A recession is a significant decline in economic activity lasting for a few months, marked by reduced consumer spending, rising unemployment, and lower industrial production. A depression, however, is a prolonged and severe downturn in the economy with a more drastic fall in GDP, widespread unemployment, and lasting hardship for years. Understanding the differences between these two economic phenomena helps in preparing effective policy responses and financial planning.

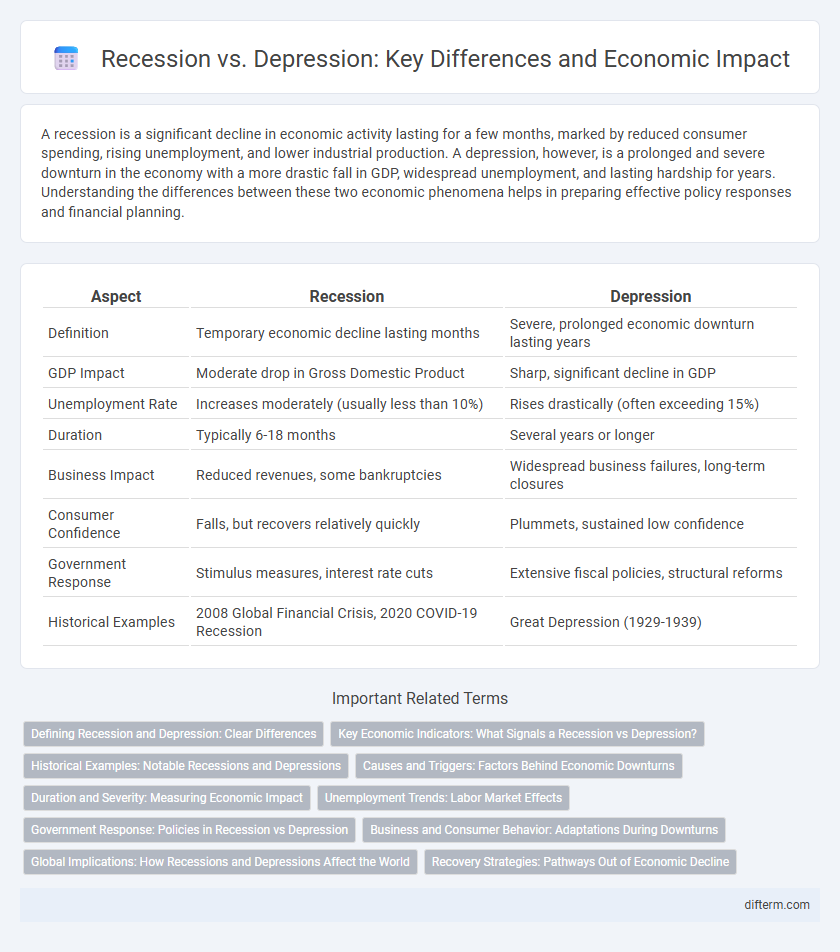

Table of Comparison

| Aspect | Recession | Depression |

|---|---|---|

| Definition | Temporary economic decline lasting months | Severe, prolonged economic downturn lasting years |

| GDP Impact | Moderate drop in Gross Domestic Product | Sharp, significant decline in GDP |

| Unemployment Rate | Increases moderately (usually less than 10%) | Rises drastically (often exceeding 15%) |

| Duration | Typically 6-18 months | Several years or longer |

| Business Impact | Reduced revenues, some bankruptcies | Widespread business failures, long-term closures |

| Consumer Confidence | Falls, but recovers relatively quickly | Plummets, sustained low confidence |

| Government Response | Stimulus measures, interest rate cuts | Extensive fiscal policies, structural reforms |

| Historical Examples | 2008 Global Financial Crisis, 2020 COVID-19 Recession | Great Depression (1929-1939) |

Defining Recession and Depression: Clear Differences

A recession is defined as a significant decline in economic activity lasting for at least two consecutive quarters, characterized by reduced GDP, rising unemployment, and decreased consumer spending. Depression represents a more severe and prolonged downturn, often exceeding several years with drastic drops in economic output, widespread unemployment, and deflationary pressures. The clear differences between recession and depression lie in the depth, duration, and overall impact on economic health.

Key Economic Indicators: What Signals a Recession vs Depression?

Key economic indicators distinguishing a recession from a depression include GDP decline, unemployment rate, and duration of the downturn. A recession typically involves a GDP contraction of 2 consecutive quarters with moderate unemployment increases around 5-7%, while a depression shows a GDP decline exceeding 10%, unemployment rates soaring above 15%, and prolonged economic stagnation lasting several years. Consumer spending, industrial production, and stock market trends also sharply deteriorate during a depression compared to the milder declines seen in recessions.

Historical Examples: Notable Recessions and Depressions

The Great Depression of the 1930s remains the most severe economic downturn in modern history, marked by a 25% drop in U.S. GDP and unemployment rates exceeding 25%. In contrast, the 2008 Great Recession, triggered by the collapse of the housing bubble and financial institutions, resulted in a 4.3% GDP contraction and significant global market turmoil. Other notable recessions include the early 1980s recession, characterized by double-digit inflation and interest rates, highlighting distinct causes and recovery patterns compared to prolonged economic depressions.

Causes and Triggers: Factors Behind Economic Downturns

Recession and depression are triggered by different economic factors, with recessions often caused by reduced consumer spending, high interest rates, or external shocks like oil price spikes. Depressions stem from prolonged and severe disruptions, including widespread bank failures, significant drops in investment, and persistent unemployment. Both conditions reflect a decline in economic activity but vary considerably in duration and intensity due to their underlying causes.

Duration and Severity: Measuring Economic Impact

Recession typically lasts from a few months to a couple of years with a moderate decline in GDP and rising unemployment, reflecting shorter-term economic contraction. Depression involves prolonged economic downturns, often exceeding several years, characterized by severe GDP contraction, high unemployment rates above 20%, and widespread business failures. Measuring economic impact requires assessing duration and severity indicators, such as GDP decline percentage, unemployment duration, and recovery timelines, to differentiate between recession and depression accurately.

Unemployment Trends: Labor Market Effects

Unemployment trends during a recession typically show a moderate rise in joblessness as businesses cut back on hiring and reduce hours, while a depression triggers a severe and prolonged spike in unemployment rates due to widespread company failures and economic collapse. Labor market effects in recessions often include temporary layoffs and slowed wage growth, whereas depressions cause sustained job scarcity, deepIncome losses, and increased long-term unemployment. Recovery in the labor market post-recession is usually quicker, whereas post-depression recovery requires significant structural changes and government interventions to restore employment levels.

Government Response: Policies in Recession vs Depression

Government response to a recession typically involves monetary easing, such as lowering interest rates, and fiscal stimulus like increased public spending to boost demand and stabilize the economy. In contrast, responses to a depression require more aggressive and sustained interventions, including large-scale public works programs, extended unemployment benefits, and structural reforms to address deep economic contraction. Policymakers prioritize short-term stabilization in recessions, while depression responses emphasize long-term recovery and systemic economic restructuring.

Business and Consumer Behavior: Adaptations During Downturns

During recessions, businesses often tighten budgets by reducing inventory and delaying capital expenditures, while consumers shift towards essential goods and increase price sensitivity. In depressions, prolonged economic contraction leads to widespread layoffs and drastically lower consumer spending, forcing businesses to implement significant operational restructuring or closures. Both downturns drive innovations in cost efficiency and value-driven marketing as companies and consumers adapt to financial constraints.

Global Implications: How Recessions and Depressions Affect the World

Recessions cause global economic slowdowns by reducing consumer demand, disrupting trade, and increasing unemployment across interconnected markets. Depressions trigger more severe and prolonged worldwide financial crises, leading to deflation, a collapse in investment, and widespread poverty. Both phenomena influence international monetary policies, cross-border capital flows, and socioeconomic stability on a global scale.

Recovery Strategies: Pathways Out of Economic Decline

Recovery strategies from recession focus on stimulating demand through monetary easing and fiscal stimulus to restore consumer confidence and business investment. In contrast, overcoming a depression requires structural reforms, targeted public works programs, and long-term investment in infrastructure and innovation to rebuild economic foundations. Both scenarios benefit from coordinated policy responses, but the depth and duration of a depression necessitate more comprehensive and sustained intervention.

Recession vs Depression Infographic

difterm.com

difterm.com