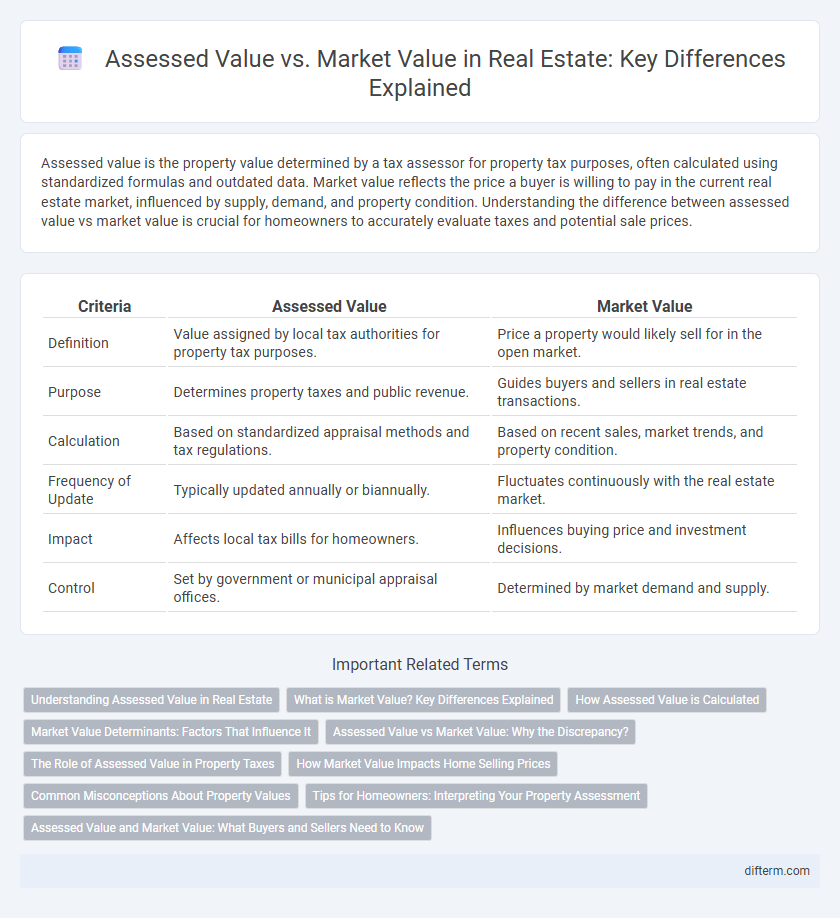

Assessed value is the property value determined by a tax assessor for property tax purposes, often calculated using standardized formulas and outdated data. Market value reflects the price a buyer is willing to pay in the current real estate market, influenced by supply, demand, and property condition. Understanding the difference between assessed value vs market value is crucial for homeowners to accurately evaluate taxes and potential sale prices.

Table of Comparison

| Criteria | Assessed Value | Market Value |

|---|---|---|

| Definition | Value assigned by local tax authorities for property tax purposes. | Price a property would likely sell for in the open market. |

| Purpose | Determines property taxes and public revenue. | Guides buyers and sellers in real estate transactions. |

| Calculation | Based on standardized appraisal methods and tax regulations. | Based on recent sales, market trends, and property condition. |

| Frequency of Update | Typically updated annually or biannually. | Fluctuates continuously with the real estate market. |

| Impact | Affects local tax bills for homeowners. | Influences buying price and investment decisions. |

| Control | Set by government or municipal appraisal offices. | Determined by market demand and supply. |

Understanding Assessed Value in Real Estate

Assessed value in real estate is the dollar value assigned to a property by a public tax assessor for the purpose of calculating property taxes. This value is typically a percentage of the market value but may differ due to assessment methods and local tax regulations. Understanding assessed value helps homeowners anticipate tax liabilities and enables buyers to evaluate property tax expenses relative to market prices.

What is Market Value? Key Differences Explained

Market value refers to the estimated price at which a property would sell in a competitive and open market under conditions where both buyer and seller are informed and acting without undue pressure. It reflects current market trends, demand, and comparable property sales, differing from assessed value, which is primarily used for tax purposes and determined by local government assessors. Understanding the distinction between market value and assessed value is crucial for accurate property appraisal and informed real estate transactions.

How Assessed Value is Calculated

Assessed value is calculated based on a percentage of the property's market value, determined by local tax assessors who evaluate factors such as recent sales data, property size, location, and condition. This value is used primarily for property tax purposes and may differ significantly from the current market value due to assessment schedules and localized valuation methods. Understanding the assessment formula and assessment ratio applied in a specific jurisdiction is crucial for property owners aiming to estimate their tax liabilities accurately.

Market Value Determinants: Factors That Influence It

Market value is primarily determined by factors such as location, property condition, and current market trends. Economic indicators including interest rates, employment rates, and local demand also significantly impact market value. Furthermore, comparable sales, property size, and neighborhood amenities play a crucial role in establishing a property's market worth.

Assessed Value vs Market Value: Why the Discrepancy?

Assessed value often differs from market value because it is calculated based on standardized criteria set by local tax authorities, primarily for property tax purposes, and may not reflect current market conditions. Market value fluctuates with supply and demand, recent sales, and economic factors, capturing the true buying price a property could fetch. These distinct methodologies create discrepancies, where assessed value can lag behind market value, leading to differences in property taxation versus sale price.

The Role of Assessed Value in Property Taxes

Assessed value is the dollar value assigned to a property by a public tax assessor for the purpose of calculating property taxes, typically based on recent sales, property characteristics, and local market trends. This value often differs from the market value, which represents the price a buyer is willing to pay in an open market transaction. Property tax bills are primarily determined by multiplying the assessed value by the local tax rate, underscoring the critical role of assessed value in funding municipal services and influencing homeowners' tax liabilities.

How Market Value Impacts Home Selling Prices

Market value directly influences home selling prices by reflecting the current demand and supply dynamics in the real estate market, often driving prices above or below the assessed value used for taxation. Sellers typically set listing prices based on market value to attract buyers and achieve competitive offers, while fluctuations in market conditions can significantly affect final sale prices. Understanding local market trends, comparable property sales, and economic factors is essential for accurately estimating a home's market value and optimizing sale outcomes.

Common Misconceptions About Property Values

Many property owners confuse assessed value with market value, mistakenly believing they represent the same price. Assessed value is determined by local tax assessors primarily for taxation purposes and often lags behind current market trends. Market value reflects the price a buyer is willing to pay in a competitive market and can fluctuate significantly based on supply, demand, and property condition.

Tips for Homeowners: Interpreting Your Property Assessment

Understanding the difference between assessed value and market value is crucial for homeowners when reviewing property assessments. The assessed value, determined by local tax authorities, often differs from the market value, which reflects current real estate trends and recent sales in the area. Homeowners should compare their property's assessed value with recent comparable sales to determine if their property tax bill is fair and consider appealing the assessment if discrepancies exist.

Assessed Value and Market Value: What Buyers and Sellers Need to Know

Assessed value is the dollar value assigned to a property by a public tax assessor for property tax purposes, often based on recent sales, construction costs, and neighborhood trends. Market value represents the price a buyer is willing to pay for the property in the current real estate market, influenced by factors like location, demand, and property condition. Buyers and sellers must understand that assessed value can differ significantly from market value, affecting taxation and pricing strategies during transactions.

Assessed Value vs Market Value Infographic

difterm.com

difterm.com