Slotting fees are upfront charges that manufacturers pay retailers to secure shelf space for their products, often impacting new product launches and market competition. Pay-to-stay fees, on the other hand, are ongoing charges imposed on suppliers to keep their products stocked on retail shelves, affecting long-term supplier-retailer relationships and pricing strategies. Both fee structures influence supply chain dynamics and consumer prices, shaping retailer profitability and market accessibility.

Table of Comparison

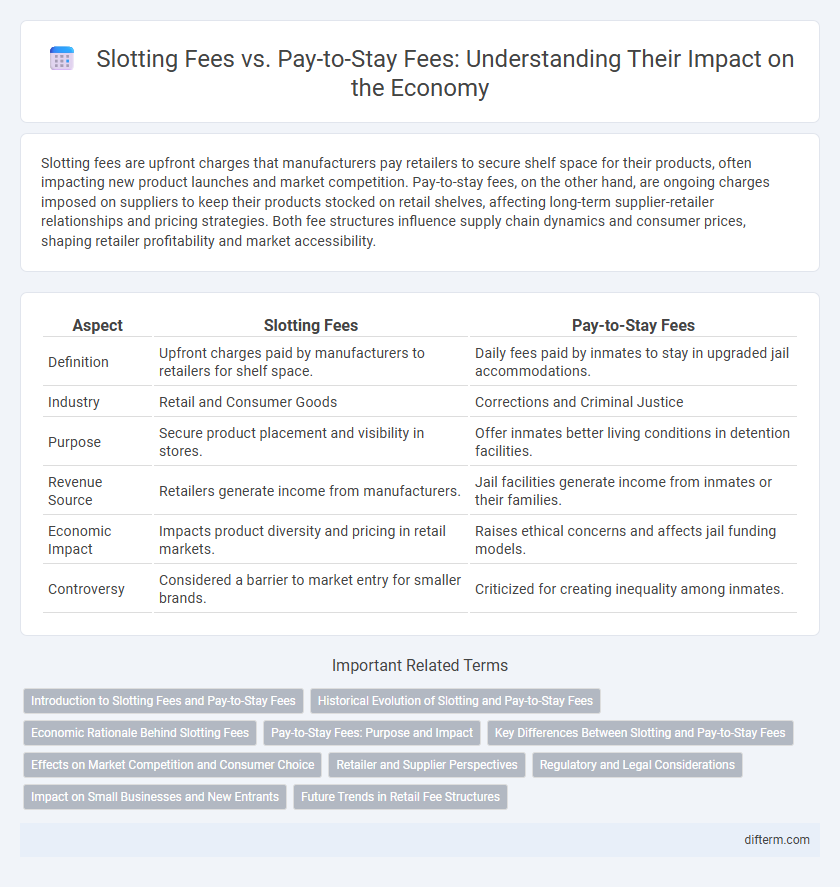

| Aspect | Slotting Fees | Pay-to-Stay Fees |

|---|---|---|

| Definition | Upfront charges paid by manufacturers to retailers for shelf space. | Daily fees paid by inmates to stay in upgraded jail accommodations. |

| Industry | Retail and Consumer Goods | Corrections and Criminal Justice |

| Purpose | Secure product placement and visibility in stores. | Offer inmates better living conditions in detention facilities. |

| Revenue Source | Retailers generate income from manufacturers. | Jail facilities generate income from inmates or their families. |

| Economic Impact | Impacts product diversity and pricing in retail markets. | Raises ethical concerns and affects jail funding models. |

| Controversy | Considered a barrier to market entry for smaller brands. | Criticized for creating inequality among inmates. |

Introduction to Slotting Fees and Pay-to-Stay Fees

Slotting fees are upfront charges retailers impose on manufacturers to secure shelf space for new products, significantly impacting product placement and market accessibility. Pay-to-stay fees are payments made by tenants to landlords or property managers to avoid eviction or maintain tenancy, influencing housing market dynamics and rental affordability. Both fee types reflect underlying economic power structures, affecting market competition and consumer choices.

Historical Evolution of Slotting and Pay-to-Stay Fees

Slotting fees originated in the 1970s as manufacturers paid retailers for shelf space to promote new products, reflecting growing competition in retail markets. Pay-to-stay fees evolved later, primarily in the rental housing and delinquency sectors, as landlords or service providers charged tenants to avoid eviction or access continuous services. Both fee structures illustrate shifting economic strategies where upfront payments secure market presence or service continuity in increasingly congested and risk-averse environments.

Economic Rationale Behind Slotting Fees

Slotting fees represent a strategic economic mechanism where manufacturers pay retailers to secure shelf space, reflecting the value of prime retail placement and mitigating retailer risk in product introduction. These fees help allocate scarce shelf space efficiently, balancing supply and demand while signaling product quality and potential sales performance. By contrast, pay-to-stay fees typically relate to maintaining access privileges rather than competing for market exposure, highlighting different economic incentives in retail finance.

Pay-to-Stay Fees: Purpose and Impact

Pay-to-stay fees are charges imposed on incarcerated individuals to cover the costs of their detention, including housing, medical care, and facility maintenance. These fees aim to offset the financial burden on taxpayers but often exacerbate the economic hardship of inmates and their families, leading to increased recidivism rates due to mounting debt. The widespread use of pay-to-stay fees raises important ethical and economic concerns about the sustainability and fairness of funding correctional systems through such mechanisms.

Key Differences Between Slotting and Pay-to-Stay Fees

Slotting fees are upfront charges paid by manufacturers to retailers for shelf space in stores, directly impacting product placement and visibility, while pay-to-stay fees are costs incurred by tenants, often in retail or commercial leasing, to maintain occupancy despite non-payment or lease violations. Slotting fees primarily influence supply chain economics and product market entry strategies, whereas pay-to-stay fees affect landlord-tenant financial dynamics and eviction processes. Understanding these distinct roles helps businesses optimize negotiations and financial planning within retail and commercial property sectors.

Effects on Market Competition and Consumer Choice

Slotting fees create high entry barriers for new products, limiting market competition and reducing the diversity of consumer choices. Pay-to-stay fees impose ongoing costs on retailers, potentially increasing prices and limiting product variety available to consumers. Both fee structures influence market dynamics by affecting the accessibility and affordability of goods, shaping consumer purchasing behavior.

Retailer and Supplier Perspectives

Slotting fees require suppliers to pay upfront for shelf space, impacting supplier cash flow but providing retailers guaranteed revenue and product control. Pay-to-stay fees demand ongoing payments from suppliers to maintain shelf presence, increasing supplier costs while enabling retailers to continuously optimize inventory and turnover. Both fees influence supplier pricing strategies and retailer merchandising decisions, affecting overall supply chain efficiency and market competition.

Regulatory and Legal Considerations

Slotting fees, often charged by retailers to manufacturers for product placement, face increasing regulatory scrutiny due to concerns about anti-competitive practices and market fairness, with several jurisdictions imposing transparency and disclosure requirements. Pay-to-stay fees, typically imposed on tenants in private prisons or housing facilities, raise significant legal considerations involving human rights and contractual obligations, prompting regulatory bodies to assess their legality and ethical implications. Both fee structures require careful compliance with evolving laws, including consumer protection regulations and anti-discrimination statutes, to mitigate legal risks and promote equitable economic practices.

Impact on Small Businesses and New Entrants

Slotting fees impose significant financial barriers for small businesses and new entrants by requiring upfront payments to secure retail shelf space, limiting their market access and growth potential. Pay-to-stay fees, often charged by landlords to tenants for continued occupancy, strain small businesses' cash flow, increasing operational costs and risking closures in competitive markets. Both practices reduce market diversity and innovation by favoring established companies with greater financial resources, hindering entrepreneurship and economic inclusivity.

Future Trends in Retail Fee Structures

Future trends in retail fee structures indicate a shift from traditional slotting fees toward more dynamic pay-to-stay fees, reflecting evolving retailer and supplier relationships. Retailers are increasingly adopting pay-to-stay models to optimize shelf space turnover and enhance flexibility in inventory management. Data analytics and AI-driven insights are expected to further refine these fee structures, promoting efficiency and responsiveness to consumer demand fluctuations.

Slotting Fees vs Pay-to-Stay Fees Infographic

difterm.com

difterm.com