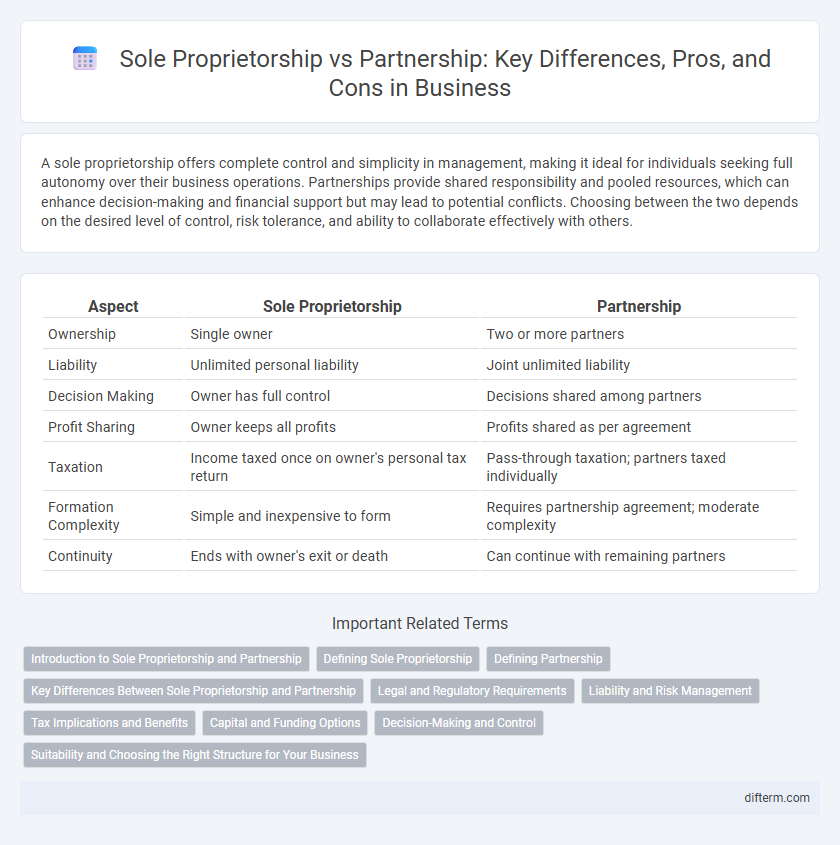

A sole proprietorship offers complete control and simplicity in management, making it ideal for individuals seeking full autonomy over their business operations. Partnerships provide shared responsibility and pooled resources, which can enhance decision-making and financial support but may lead to potential conflicts. Choosing between the two depends on the desired level of control, risk tolerance, and ability to collaborate effectively with others.

Table of Comparison

| Aspect | Sole Proprietorship | Partnership |

|---|---|---|

| Ownership | Single owner | Two or more partners |

| Liability | Unlimited personal liability | Joint unlimited liability |

| Decision Making | Owner has full control | Decisions shared among partners |

| Profit Sharing | Owner keeps all profits | Profits shared as per agreement |

| Taxation | Income taxed once on owner's personal tax return | Pass-through taxation; partners taxed individually |

| Formation Complexity | Simple and inexpensive to form | Requires partnership agreement; moderate complexity |

| Continuity | Ends with owner's exit or death | Can continue with remaining partners |

Introduction to Sole Proprietorship and Partnership

Sole proprietorship is the simplest business structure, owned and operated by a single individual, offering complete control and straightforward tax reporting but unlimited personal liability. Partnership involves two or more individuals sharing ownership, resources, and profits, providing diversified skills and capital but requiring clear agreements to manage shared responsibilities and liabilities. Both structures differ significantly in legal obligations, tax implications, and potential for growth, making the choice crucial for business planning and risk management.

Defining Sole Proprietorship

A sole proprietorship is a business structure owned and operated by a single individual, providing full control and decision-making authority. This entity type offers simplicity in formation and taxation, as profits are reported on the owner's personal tax return. Unlike partnerships, sole proprietorships bear unlimited personal liability for business debts and obligations.

Defining Partnership

A partnership is a business structure where two or more individuals share ownership, responsibilities, and profits according to a mutual agreement. Unlike sole proprietorships, partnerships enable pooling of resources, diverse skills, and shared decision-making, often enhancing business growth potential. Legal frameworks governing partnerships define liabilities, profit distribution, and management roles, ensuring clear operational guidelines for all partners involved.

Key Differences Between Sole Proprietorship and Partnership

Sole proprietorships are owned and managed by a single individual who assumes all liabilities and retains complete control, while partnerships involve two or more individuals sharing ownership, management responsibilities, and profits. Liability in sole proprietorships is unlimited, exposing personal assets, whereas partnerships can have unlimited or limited liability depending on the partnership type, such as general or limited partnerships. Taxation differs as sole proprietors report business income on their personal tax returns, while partnerships file separate informational returns with income passed through to partners.

Legal and Regulatory Requirements

Sole proprietorships face minimal legal and regulatory requirements, with simpler registration processes and fewer compliance obligations, making them easier and cheaper to establish. In contrast, partnerships require formal agreements outlining the roles and responsibilities of each partner, along with registration under partnership laws that vary by jurisdiction, often demanding more complex tax reporting and regulatory adherence. The legal liability in sole proprietorships is unlimited and personal, whereas partnerships distribute liabilities among partners, necessitating clear legal structures to manage financial and operational risks.

Liability and Risk Management

Sole proprietorships expose owners to unlimited personal liability, making them personally responsible for all business debts and legal obligations. In contrast, partnerships distribute liability among partners, which can either be unlimited in general partnerships or limited to ownership stakes in limited partnerships, providing more flexibility in risk management. Effective risk mitigation in partnerships often involves detailed agreements and insurance policies to protect individual partners from collective liabilities.

Tax Implications and Benefits

Sole proprietorships face simpler tax filings, as business income is reported directly on the owner's personal tax return, preventing double taxation. Partnerships require filing an informational return, with income passing through to partners' individual tax returns, allowing income and losses to be split among partners according to ownership shares. Partnerships offer flexibility in tax benefit allocation and can deduct a wider range of business expenses, often resulting in potential tax advantages over sole proprietorships.

Capital and Funding Options

Sole proprietorships rely primarily on personal savings, loans, or credit to fund operations, limiting capital to the owner's resources and creditworthiness. Partnerships benefit from pooled capital contributions and combined borrowing capacity, increasing funding options and financial flexibility. Access to diverse investor networks and shared financial risk enhances partnerships' ability to raise substantial capital compared to sole proprietorships.

Decision-Making and Control

In a sole proprietorship, the owner holds complete decision-making power and control over business operations, allowing for swift and unilateral choices. Partnerships distribute decision-making responsibilities among partners, requiring consensus or majority agreement, which can lead to more diverse input but slower resolutions. The balance between centralized control in sole proprietorships and collaborative governance in partnerships impacts operational agility and strategic direction.

Suitability and Choosing the Right Structure for Your Business

Sole proprietorships suit small businesses with minimal startup costs and simple management, offering complete control and straightforward tax reporting. Partnerships work best when multiple owners bring complementary skills and shared financial commitment, facilitating collaborative decision-making and diversified resources. Choosing the right structure depends on factors like liability preference, tax implications, capital needs, and long-term business goals.

sole proprietorship vs partnership Infographic

difterm.com

difterm.com