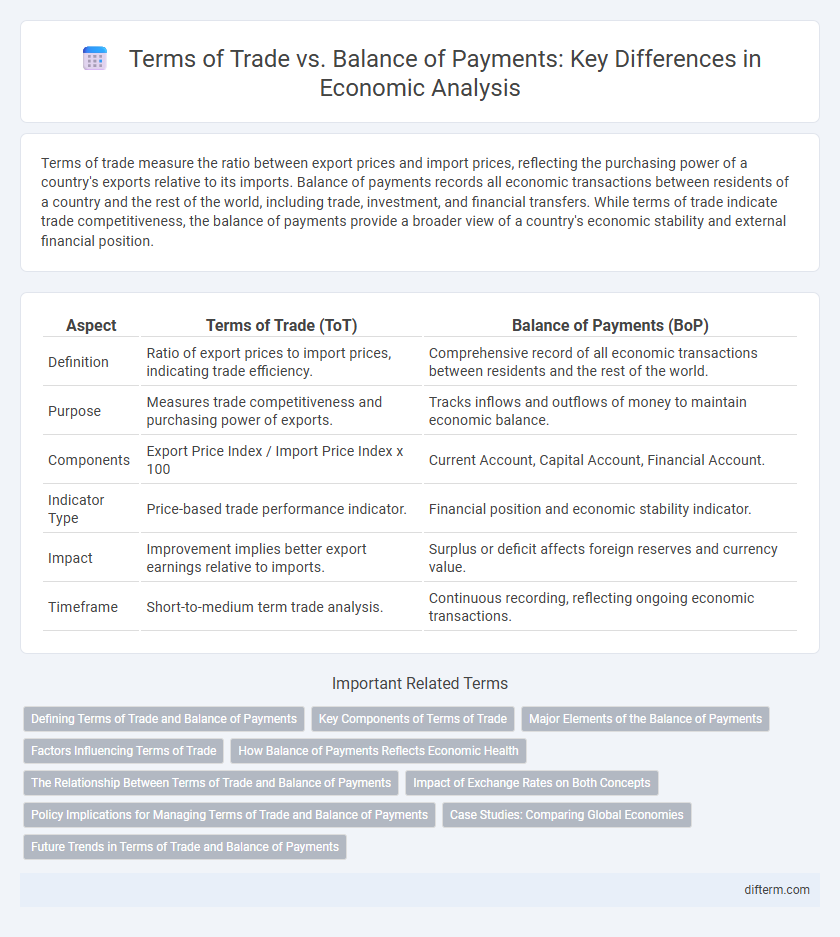

Terms of trade measure the ratio between export prices and import prices, reflecting the purchasing power of a country's exports relative to its imports. Balance of payments records all economic transactions between residents of a country and the rest of the world, including trade, investment, and financial transfers. While terms of trade indicate trade competitiveness, the balance of payments provide a broader view of a country's economic stability and external financial position.

Table of Comparison

| Aspect | Terms of Trade (ToT) | Balance of Payments (BoP) |

|---|---|---|

| Definition | Ratio of export prices to import prices, indicating trade efficiency. | Comprehensive record of all economic transactions between residents and the rest of the world. |

| Purpose | Measures trade competitiveness and purchasing power of exports. | Tracks inflows and outflows of money to maintain economic balance. |

| Components | Export Price Index / Import Price Index x 100 | Current Account, Capital Account, Financial Account. |

| Indicator Type | Price-based trade performance indicator. | Financial position and economic stability indicator. |

| Impact | Improvement implies better export earnings relative to imports. | Surplus or deficit affects foreign reserves and currency value. |

| Timeframe | Short-to-medium term trade analysis. | Continuous recording, reflecting ongoing economic transactions. |

Defining Terms of Trade and Balance of Payments

Terms of trade measure the relative prices of a country's exports compared to its imports, indicating the purchasing power of its exports in international markets. Balance of payments is a comprehensive record of all economic transactions between residents of a country and the rest of the world, including trade, investment, and financial transfers. Understanding terms of trade helps assess trade competitiveness, while the balance of payments reflects overall economic stability and external financial flows.

Key Components of Terms of Trade

Terms of trade measure the ratio between export and import prices, reflecting a country's purchasing power on the global market. Key components include export price index, import price index, and the terms of trade index, which collectively determine how much import goods a country can obtain per unit of exported goods. This contrasts with the balance of payments, which records all economic transactions between residents and the rest of the world, encompassing trade balances, capital flows, and financial transfers.

Major Elements of the Balance of Payments

The major elements of the balance of payments include the current account, capital account, and financial account, each capturing different types of international transactions. Terms of trade specifically measure the ratio between export prices and import prices, influencing the current account by affecting trade balances. A favorable terms of trade improves the balance of payments by increasing export revenue relative to import costs, thereby supporting economic stability.

Factors Influencing Terms of Trade

Terms of trade are influenced by factors such as changes in export and import prices, global demand and supply fluctuations, exchange rate variations, and trade policies like tariffs and quotas. These elements affect the relative price of exports to imports, directly impacting a country's purchasing power in international markets. While the balance of payments records all transactions between residents and the rest of the world, shifts in terms of trade can significantly alter trade balances by affecting export revenues and import costs.

How Balance of Payments Reflects Economic Health

Balance of payments records all economic transactions between residents of a country and the rest of the world, providing a comprehensive snapshot of its financial stability and economic health. A surplus in the balance of payments indicates a strong export market and foreign investment inflows, boosting national currency value and reserves. Conversely, persistent deficits may signal economic vulnerabilities, affecting trade balances, investor confidence, and long-term growth prospects.

The Relationship Between Terms of Trade and Balance of Payments

The terms of trade, which measure the ratio of export prices to import prices, directly influence the balance of payments by affecting the trade balance component. Improved terms of trade enhance export revenues relative to import costs, potentially leading to a surplus in the current account of the balance of payments. Conversely, deterioration in terms of trade can result in higher import expenses and a worsening trade deficit, thereby negatively impacting the overall balance of payments position.

Impact of Exchange Rates on Both Concepts

Exchange rate fluctuations directly influence the terms of trade by altering the relative price of exports and imports, impacting a country's export competitiveness and import costs. In the balance of payments, exchange rate changes affect the current account by modifying trade balances and influencing capital flows through currency valuation shifts. Persistent exchange rate volatility can lead to imbalances in both the terms of trade and balance of payments, affecting economic stability and growth prospects.

Policy Implications for Managing Terms of Trade and Balance of Payments

Effective management of terms of trade and balance of payments requires coordinated fiscal and monetary policies that stabilize exchange rates and control inflation. Policymakers must implement export promotion strategies and import substitution to improve trade balances, while monitoring capital flows to prevent destabilizing financial volatility. Structural reforms enhancing productivity and competitiveness directly influence terms of trade, supporting sustainable external equilibrium.

Case Studies: Comparing Global Economies

Terms of trade measure the ratio of export prices to import prices and directly impact a country's purchasing power in international markets, while the balance of payments records all economic transactions between residents of a country and the rest of the world. In case studies comparing global economies such as Japan and Brazil, Japan's favorable terms of trade with high-tech exports improve its balance of payments surplus, contrasting with Brazil's terms of trade volatility due to commodity dependence, which often leads to deficit imbalances. This comparison highlights how variations in export composition and global price fluctuations shape trade balances and economic stability across different national contexts.

Future Trends in Terms of Trade and Balance of Payments

Future trends in terms of trade are influenced by shifts in global demand, technological advancements, and changes in commodity prices, which can alter export-import price ratios. Balance of payments will increasingly reflect digital services and cross-border financial flows, as economies integrate further into global value chains. Monitoring these dynamics is essential for policymakers to maintain stability and foster sustainable economic growth.

Terms of trade vs Balance of payments Infographic

difterm.com

difterm.com