Treasury bills are short-term government securities with maturities of one year or less, offering lower yields but higher liquidity and lower risk. Treasury bonds, on the other hand, have long-term maturities typically ranging from 10 to 30 years, providing higher yields to compensate for increased interest rate risk and inflation exposure. Investors choose Treasury bills for capital preservation and quick access to funds, while Treasury bonds suit those seeking steady income through periodic interest payments over an extended period.

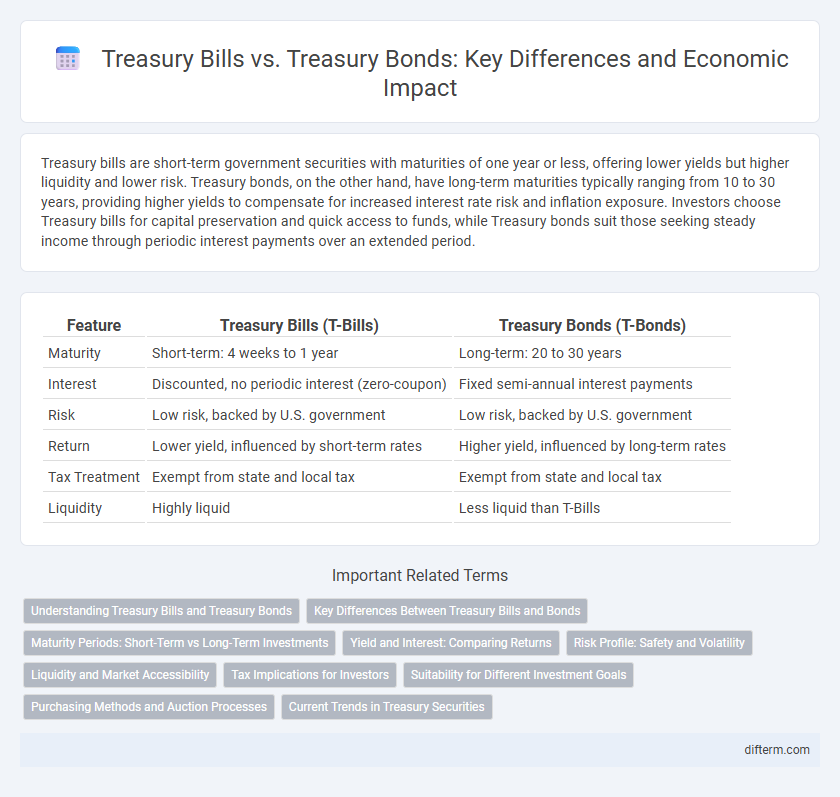

Table of Comparison

| Feature | Treasury Bills (T-Bills) | Treasury Bonds (T-Bonds) |

|---|---|---|

| Maturity | Short-term: 4 weeks to 1 year | Long-term: 20 to 30 years |

| Interest | Discounted, no periodic interest (zero-coupon) | Fixed semi-annual interest payments |

| Risk | Low risk, backed by U.S. government | Low risk, backed by U.S. government |

| Return | Lower yield, influenced by short-term rates | Higher yield, influenced by long-term rates |

| Tax Treatment | Exempt from state and local tax | Exempt from state and local tax |

| Liquidity | Highly liquid | Less liquid than T-Bills |

Understanding Treasury Bills and Treasury Bonds

Treasury Bills (T-Bills) are short-term government debt securities with maturities of one year or less, offering discounted prices without periodic interest payments, making them highly liquid and low risk for investors seeking short-term investments. Treasury Bonds (T-Bonds) are long-term government securities with maturities ranging from 10 to 30 years, providing fixed semiannual interest payments (coupons) and serving as a stable income source for long-term investors. Both are backed by the U.S. government, but T-Bills focus on capital preservation and liquidity, while T-Bonds emphasize consistent income and long-term growth.

Key Differences Between Treasury Bills and Bonds

Treasury Bills (T-Bills) are short-term debt securities with maturities of one year or less, sold at a discount and redeemed at face value, providing returns through capital appreciation. Treasury Bonds (T-Bonds) have longer maturities ranging from 10 to 30 years and pay semi-annual interest, offering fixed income over time. The key differences include maturity length, interest payment structure, and risk exposure, with T-Bills generally considered lower risk due to shorter duration.

Maturity Periods: Short-Term vs Long-Term Investments

Treasury Bills (T-Bills) are short-term government securities with maturity periods ranging from a few days up to one year, making them ideal for investors seeking liquidity and minimal risk. Treasury Bonds, on the other hand, have long-term maturities typically spanning 10 to 30 years, offering higher yields in exchange for longer investment horizons. The distinct maturity periods directly influence investment strategies, risk tolerance, and return expectations within fixed-income portfolios.

Yield and Interest: Comparing Returns

Treasury bills are short-term government securities that typically offer lower yields due to their maturity of one year or less, whereas Treasury bonds provide higher interest rates because of their long-term maturity, often 10 to 30 years. The yield on Treasury bonds reflects greater risk over time, compensating investors with more substantial interest payments compared to the relatively modest returns from Treasury bills. Investors seeking steady income may prefer Treasury bonds for their fixed interest, while those prioritizing liquidity and safety might favor Treasury bills despite their lower yields.

Risk Profile: Safety and Volatility

Treasury bills offer a higher degree of safety due to their short-term maturity of one year or less, minimizing exposure to interest rate fluctuations and market volatility. Treasury bonds, with maturities ranging from 10 to 30 years, carry increased volatility risk as their long duration makes them more sensitive to interest rate changes and inflation. Investors seeking stability typically favor Treasury bills, while those willing to accept higher risk for potentially greater returns may choose Treasury bonds.

Liquidity and Market Accessibility

Treasury Bills offer higher liquidity due to their short-term maturities, making them easily tradable in the secondary market with lower transaction costs. Treasury Bonds, with longer maturities, provide less liquidity but attract investors seeking stable, long-term returns. Market accessibility for Treasury Bills is broader among retail investors due to lower minimum purchase requirements compared to Treasury Bonds.

Tax Implications for Investors

Treasury Bills (T-Bills) are short-term government securities issued at a discount and mature within one year, with interest income exempt from state and local taxes but subject to federal income tax. Treasury Bonds are long-term securities with maturities exceeding 10 years, paying semiannual interest that is also exempt from state and local taxes but fully taxable at the federal level. Investors must consider that while both instruments offer federal tax obligations, their differing maturities and interest payment structures impact the timing and amount of taxable income.

Suitability for Different Investment Goals

Treasury Bills (T-Bills) offer short-term investment horizons ideal for preserving capital and maintaining liquidity, making them suitable for risk-averse investors seeking quick returns with minimal exposure to interest rate fluctuations. Treasury Bonds provide long-term fixed interest payments over 10 to 30 years, aligning with goals like retirement planning or income generation through stable, predictable cash flow. Investors targeting short-term safety favor T-Bills, while those focused on long-term growth and steady income prefer Treasury Bonds.

Purchasing Methods and Auction Processes

Treasury bills (T-bills) are short-term government securities sold at a discount through a competitive bidding auction process, where investors submit bids specifying the discount rate they are willing to accept. Treasury bonds (T-bonds) are long-term debt instruments typically issued through non-competitive auctions, allowing investors to purchase at the yield determined by the auction. Both securities can be bought directly from the U.S. Treasury via TreasuryDirect or through brokers, but T-bills emphasize discounted purchase pricing while T-bonds involve periodic interest payments.

Current Trends in Treasury Securities

Treasury Bills (T-Bills) offer short-term debt options with maturities of one year or less, emphasizing liquidity and low risk amid fluctuating interest rates. Treasury Bonds provide long-term investment opportunities, typically maturing in 20 to 30 years, appealing to investors seeking steady income through fixed interest payments. Recent trends indicate rising demand for T-Bills as investors prioritize flexibility during economic uncertainty, while Treasury Bonds face pressure from inflation concerns affecting long-term yield attractiveness.

Treasury Bills vs Treasury Bonds Infographic

difterm.com

difterm.com