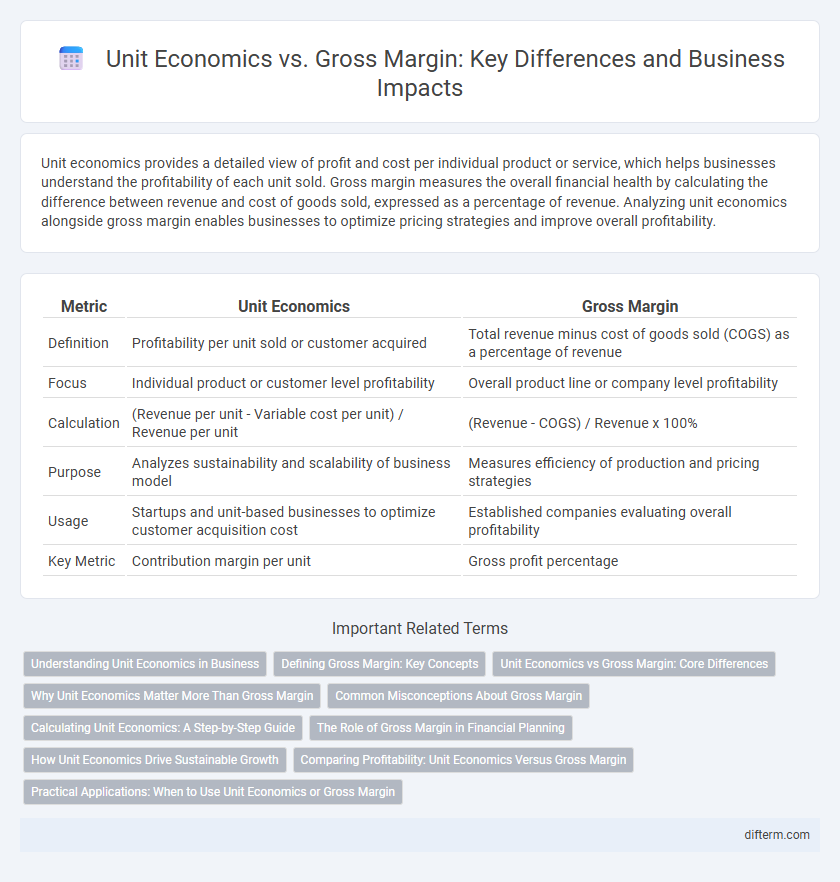

Unit economics provides a detailed view of profit and cost per individual product or service, which helps businesses understand the profitability of each unit sold. Gross margin measures the overall financial health by calculating the difference between revenue and cost of goods sold, expressed as a percentage of revenue. Analyzing unit economics alongside gross margin enables businesses to optimize pricing strategies and improve overall profitability.

Table of Comparison

| Metric | Unit Economics | Gross Margin |

|---|---|---|

| Definition | Profitability per unit sold or customer acquired | Total revenue minus cost of goods sold (COGS) as a percentage of revenue |

| Focus | Individual product or customer level profitability | Overall product line or company level profitability |

| Calculation | (Revenue per unit - Variable cost per unit) / Revenue per unit | (Revenue - COGS) / Revenue x 100% |

| Purpose | Analyzes sustainability and scalability of business model | Measures efficiency of production and pricing strategies |

| Usage | Startups and unit-based businesses to optimize customer acquisition cost | Established companies evaluating overall profitability |

| Key Metric | Contribution margin per unit | Gross profit percentage |

Understanding Unit Economics in Business

Unit economics measures the direct revenues and costs associated with a single unit of product or service, enabling businesses to assess profitability on a granular level. Gross margin represents the percentage of revenue remaining after deducting the cost of goods sold, highlighting overall product profitability but lacking detailed insight into per-unit financial efficiency. Understanding unit economics allows businesses to optimize pricing, cost control, and scalability, ensuring sustainable growth beyond what gross margin alone can indicate.

Defining Gross Margin: Key Concepts

Gross Margin represents the percentage of total revenue remaining after accounting for the cost of goods sold (COGS), serving as a critical profitability metric in business financial analysis. It highlights a company's efficiency in production and pricing strategies, calculated as (Revenue - COGS) / Revenue, expressed in percentage. Understanding Gross Margin facilitates strategic decisions that improve cost control and enhance profit sustainability.

Unit Economics vs Gross Margin: Core Differences

Unit economics analyzes the profitability of a single unit of product or service by evaluating direct revenues and variable costs associated with its production and sale, providing insights into individual transaction efficiency. Gross margin, expressed as a percentage, measures total revenue minus cost of goods sold (COGS) divided by total revenue, reflecting the overall company profitability and pricing strategy effectiveness. Understanding the core differences between unit economics and gross margin helps businesses optimize pricing, cost management, and scalability on both micro and macro levels.

Why Unit Economics Matter More Than Gross Margin

Unit economics provide a granular view of profitability by analyzing revenue and costs at the individual product or customer level, enabling precise decision-making and scalability assessment. Gross margin offers an overall profit percentage but can obscure inefficiencies in specific units that impact long-term growth. Understanding unit economics helps businesses optimize customer acquisition costs, lifetime value, and operational expenses to drive sustainable profitability beyond what gross margin alone reveals.

Common Misconceptions About Gross Margin

Gross margin is often misunderstood as the sole indicator of profitability, but it overlooks fixed costs and operating expenses crucial to unit economics analysis. Many businesses mistakenly rely on gross margin percentages without considering customer acquisition costs, churn rates, or lifetime value, which directly impact unit economics. Accurate evaluation requires integrating gross margin with per-unit data to assess true financial health and scalability.

Calculating Unit Economics: A Step-by-Step Guide

Calculating unit economics involves determining the revenue and costs associated with a single unit of product or service to assess profitability and scalability. Key metrics include cost per acquisition (CPA), variable costs, and contribution margin, which directly influence gross margin calculation. Understanding unit economics enables businesses to optimize pricing strategies and cost structures to improve gross margin and overall financial health.

The Role of Gross Margin in Financial Planning

Gross margin plays a critical role in financial planning by directly reflecting the profitability of product sales after accounting for the cost of goods sold, enabling businesses to assess their core operational efficiency. Understanding unit economics in conjunction with gross margin helps companies forecast cash flow requirements, set pricing strategies, and make informed investment decisions. Accurate gross margin analysis supports budgeting, resource allocation, and long-term financial sustainability within competitive markets.

How Unit Economics Drive Sustainable Growth

Unit economics provide a granular view of profitability by measuring revenue and costs per individual unit, enabling businesses to identify which products or services are truly scalable. Gross margin offers a broader overview of overall profitability but may obscure inefficiencies at the unit level that hinder sustainable growth. By optimizing unit economics, companies can make data-driven decisions that improve customer acquisition cost, lifetime value, and operational efficiency, fostering long-term financial health.

Comparing Profitability: Unit Economics Versus Gross Margin

Unit economics measures profitability on a per-unit basis, highlighting the revenue and costs directly attributed to producing one unit of a product or service, essential for scalable business models. Gross margin calculates the overall profitability by subtracting the cost of goods sold (COGS) from total revenue, reflecting the percentage of sales revenue remaining after production costs. Comparing unit economics with gross margin offers deeper insights into operational efficiency and informs pricing strategies, investment decisions, and growth potential.

Practical Applications: When to Use Unit Economics or Gross Margin

Unit economics provides granular insights into profitability per customer or product, making it essential for early-stage startups evaluating pricing strategies and customer acquisition costs. Gross margin offers a broader financial overview, useful for established businesses monitoring overall product line profitability and operational efficiency. Leveraging unit economics optimizes customer-level decision-making, while gross margin guides strategic planning and resource allocation across the entire business.

Unit Economics vs Gross Margin Infographic

difterm.com

difterm.com