Revenue streams represent the total income generated from the sale of goods or services, while profit streams focus on the net earnings after all expenses are deducted. Understanding the distinction between these streams is crucial for effective financial planning and sustainable business growth. Optimizing profit streams requires managing costs and enhancing operational efficiency beyond merely increasing revenue.

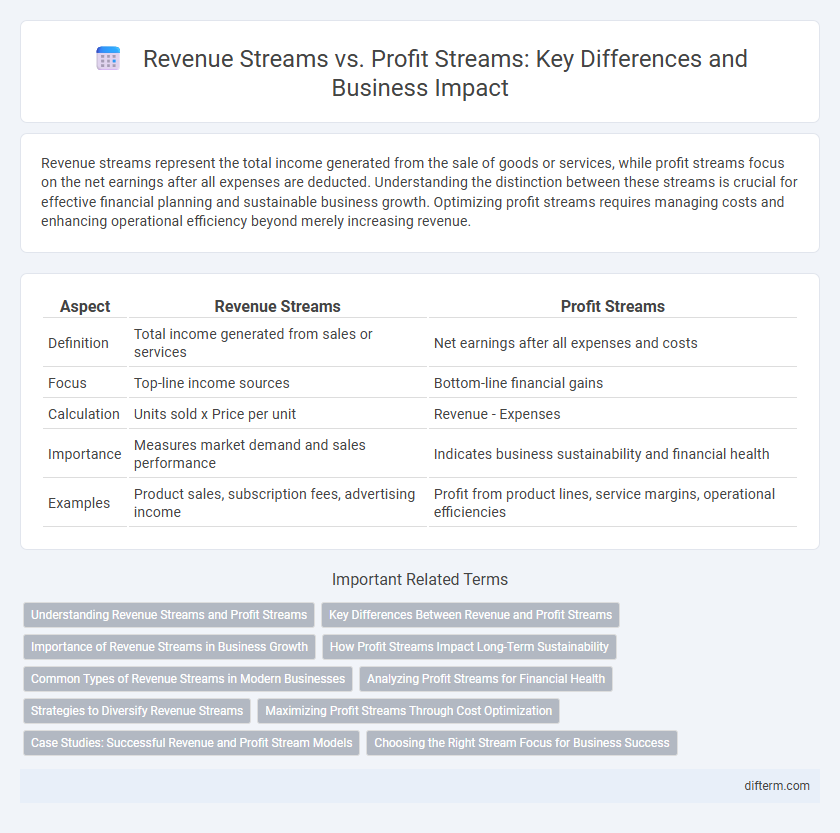

Table of Comparison

| Aspect | Revenue Streams | Profit Streams |

|---|---|---|

| Definition | Total income generated from sales or services | Net earnings after all expenses and costs |

| Focus | Top-line income sources | Bottom-line financial gains |

| Calculation | Units sold x Price per unit | Revenue - Expenses |

| Importance | Measures market demand and sales performance | Indicates business sustainability and financial health |

| Examples | Product sales, subscription fees, advertising income | Profit from product lines, service margins, operational efficiencies |

Understanding Revenue Streams and Profit Streams

Revenue streams represent the total income generated from all business activities such as sales, subscriptions, or services, reflecting the gross inflow of cash. Profit streams indicate the net earnings remaining after deducting all expenses, costs, and taxes from the total revenue, highlighting actual financial gain. Understanding the distinction between revenue streams and profit streams is crucial for strategic decision-making, budgeting, and sustainable business growth.

Key Differences Between Revenue and Profit Streams

Revenue streams represent the total income generated from business activities before any expenses are deducted, including sales, services, and other operations. Profit streams reflect the net earnings after all costs, taxes, and expenses are subtracted from revenue, highlighting the actual financial gain. Understanding the distinction between these streams is crucial for effective financial analysis and strategic planning in business management.

Importance of Revenue Streams in Business Growth

Revenue streams are crucial for business growth as they provide the primary inflow of capital needed to fund operations, invest in innovation, and expand market reach. A diverse and sustainable revenue stream portfolio enhances financial stability and enables businesses to adapt to market fluctuations, thereby securing long-term growth. Prioritizing the development and optimization of multiple revenue sources directly impacts profitability and overall business resilience.

How Profit Streams Impact Long-Term Sustainability

Profit streams, derived from net income after expenses, directly influence long-term sustainability by enabling reinvestment and financial resilience, unlike revenue streams that reflect total income without cost considerations. Sustainable profit management ensures steady cash flow, supports innovation, and cushions against market volatility, securing business longevity. Effective analysis of profit streams allows businesses to prioritize high-margin products and optimize operational efficiency for enduring success.

Common Types of Revenue Streams in Modern Businesses

Common types of revenue streams in modern businesses include product sales, subscription fees, licensing, and advertising revenue. Product sales generate income from one-time purchases, while subscription fees provide recurring revenue through ongoing service access. Licensing involves granting usage rights for intellectual property, and advertising revenue comes from promoting third-party products or services on digital platforms.

Analyzing Profit Streams for Financial Health

Analyzing profit streams provides a clearer insight into a company's financial health by isolating net earnings after all expenses are accounted for, unlike revenue streams which only measure total income. Profit stream analysis highlights sustainable business activities that generate positive cash flow and contribute to long-term growth. Focusing on profit margins and cost structures helps identify inefficiencies and optimize resource allocation for improved profitability.

Strategies to Diversify Revenue Streams

Diversifying revenue streams involves expanding income sources beyond core offerings to enhance business resilience and growth potential. Strategies include introducing complementary products or services, leveraging subscription models, and exploring partnerships or licensing opportunities. Implementing multiple revenue streams mitigates risk, stabilizes cash flow, and increases market reach, driving long-term profitability.

Maximizing Profit Streams Through Cost Optimization

Maximizing profit streams involves focusing on cost optimization strategies that reduce operational expenses while maintaining or increasing revenue streams. Implementing efficient resource management, automating repetitive tasks, and negotiating better supplier contracts can significantly enhance profit margins. Prioritizing high-margin products or services within revenue streams ensures sustainable business growth and improved financial performance.

Case Studies: Successful Revenue and Profit Stream Models

Case studies of companies like Amazon and Apple highlight the distinction between revenue streams and profit streams by demonstrating how diverse income sources contribute to overall profitability. Amazon's revenue streams include e-commerce sales, subscription services, and cloud computing, while its profit streams are driven primarily by AWS and subscription models with higher margins. Apple's case emphasizes product sales as main revenue drivers, with profit streams bolstered by high-margin services like the App Store and digital content.

Choosing the Right Stream Focus for Business Success

Selecting the right revenue stream is essential for scaling a business, as it dictates the flow of income from customers through products, services, or subscriptions. Profit streams emphasize net earnings after costs, guiding strategic decisions to enhance operational efficiency and margin expansion. Prioritizing streams with sustainable cash flow and high profit margins ensures long-term business success and competitive advantage.

Revenue Streams vs Profit Streams Infographic

difterm.com

difterm.com