Pre-seed funding is the initial capital used to develop a business idea, often involving smaller amounts from founders, friends, or angel investors to validate the concept. Seed funding follows pre-seed and provides larger investments aimed at product development, market research, and early team building to prepare for scaling. Understanding the differences between pre-seed and seed stages helps entrepreneurs target the right investors and allocate resources efficiently for business growth.

Table of Comparison

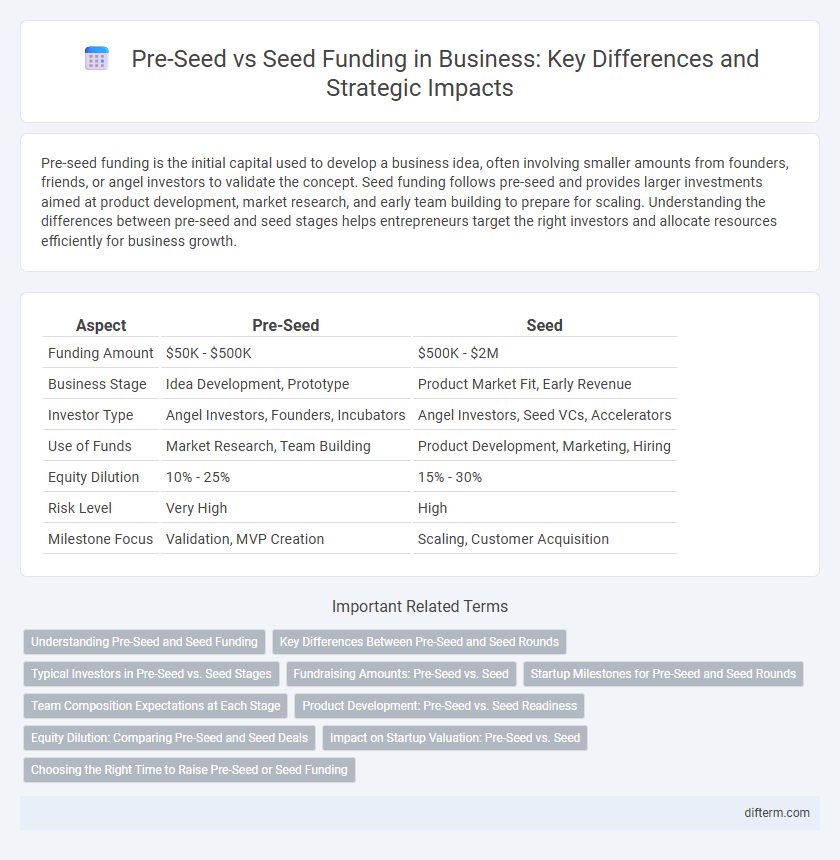

| Aspect | Pre-Seed | Seed |

|---|---|---|

| Funding Amount | $50K - $500K | $500K - $2M |

| Business Stage | Idea Development, Prototype | Product Market Fit, Early Revenue |

| Investor Type | Angel Investors, Founders, Incubators | Angel Investors, Seed VCs, Accelerators |

| Use of Funds | Market Research, Team Building | Product Development, Marketing, Hiring |

| Equity Dilution | 10% - 25% | 15% - 30% |

| Risk Level | Very High | High |

| Milestone Focus | Validation, MVP Creation | Scaling, Customer Acquisition |

Understanding Pre-Seed and Seed Funding

Pre-seed funding typically ranges from $100K to $500K and focuses on product development and market research, helping startups validate their business ideas before launching. Seed funding usually extends from $500K to $2 million, aimed at scaling operations, building a team, and acquiring initial customers. Both stages are critical in the startup lifecycle, with pre-seed emphasizing concept validation and seed funding supporting early growth and market entry.

Key Differences Between Pre-Seed and Seed Rounds

Pre-seed rounds typically involve early-stage funding from founders, friends, or angel investors to develop initial ideas and prototypes, usually raising between $50,000 and $500,000. Seed rounds focus on validating product-market fit, expanding the team, and attracting venture capital investments, typically ranging from $500,000 to $2 million. Key differences lie in the amount raised, investor profiles, and business milestones targeted during each funding stage.

Typical Investors in Pre-Seed vs. Seed Stages

Typical investors in the pre-seed stage include angel investors, friends and family, and early-stage venture funds focused on high-risk startups with unproven concepts. Seed stage investors often comprise institutional venture capital firms, seed-focused funds, and accelerators looking for startups with initial traction and market validation. Investment amounts generally increase from tens of thousands in pre-seed to hundreds of thousands or more in seed rounds, reflecting growing investor confidence and startup maturity.

Fundraising Amounts: Pre-Seed vs. Seed

Pre-seed funding rounds typically raise between $100,000 and $500,000, focusing on product development and initial market research. Seed funding rounds generally secure between $500,000 and $2 million, aimed at scaling operations and expanding customer acquisition. Understanding these distinct fundraising amounts helps startups effectively plan growth strategies and attract suitable investors.

Startup Milestones for Pre-Seed and Seed Rounds

Pre-seed startup milestones typically include validating the business idea, developing a minimum viable product (MVP), and securing initial customer feedback to demonstrate market potential. Seed rounds focus on scaling the MVP, refining the business model, achieving product-market fit, and building a core team capable of driving growth. Investors in pre-seed and seed rounds assess progress based on traction, user engagement metrics, and early revenue indicators to justify additional funding.

Team Composition Expectations at Each Stage

Pre-seed startups typically have a small, core team consisting of founders with complementary skills, often including a product visionary and a technical co-founder to develop the minimum viable product (MVP). Seed-stage companies are expected to expand their teams to include early hires in product development, marketing, and sales to validate market fit and accelerate growth. Investors at the seed stage look for a demonstrated ability of the team to execute the business plan and scale operations beyond initial product development.

Product Development: Pre-Seed vs. Seed Readiness

Pre-seed funding primarily supports initial product development, including prototyping and market research, to validate the core idea. Seed funding focuses on refining the product, enhancing features based on user feedback, and preparing for market entry. Companies at the seed stage demonstrate stronger product-market fit and scalability potential compared to the pre-seed phase.

Equity Dilution: Comparing Pre-Seed and Seed Deals

Pre-seed funding typically involves higher equity dilution for founders, often ranging from 10% to 25%, due to higher risk and lower valuation. Seed rounds generally result in dilution between 10% and 20%, reflecting increased company validation and valuation growth. Founders should carefully evaluate dilution impact in pre-seed versus seed deals to maintain control while securing necessary capital.

Impact on Startup Valuation: Pre-Seed vs. Seed

Pre-seed funding typically results in lower startup valuations due to higher uncertainty and limited traction, often ranging between $1 million to $3 million. Seed-stage investments usually reflect increased valuation, commonly between $3 million and $10 million, as startups demonstrate viable product development and early market validation. The transition from pre-seed to seed marks a critical valuation inflection driven by progress in customer acquisition, revenue potential, and technology proof-of-concept.

Choosing the Right Time to Raise Pre-Seed or Seed Funding

Raising pre-seed funding is ideal when developing a prototype and validating the core business idea, targeting angel investors or early-stage venture funds. Seed funding becomes appropriate once initial traction is demonstrated, such as user growth or revenue metrics, attracting venture capital firms focused on scaling operations. Assessing product maturity, market validation, and team readiness ensures optimal timing for maximizing investor interest and fundraising success.

pre-seed vs seed Infographic

difterm.com

difterm.com