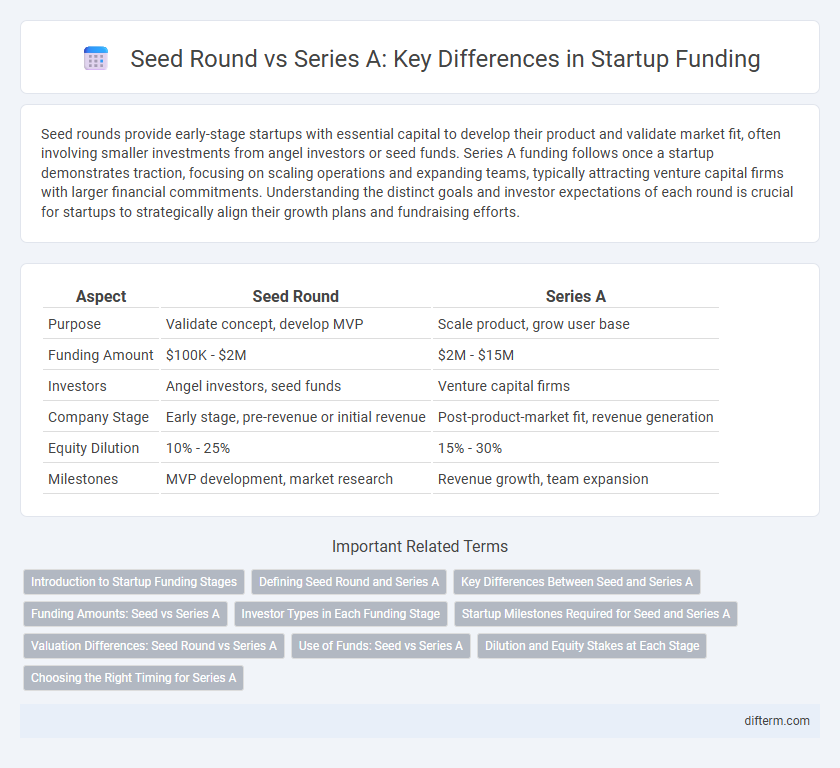

Seed rounds provide early-stage startups with essential capital to develop their product and validate market fit, often involving smaller investments from angel investors or seed funds. Series A funding follows once a startup demonstrates traction, focusing on scaling operations and expanding teams, typically attracting venture capital firms with larger financial commitments. Understanding the distinct goals and investor expectations of each round is crucial for startups to strategically align their growth plans and fundraising efforts.

Table of Comparison

| Aspect | Seed Round | Series A |

|---|---|---|

| Purpose | Validate concept, develop MVP | Scale product, grow user base |

| Funding Amount | $100K - $2M | $2M - $15M |

| Investors | Angel investors, seed funds | Venture capital firms |

| Company Stage | Early stage, pre-revenue or initial revenue | Post-product-market fit, revenue generation |

| Equity Dilution | 10% - 25% | 15% - 30% |

| Milestones | MVP development, market research | Revenue growth, team expansion |

Introduction to Startup Funding Stages

Seed round funding marks the initial capital injection that helps startups develop their product and validate market fit, typically sourced from angel investors, friends, and family. Series A funding follows once a startup demonstrates clear traction and scalability potential, attracting venture capital firms to fuel growth and expand operations. Understanding these stages is crucial for entrepreneurs seeking strategic financial support to transition from concept to a sustainable business model.

Defining Seed Round and Series A

Seed round funding is the initial capital raised by startups to develop their product and gain early traction, typically involving angel investors and seed venture capital firms. Series A financing follows seed funding, aiming to scale the business, expand the team, and optimize the business model, usually led by institutional venture capital firms. The key distinction lies in the stage of the company's growth and the investment amount, with Series A rounds generally larger and more structured.

Key Differences Between Seed and Series A

Seed rounds provide early-stage startups with initial capital to develop products and validate ideas, typically ranging from $500K to $2M, while Series A rounds raise larger amounts, usually $2M to $15M, aimed at scaling operations and expanding the customer base. Seed investors often include angel investors and seed funds, whereas Series A investors are typically venture capital firms seeking businesses with proven traction and clear growth potential. Ownership dilution and company valuation differ significantly, with seed rounds setting initial valuations often below $10M and Series A rounds commanding higher valuations based on market validation and revenue metrics.

Funding Amounts: Seed vs Series A

Seed rounds typically raise between $500K to $2M, targeting early product development and market validation, whereas Series A rounds secure significantly higher funding, ranging from $2M to $15M, aimed at scaling operations and expanding market reach. Investors in Series A rounds seek traction metrics and revenue proof, justifying the increased capital injection compared to seed funding. This substantial difference in funding amounts influences startup valuation and growth trajectory, highlighting the transition from product concept to business scaling.

Investor Types in Each Funding Stage

Seed round investors primarily include angel investors, early-stage venture capital firms, and family offices seeking high-growth potential startups. Series A funding attracts more established venture capital firms and occasionally strategic corporate investors interested in companies with proven market traction and scalable business models. The shift in investor types reflects increasing risk tolerance and capital infusion aligned with the startup's progression.

Startup Milestones Required for Seed and Series A

Seed round funding typically requires startups to demonstrate a strong product-market fit, a minimum viable product (MVP), and initial user traction or revenue. Series A funding demands more advanced milestones such as scalable business models, consistent revenue growth, and clear unit economics to attract venture capital investment. Investors look for validated market demand and operational metrics that prove the startup's potential for rapid expansion during the Series A stage.

Valuation Differences: Seed Round vs Series A

Seed round valuations typically range from $3 million to $8 million, reflecting higher risk and early-stage development, while Series A valuations usually span $10 million to $30 million, indicating proven traction and market validation. The valuation increase between seed and Series A rounds often exceeds 2-3x, driven by milestones such as product-market fit, revenue growth, and user base expansion. Investors in Series A expect lower risk profiles and more scalable business models compared to the seed stage.

Use of Funds: Seed vs Series A

Seed round funds primarily focus on product development, market research, and initial team building, fueling proof of concept and early traction. Series A financing allocates capital towards scaling operations, expanding market reach, and optimizing business models to achieve sustainable growth. Understanding the strategic deployment of funds at each stage enhances investor confidence and supports targeted business milestones.

Dilution and Equity Stakes at Each Stage

Seed round investors typically acquire 10-25% equity, resulting in moderate dilution for founders who often retain 70-85% ownership post-funding. Series A rounds usually raise larger capital amounts, causing dilution levels of 15-30%, which reduces founders' equity stakes to approximately 50-70%. Strategic management of dilution during these stages is crucial to maintaining sufficient founder control while attracting essential growth capital.

Choosing the Right Timing for Series A

Determining the optimal timing for a Series A round hinges on achieving key milestones such as consistent revenue growth, product-market fit, and a scalable business model established during the seed round. Startups that secure a robust customer base and demonstrate clear unit economics position themselves to attract larger venture capital investments in Series A. Premature fundraising risks diluting equity without substantial valuation gains, while waiting too long may hinder market momentum and competitive advantage.

seed round vs series A Infographic

difterm.com

difterm.com