed professionals who provide a detailed, formal valuation used by lenders for financing decisions. Understanding the difference between a CMA and an appraisal helps sellers and buyers make informed choices during property transactions.

Table of Comparison

| Feature | Comparative Market Analysis (CMA) | Appraisal |

|---|---|---|

| Purpose | Estimate property value for pricing and marketing | Determine official property value for financing and legal |

| Prepared by | Real Estate Agent or Broker | Licensed Professional Appraiser |

| Method | Comparing similar recent sales in local market | Detailed inspection plus market data analysis |

| Cost | Usually free with listing services | Typically $300 to $600 or more |

| Usage | Setting listing price, negotiation strategy | Mortgage approval, legal documentation |

| Formality | Informal estimate, no legal standing | Formal, legally recognized valuation |

| Timeframe | Quick, often within days | Takes days to weeks |

Understanding Comparative Market Analysis (CMA)

A Comparative Market Analysis (CMA) evaluates a property's value by examining recent sales of similar homes in the same area, providing a current market perspective for sellers and buyers. Unlike formal appraisals conducted by licensed appraisers, CMAs are typically prepared by real estate agents and focus on market trends, neighborhood data, and property features. This tool helps determine a competitive listing price based on comparable properties, making it essential for pricing strategy in real estate transactions.

What Is a Real Estate Appraisal?

A real estate appraisal is a professional, unbiased estimate of a property's market value conducted by a licensed appraiser. It involves a detailed evaluation of the property's condition, location, and comparable sales to determine an accurate value primarily used for loan underwriting or tax assessments. Unlike a comparative market analysis (CMA), which is an informal estimate by real estate agents, an appraisal is a legally recognized, standardized process essential for financing decisions.

Key Differences Between CMA and Appraisal

Comparative Market Analysis (CMA) estimates a property's value by analyzing recent sales of similar homes in the area, primarily used by real estate agents for pricing strategies. In contrast, an appraisal is a formal, detailed valuation performed by a licensed appraiser, required for mortgage lending and legal purposes. Key differences include the CMA's reliance on current market trends and agent expertise versus the appraisal's strict adherence to standardized methodologies and regulatory guidelines.

Who Conducts CMAs and Appraisals?

Comparative Market Analyses (CMAs) are typically conducted by real estate agents and brokers who analyze recent sales data, active listings, and market trends to estimate a property's value. Appraisals are performed by licensed or certified appraisers who follow standardized methods and regulatory guidelines to provide an objective valuation often required by lenders. The distinct expertise and purpose of each professional significantly influence the accuracy and application of the property valuation.

Purpose and Use Cases of CMA vs Appraisal

Comparative Market Analysis (CMA) is primarily used by real estate agents to estimate a property's market value by analyzing recent sales of similar homes in the area, aiding sellers in setting competitive listing prices. An appraisal, conducted by licensed appraisers, provides a formal, unbiased valuation required by lenders during mortgage approval to determine the property's fair market value. While CMA is a marketing tool to guide pricing strategy, an appraisal serves legal and financial purposes, ensuring accurate valuation for loan underwriting and refinancing decisions.

Methods and Processes: CMA Steps Explained

Comparative Market Analysis (CMA) involves evaluating recently sold, active, and expired listings similar to the subject property to estimate its market value based on current market trends. The process includes selecting comparable properties, adjusting for differences such as size, features, and location, and analyzing market conditions to derive a competitive price range. Unlike formal appraisals, CMAs rely primarily on local real estate agent expertise and current market data rather than strict regulatory standards or professional appraisal methods.

Appraisal Methodology: How Appraisers Determine Value

Appraisers determine property value through a systematic appraisal methodology that includes the cost approach, sales comparison approach, and income approach, each tailored to the property's characteristics and market conditions. The sales comparison approach analyzes recent comparable property sales to assess market value, while the cost approach estimates the replacement cost minus depreciation. Income approach is utilized primarily for investment properties by evaluating expected income streams to determine value, ensuring a comprehensive and objective valuation in real estate transactions.

Accuracy and Reliability: CMA vs Appraisal

A Comparative Market Analysis (CMA) provides a quick estimate of a property's value based on recent sales of similar homes in the area, making it less precise and more reliant on the agent's judgment. In contrast, an appraisal is conducted by a certified appraiser who uses standardized methods and in-depth property evaluation, resulting in higher accuracy and reliability. Appraisals are typically required by lenders for mortgage approval, reflecting their trusted and verified nature in determining true market value.

Cost and Time: Comparing CMA and Appraisal Services

Comparative Market Analysis (CMA) typically costs less and can be completed within a few days, providing a quick estimate of property value based on recent sales data. Appraisal services demand higher fees, often ranging from $300 to $500, and require more time, usually 7 to 10 days, due to in-depth inspections and professional evaluations. While CMA offers affordability and speed for market insights, appraisals provide more comprehensive and legally recognized valuations essential for financing and official transactions.

When to Use a CMA or an Appraisal in Real Estate Transactions

Comparative Market Analysis (CMA) is ideal for sellers and buyers who need a quick, cost-effective estimate of a property's market value based on recent sales of similar homes. Appraisals are essential during mortgage transactions, refinancing, or legal disputes, providing a detailed, professional valuation conducted by a licensed appraiser. Choosing between a CMA and an appraisal depends on the purpose of the valuation, the required accuracy, and whether the report will be used for lending or negotiation.

comparative market analysis (CMA) vs appraisal Infographic

difterm.com

difterm.com