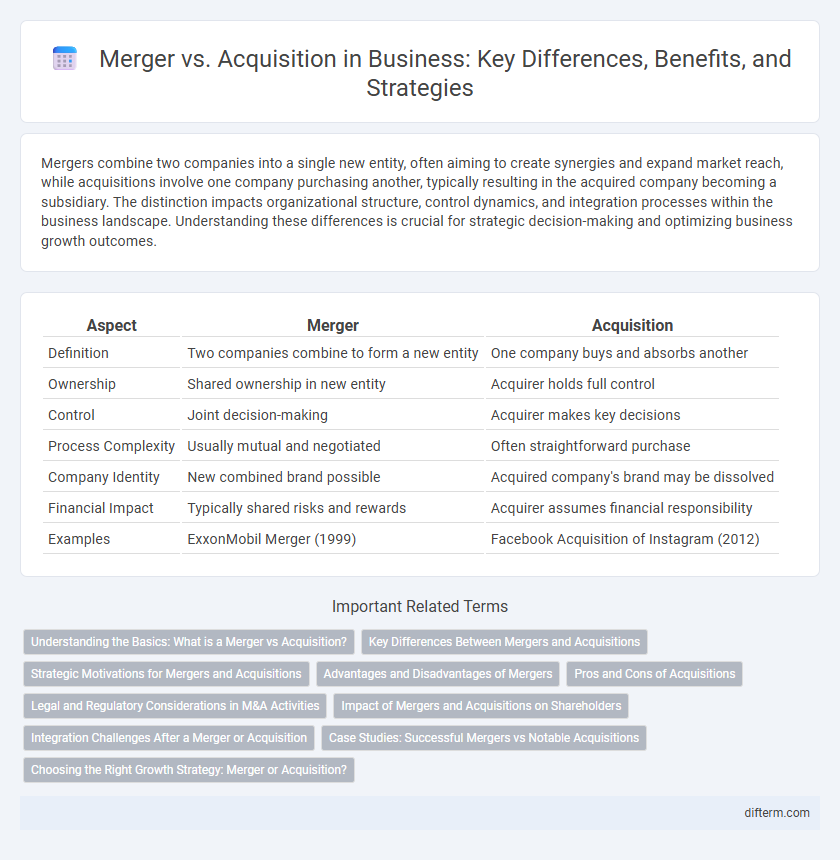

Mergers combine two companies into a single new entity, often aiming to create synergies and expand market reach, while acquisitions involve one company purchasing another, typically resulting in the acquired company becoming a subsidiary. The distinction impacts organizational structure, control dynamics, and integration processes within the business landscape. Understanding these differences is crucial for strategic decision-making and optimizing business growth outcomes.

Table of Comparison

| Aspect | Merger | Acquisition |

|---|---|---|

| Definition | Two companies combine to form a new entity | One company buys and absorbs another |

| Ownership | Shared ownership in new entity | Acquirer holds full control |

| Control | Joint decision-making | Acquirer makes key decisions |

| Process Complexity | Usually mutual and negotiated | Often straightforward purchase |

| Company Identity | New combined brand possible | Acquired company's brand may be dissolved |

| Financial Impact | Typically shared risks and rewards | Acquirer assumes financial responsibility |

| Examples | ExxonMobil Merger (1999) | Facebook Acquisition of Instagram (2012) |

Understanding the Basics: What is a Merger vs Acquisition?

A merger occurs when two companies combine to form a new entity, sharing resources, management, and ownership. An acquisition involves one company purchasing another, taking control of its assets and operations without combining into a new firm. Understanding these core distinctions helps businesses strategize growth, market expansion, and competitive advantage.

Key Differences Between Mergers and Acquisitions

Mergers involve the combination of two companies to form a new entity, while acquisitions occur when one company purchases another and assimilates it into its operations. A merger typically results in shared ownership and resources, whereas acquisitions lead to one company maintaining control and absorbing the target's assets. Key differences include the level of integration, financial structure, and regulatory requirements, which influence strategic goals and organizational culture.

Strategic Motivations for Mergers and Acquisitions

Strategic motivations for mergers and acquisitions center on achieving market expansion, gaining competitive advantages, and diversifying product portfolios. Companies pursue mergers to combine resources and enhance operational efficiency, while acquisitions often target technology acquisition and access to new customer bases. Both strategies aim to increase shareholder value through synergies, cost reductions, and improved innovation capacity.

Advantages and Disadvantages of Mergers

Mergers offer advantages such as enhanced market share, combined resources for innovation, and increased competitive advantage by uniting complementary strengths of two companies. However, disadvantages include potential cultural clashes, integration challenges, and the risk of reduced employee morale due to restructuring or redundancies. Evaluating these factors is essential for determining whether a merger aligns with long-term strategic goals and operational capabilities.

Pros and Cons of Acquisitions

Acquisitions enable rapid market expansion and increased market share by absorbing competitors or complementary businesses, facilitating access to new technologies, talent, and resources. However, acquisitions carry risks such as cultural clashes, integration challenges, and potential overvaluation, which can lead to financial strain and operational disruptions. Careful due diligence and post-acquisition planning are essential to maximize value and minimize the risks associated with these complex transactions.

Legal and Regulatory Considerations in M&A Activities

Legal and regulatory considerations in mergers and acquisitions (M&A) activities are critical for ensuring compliance with antitrust laws, securities regulations, and industry-specific rules. Due diligence must address potential liabilities, contract obligations, and regulatory approvals to avoid post-transaction disputes and penalties. Failure to obtain necessary regulatory clearances from authorities such as the Federal Trade Commission (FTC) or the Securities and Exchange Commission (SEC) can result in transaction delays or unwinding of deals.

Impact of Mergers and Acquisitions on Shareholders

Mergers and acquisitions significantly impact shareholders through changes in stock value, dividend policies, and ownership structure. Shareholders may experience increased wealth if the combined entity achieves synergies and market expansion, enhancing earnings per share and long-term growth potential. Conversely, risks include dilution of shares, integration challenges, and possible short-term stock volatility affecting shareholder returns.

Integration Challenges After a Merger or Acquisition

Integration challenges after a merger or acquisition often stem from cultural clashes, incompatible systems, and employee uncertainty. Successful integration requires aligning organizational structures, streamlining processes, and fostering clear communication to minimize disruption. Addressing these issues promptly enhances operational efficiency and preserves value created through the transaction.

Case Studies: Successful Mergers vs Notable Acquisitions

Successful mergers like Disney and Pixar showcased seamless cultural integration and enhanced market reach, driving sustained growth and innovation. In contrast, notable acquisitions such as AOL and Time Warner highlight challenges in synergy realization and value creation, often leading to disappointing outcomes. Analyzing these case studies provides critical insights into strategic alignment, due diligence, and post-deal integration for optimizing merger and acquisition success.

Choosing the Right Growth Strategy: Merger or Acquisition?

Choosing the right growth strategy--merger or acquisition--depends on factors such as market expansion goals, resource availability, and company culture compatibility. Mergers often create synergies by combining strengths of both firms, while acquisitions allow faster market entry and control over the target company's assets. Evaluating financial metrics, integration complexity, and long-term strategic fit is critical for maximizing shareholder value and competitive advantage.

Merger vs Acquisition Infographic

difterm.com

difterm.com