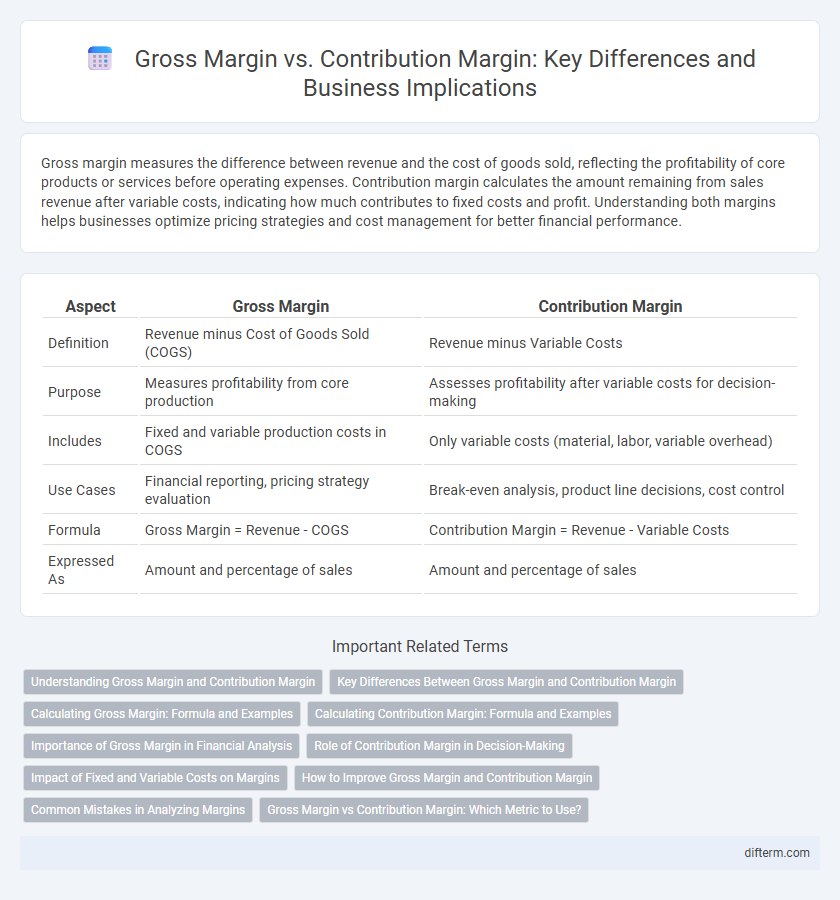

Gross margin measures the difference between revenue and the cost of goods sold, reflecting the profitability of core products or services before operating expenses. Contribution margin calculates the amount remaining from sales revenue after variable costs, indicating how much contributes to fixed costs and profit. Understanding both margins helps businesses optimize pricing strategies and cost management for better financial performance.

Table of Comparison

| Aspect | Gross Margin | Contribution Margin |

|---|---|---|

| Definition | Revenue minus Cost of Goods Sold (COGS) | Revenue minus Variable Costs |

| Purpose | Measures profitability from core production | Assesses profitability after variable costs for decision-making |

| Includes | Fixed and variable production costs in COGS | Only variable costs (material, labor, variable overhead) |

| Use Cases | Financial reporting, pricing strategy evaluation | Break-even analysis, product line decisions, cost control |

| Formula | Gross Margin = Revenue - COGS | Contribution Margin = Revenue - Variable Costs |

| Expressed As | Amount and percentage of sales | Amount and percentage of sales |

Understanding Gross Margin and Contribution Margin

Gross margin measures the percentage of revenue retained after deducting the cost of goods sold, highlighting the profitability related to core production activities. Contribution margin calculates the remaining revenue after variable costs, indicating how much sales contribute to covering fixed expenses and generating profit. Understanding these metrics helps businesses optimize pricing strategies and cost management for sustainable growth.

Key Differences Between Gross Margin and Contribution Margin

Gross margin represents the percentage of revenue remaining after deducting the cost of goods sold (COGS), highlighting the profitability of core production activities. Contribution margin calculates the revenue left after variable costs, emphasizing the ability to cover fixed costs and generate profit. The key difference lies in gross margin's inclusion of all manufacturing costs, while contribution margin isolates variable costs to assess operational leverage.

Calculating Gross Margin: Formula and Examples

Gross margin is calculated by subtracting the cost of goods sold (COGS) from total revenue, then dividing the result by total revenue, expressed as a percentage: Gross Margin = (Revenue - COGS) / Revenue x 100. For example, if a company reports $500,000 in sales and $300,000 in COGS, its gross margin is 40%. This metric highlights the efficiency of production and pricing strategies before accounting for operating expenses.

Calculating Contribution Margin: Formula and Examples

Contribution margin is calculated by subtracting variable costs from total sales revenue, expressed as Contribution Margin = Sales Revenue - Variable Costs. This metric highlights the portion of sales contributing to fixed costs and profits, essential for break-even analysis and decision-making. For example, if sales revenue is $100,000 and variable costs are $60,000, the contribution margin equals $40,000, indicating the amount available to cover fixed expenses.

Importance of Gross Margin in Financial Analysis

Gross margin plays a vital role in financial analysis by indicating the profitability of a company's core production activities before accounting for operating expenses. It helps businesses assess pricing strategies, cost control, and overall efficiency, enabling more accurate forecasting and strategic planning. Unlike contribution margin, gross margin provides a clearer view of product-level profitability, essential for long-term financial health evaluation.

Role of Contribution Margin in Decision-Making

Contribution margin plays a critical role in business decision-making by highlighting the profitability of individual products or services after variable costs are deducted. It enables managers to assess which offerings generate sufficient revenue to cover fixed costs and contribute to overall profit, guiding pricing strategies and product mix optimization. Unlike gross margin, which accounts for cost of goods sold, contribution margin focuses more precisely on cost behavior, making it essential for break-even analysis and short-term financial planning.

Impact of Fixed and Variable Costs on Margins

Gross margin measures the difference between revenue and the cost of goods sold, reflecting the impact of variable costs directly tied to production volume, while contribution margin accounts for variable costs as well but also highlights the effect of fixed costs on profitability by indicating how much revenue remains after covering variable expenses. Fixed costs remain constant regardless of sales volume, so they don't influence gross margin but significantly impact contribution margin by determining the break-even point and profitability thresholds. Understanding the distinctions helps businesses optimize pricing strategies and cost management to enhance overall financial performance.

How to Improve Gross Margin and Contribution Margin

Improving gross margin involves increasing revenue through pricing strategies and reducing cost of goods sold by negotiating with suppliers, optimizing production efficiency, and minimizing waste. Enhancing contribution margin requires controlling variable costs, focusing on high-margin products, and improving sales mix to boost overall profitability. Both margins benefit from detailed financial analysis, effective cost management, and targeted marketing efforts to maximize business performance.

Common Mistakes in Analyzing Margins

Confusing gross margin with contribution margin often leads to inaccurate profitability analysis, as gross margin only accounts for direct production costs while contribution margin includes variable expenses critical for decision-making. Overlooking fixed costs in contribution margin analysis can result in misleading conclusions about a product's true financial performance. Mistaking these margins undermines cost control strategies and impairs effective pricing, forecasting, and resource allocation decisions.

Gross Margin vs Contribution Margin: Which Metric to Use?

Gross margin measures the percentage of revenue remaining after deducting the cost of goods sold, highlighting overall product profitability, while contribution margin focuses on the amount left after variable costs, emphasizing the impact on covering fixed expenses and generating profit. Businesses aiming to assess product efficiency and pricing often rely on gross margin, whereas contribution margin is critical for break-even analysis and decision-making around product lines or sales strategies. Choosing the correct metric depends on whether the focus is on long-term profitability through gross margin or short-term operational decisions through contribution margin.

Gross Margin vs Contribution Margin Infographic

difterm.com

difterm.com