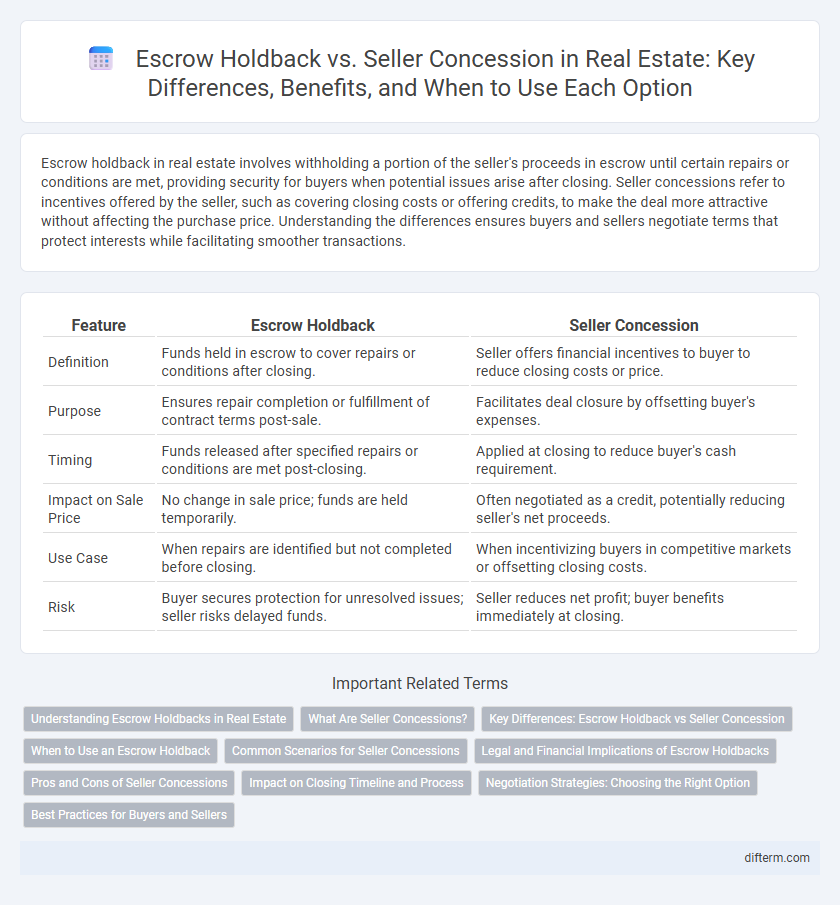

Escrow holdback in real estate involves withholding a portion of the seller's proceeds in escrow until certain repairs or conditions are met, providing security for buyers when potential issues arise after closing. Seller concessions refer to incentives offered by the seller, such as covering closing costs or offering credits, to make the deal more attractive without affecting the purchase price. Understanding the differences ensures buyers and sellers negotiate terms that protect interests while facilitating smoother transactions.

Table of Comparison

| Feature | Escrow Holdback | Seller Concession |

|---|---|---|

| Definition | Funds held in escrow to cover repairs or conditions after closing. | Seller offers financial incentives to buyer to reduce closing costs or price. |

| Purpose | Ensures repair completion or fulfillment of contract terms post-sale. | Facilitates deal closure by offsetting buyer's expenses. |

| Timing | Funds released after specified repairs or conditions are met post-closing. | Applied at closing to reduce buyer's cash requirement. |

| Impact on Sale Price | No change in sale price; funds are held temporarily. | Often negotiated as a credit, potentially reducing seller's net proceeds. |

| Use Case | When repairs are identified but not completed before closing. | When incentivizing buyers in competitive markets or offsetting closing costs. |

| Risk | Buyer secures protection for unresolved issues; seller risks delayed funds. | Seller reduces net profit; buyer benefits immediately at closing. |

Understanding Escrow Holdbacks in Real Estate

Escrow holdbacks in real estate involve retaining a portion of the seller's proceeds in escrow to cover specific repairs or pending conditions after closing, providing security for buyers without delaying the transaction. Unlike seller concessions, which are negotiated credits from the seller to the buyer to offset closing costs or repairs, escrow holdbacks ensure funds are available until agreed-upon work is completed and verified. This mechanism helps maintain transaction integrity and protects buyer interests when issues are identified during property inspections or appraisal contingencies.

What Are Seller Concessions?

Seller concessions are incentives offered by the seller to help the buyer cover closing costs, reducing the buyer's upfront expenses in a real estate transaction. These concessions can include paying for appraisal fees, inspection costs, or contributing toward the buyer's mortgage points, ultimately making the property more affordable. Understanding seller concessions is crucial for both buyers and sellers to negotiate terms that benefit both parties and facilitate a smoother closing process.

Key Differences: Escrow Holdback vs Seller Concession

Escrow holdback involves withholding a portion of the seller's proceeds in a neutral escrow account until specific repairs or conditions are met, providing security for buyers in property transactions. Seller concessions refer to credits or financial incentives offered by the seller to cover the buyer's closing costs or other expenses, often used to make the deal more attractive. The key difference lies in escrow holdbacks being conditional funds held post-closing for agreed-upon repairs, while seller concessions are upfront financial incentives reducing the buyer's initial out-of-pocket costs.

When to Use an Escrow Holdback

An escrow holdback is used when repairs or agreed-upon improvements cannot be completed before closing, ensuring funds are reserved until the work is verified. It protects buyers by holding money in escrow until sellers fulfill contractual obligations, often applied in transactions with pending inspections or deferred repairs. This method is preferred when immediate remediation is necessary, but timing or logistics delay completion beyond closing.

Common Scenarios for Seller Concessions

Seller concessions frequently occur in competitive real estate markets where buyers aim to reduce upfront costs by negotiating the seller to cover expenses such as closing costs, repairs, or HOA fees. In contrast, escrow holdbacks are typically employed when repairs or contingencies are incomplete at closing, ensuring funds are reserved to secure their completion. Common scenarios for seller concessions include helping first-time homebuyers afford down payments or making properties more attractive in slow markets by lowering the total out-of-pocket expense for buyers.

Legal and Financial Implications of Escrow Holdbacks

Escrow holdbacks involve temporarily withholding a portion of the sale proceeds to cover specified repairs or conditions post-closing, creating a legally binding agreement that protects buyers but may delay the seller's full payment. Unlike seller concessions, which are upfront financial incentives reducing the buyer's closing costs, escrow holdbacks directly influence the transaction's legal framework by establishing enforceable obligations for the seller's compliance with negotiated terms. Financially, escrow holdbacks can affect cash flow timing and hold a risk of disputes if repairs are not satisfactorily completed, requiring clear documentation and legal oversight.

Pros and Cons of Seller Concessions

Seller concessions offer buyers financial relief by covering closing costs, making a property more affordable and competitive in a market. However, concessions can reduce the seller's net proceeds and may signal a less motivated seller, potentially affecting the negotiation leverage. Evaluating the impact on final sale price and understanding lender restrictions is crucial when considering the pros and cons of seller concessions.

Impact on Closing Timeline and Process

Escrow holdbacks extend the closing timeline by requiring funds to be retained post-closing for specific repairs or conditions, ensuring buyer protection without delaying possession. Seller concessions streamline the process by adjusting closing costs upfront, often facilitating a faster close since the seller credits the buyer directly at settlement. Understanding these distinctions helps buyers and sellers manage expectations and optimize timing in real estate transactions.

Negotiation Strategies: Choosing the Right Option

Escrow holdback and seller concession each offer distinct advantages in real estate negotiations, allowing buyers and sellers to address repair costs or closing adjustments effectively. Selecting escrow holdback provides a security mechanism by withholding funds until specific repairs are completed, ensuring compliance and protecting buyer interests. Alternatively, seller concessions can facilitate smoother negotiations by reducing upfront costs for buyers, often increasing their purchasing power without delaying closing timelines.

Best Practices for Buyers and Sellers

Escrow holdbacks protect buyers by ensuring repairs or agreed-upon work are completed before final funds are released, while seller concessions provide financial incentives to ease buyer costs or negotiations. Buyers should carefully review escrow holdback terms to confirm deadlines and specific requirements, whereas sellers must clearly define concession limits to avoid unexpected financial burdens. Both parties benefit from detailed contract clauses and communication with real estate agents to align expectations and secure a smooth closing process.

Escrow Holdback vs Seller Concession Infographic

difterm.com

difterm.com