Inside lag refers to the delay between recognizing an economic problem and implementing a policy response, impacting the timeliness of economic interventions. Outside lag denotes the time it takes for the effects of a policy to be felt in the economy after implementation, influencing the overall effectiveness of economic measures. Understanding both lags is crucial for designing responsive and adaptive economic policies to stabilize markets and manage business cycles efficiently.

Table of Comparison

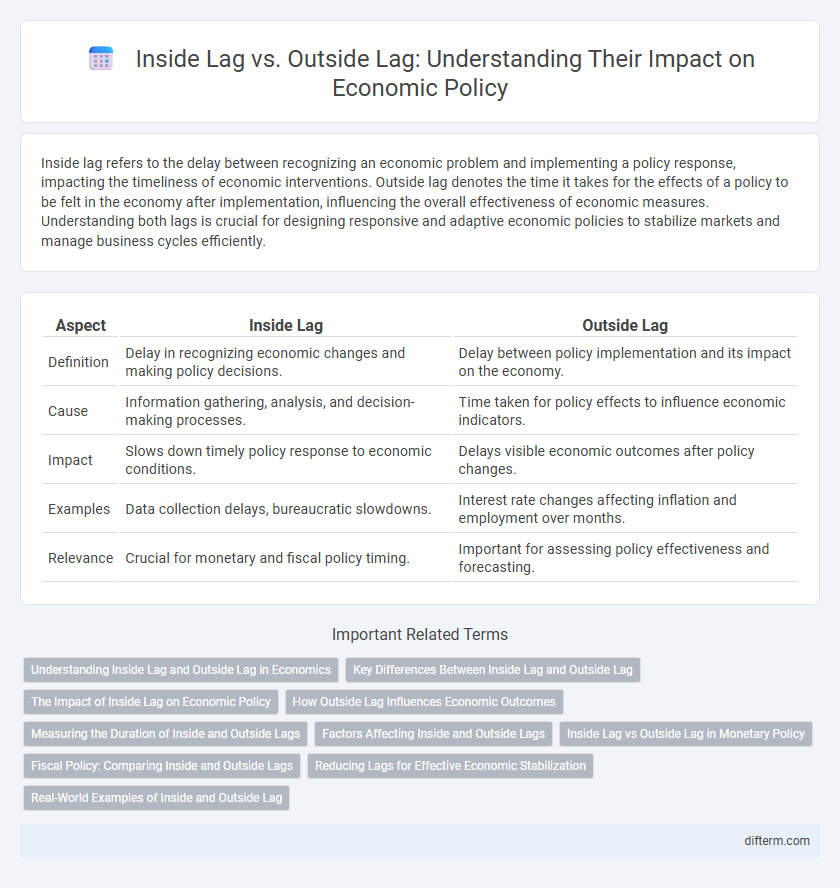

| Aspect | Inside Lag | Outside Lag |

|---|---|---|

| Definition | Delay in recognizing economic changes and making policy decisions. | Delay between policy implementation and its impact on the economy. |

| Cause | Information gathering, analysis, and decision-making processes. | Time taken for policy effects to influence economic indicators. |

| Impact | Slows down timely policy response to economic conditions. | Delays visible economic outcomes after policy changes. |

| Examples | Data collection delays, bureaucratic slowdowns. | Interest rate changes affecting inflation and employment over months. |

| Relevance | Crucial for monetary and fiscal policy timing. | Important for assessing policy effectiveness and forecasting. |

Understanding Inside Lag and Outside Lag in Economics

Inside lag in economics refers to the delay between recognizing an economic problem and implementing a policy response, often caused by the time needed for data collection, decision-making processes, and political considerations. Outside lag describes the period between policy implementation and the observable effects on the economy, which can vary depending on the nature of the policy and economic conditions. Understanding these lags is crucial for effective economic policy, as shorter inside and outside lags lead to more timely and impactful interventions in economic cycles.

Key Differences Between Inside Lag and Outside Lag

Inside lag refers to the delay between the occurrence of an economic shock and the implementation of policy responses, primarily caused by the time needed for policymakers to recognize and analyze the problem. Outside lag denotes the time it takes for the effects of the implemented policy to manifest in the economy after action has been taken. Key differences include that inside lag concerns policy decision-making speed, while outside lag involves the effectiveness timeline of those policies in influencing economic variables like GDP, inflation, and unemployment.

The Impact of Inside Lag on Economic Policy

Inside lag, the delay between the onset of an economic shock and the implementation of policy, significantly affects the effectiveness of economic interventions. Prolonged inside lag can lead to policies that are mistimed or misaligned with current economic conditions, reducing their impact on stabilizing growth or controlling inflation. Policymakers aim to minimize inside lag through improved data collection and faster decision-making processes to enhance economic responsiveness.

How Outside Lag Influences Economic Outcomes

Outside lag, the delay between policy implementation and observable economic effects, significantly shapes economic outcomes by determining the timing of recovery or recession adjustments. Extended outside lags can exacerbate economic volatility, as delayed responses may lead to prolonged unemployment or inflationary pressures. Analyzing outside lag durations helps policymakers optimize intervention strategies to stabilize growth and control inflation effectively.

Measuring the Duration of Inside and Outside Lags

Inside lag refers to the time interval between the occurrence of an economic shock and the implementation of a policy response, typically influenced by data gathering, analysis, and decision-making processes. Outside lag measures the period between the execution of a policy and its tangible effects on the economy, often variable due to transmission mechanisms and adjustment speeds. Accurate measurement of these lags is crucial for evaluating the timeliness and effectiveness of fiscal and monetary policies in stabilizing economic fluctuations.

Factors Affecting Inside and Outside Lags

Inside lag is influenced by the speed of data collection, the decision-making process of policymakers, and the efficiency of communication channels within institutions. Outside lag depends on the natural time it takes for monetary or fiscal policy changes to affect the economy, which varies based on economic structure, market flexibility, and adaptive expectations. Both lags are affected by factors such as institutional rigidity, information availability, and the complexity of economic mechanisms.

Inside Lag vs Outside Lag in Monetary Policy

Inside lag in monetary policy refers to the delay between recognizing an economic problem and implementing an appropriate policy response. Outside lag describes the time taken for the monetary policy actions to affect the economy after they are enacted. Minimizing both inside and outside lags is critical for effective stabilization of inflation and employment levels.

Fiscal Policy: Comparing Inside and Outside Lags

Inside lag in fiscal policy refers to the time delay between recognizing an economic issue and implementing appropriate government measures, often prolonged by legislative processes and political debates. Outside lag describes the interval from policy implementation to observable effects on the economy, which can vary depending on factors such as the type of fiscal stimulus and economic conditions. Understanding and minimizing both inside and outside lags is crucial for effective fiscal management and timely response to economic fluctuations.

Reducing Lags for Effective Economic Stabilization

Reducing inside lag, the delay between economic shock recognition and policy implementation, requires streamlined decision-making processes and real-time data analytics. Minimizing outside lag, the time between policy action and observable economic effects, depends on designing flexible policies with immediate transmission mechanisms. Effective economic stabilization hinges on synchronizing rapid detection with prompt and impactful responses to mitigate business cycle fluctuations.

Real-World Examples of Inside and Outside Lag

Inside lag refers to the delay between the onset of an economic shock and the implementation of policy responses, commonly observed in the 2008 financial crisis when stimulus packages were enacted months after the downturn began. Outside lag describes the time it takes for those policies to impact the economy, exemplified by the Federal Reserve's interest rate cuts in 2020 which only influenced lending and spending behaviors several quarters later. Real-world cases highlight that minimizing inside lag through faster decision-making and understanding outside lag through economic transmission mechanisms is crucial for effective economic stabilization.

Inside Lag vs Outside Lag Infographic

difterm.com

difterm.com