ROAS (Return on Ad Spend) measures the revenue generated for every dollar spent on advertising, providing insight into the effectiveness of marketing campaigns. ROI (Return on Investment) offers a broader analysis by accounting for total costs and profits, helping businesses evaluate overall financial performance. Understanding the distinction between ROAS and ROI is essential for optimizing advertising strategies and achieving sustainable growth.

Table of Comparison

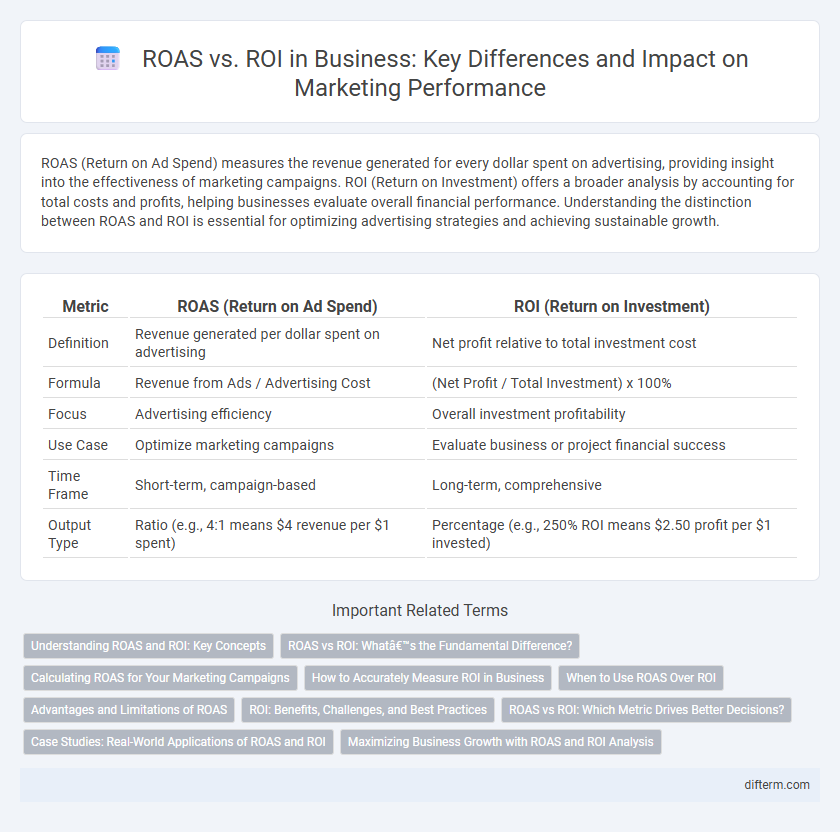

| Metric | ROAS (Return on Ad Spend) | ROI (Return on Investment) |

|---|---|---|

| Definition | Revenue generated per dollar spent on advertising | Net profit relative to total investment cost |

| Formula | Revenue from Ads / Advertising Cost | (Net Profit / Total Investment) x 100% |

| Focus | Advertising efficiency | Overall investment profitability |

| Use Case | Optimize marketing campaigns | Evaluate business or project financial success |

| Time Frame | Short-term, campaign-based | Long-term, comprehensive |

| Output Type | Ratio (e.g., 4:1 means $4 revenue per $1 spent) | Percentage (e.g., 250% ROI means $2.50 profit per $1 invested) |

Understanding ROAS and ROI: Key Concepts

ROAS (Return on Ad Spend) measures the revenue generated directly from advertising efforts, indicating campaign efficiency by comparing ad spend to generated sales. ROI (Return on Investment) evaluates the overall profitability of a business initiative, accounting for total costs and net gains beyond just advertising. Understanding the distinction between ROAS and ROI is crucial for optimizing marketing budgets and making informed financial decisions that align with business growth objectives.

ROAS vs ROI: What’s the Fundamental Difference?

ROAS (Return on Ad Spend) measures the revenue generated for every dollar spent on advertising, highlighting the efficiency of marketing campaigns, while ROI (Return on Investment) evaluates the overall profitability by comparing net profit to total investment costs. ROAS focuses specifically on advertising effectiveness, often used to optimize digital marketing tactics, whereas ROI encompasses all business expenses and revenues, providing a broader financial performance overview. Understanding the fundamental difference helps businesses allocate budgets efficiently, balancing short-term campaign success with long-term profitability goals.

Calculating ROAS for Your Marketing Campaigns

Calculating ROAS for your marketing campaigns involves dividing the total revenue generated by the campaign by the total ad spend, providing a direct measure of advertising effectiveness. Unlike ROI, which accounts for all costs and profits, ROAS focuses specifically on revenue return relative to advertising investment. Accurately measuring ROAS allows businesses to optimize budget allocation and improve future campaign performance.

How to Accurately Measure ROI in Business

Accurately measuring ROI in business requires tracking all costs associated with an investment, including direct expenses and overhead, to determine true profitability. Implementing comprehensive analytics tools that connect marketing spend to revenue enables precise calculation of net returns over time. Regularly updating data inputs and considering timeframes ensures ROI reflects the real financial impact of business decisions beyond surface-level metrics like ROAS.

When to Use ROAS Over ROI

ROAS (Return on Ad Spend) is ideal for evaluating the effectiveness of specific advertising campaigns by measuring revenue generated per dollar spent, providing immediate insights into ad performance. ROI (Return on Investment) offers a broader financial perspective, including all expenses and revenues, better suited for assessing overall business profitability or long-term projects. Use ROAS when the primary goal is to optimize marketing budgets and assess individual channel or campaign efficiency in generating sales.

Advantages and Limitations of ROAS

ROAS (Return on Ad Spend) provides a clear, immediate metric to evaluate the effectiveness of advertising campaigns by measuring revenue generated per dollar spent, allowing businesses to optimize marketing budgets in real-time. Its primary advantage lies in its simplicity and direct correlation to ad performance, but ROAS has limitations as it ignores other costs like overhead, production, and operational expenses, thus not reflecting overall profitability. Focusing solely on ROAS can mislead decision-makers into prioritizing campaigns with high revenue but low net profit, underscoring the need to consider ROI for comprehensive business insights.

ROI: Benefits, Challenges, and Best Practices

Return on Investment (ROI) measures the profitability and efficiency of business investments, providing a comprehensive view of financial performance beyond just advertising spend effectiveness tracked by ROAS. Key benefits of ROI include its ability to capture overall business impact, guide strategic decision-making, and prioritize resource allocation, while challenges involve accurately attributing indirect costs and long-term gains. Best practices for maximizing ROI include setting clear objectives, continuous performance analysis, integrating qualitative and quantitative metrics, and aligning marketing efforts with broader business goals.

ROAS vs ROI: Which Metric Drives Better Decisions?

ROAS (Return on Ad Spend) measures the revenue generated per dollar spent on advertising, providing immediate insight into campaign efficiency. ROI (Return on Investment) offers a broader perspective by accounting for total costs and overall profitability beyond advertising alone. Businesses benefit from using ROAS for short-term marketing adjustments and ROI for long-term strategic financial decisions.

Case Studies: Real-World Applications of ROAS and ROI

Case studies reveal diverse applications of ROAS and ROI across industries, highlighting their unique roles in measuring marketing efficiency and overall profitability. E-commerce brands often leverage ROAS to optimize ad spend by tracking immediate campaign revenue, while ROI is utilized by manufacturing firms to assess the long-term gains from capital investments. These real-world examples demonstrate how balancing ROAS and ROI metrics can drive strategic decision-making and maximize business growth.

Maximizing Business Growth with ROAS and ROI Analysis

Maximizing business growth requires a strategic focus on both Return on Ad Spend (ROAS) and Return on Investment (ROI) to evaluate marketing efficiency and overall profitability. ROAS quantifies the revenue generated per advertising dollar, guiding budget allocations toward high-performing campaigns, while ROI measures net profit relative to total investment, ensuring sustainable financial health. Integrating ROAS and ROI analysis empowers businesses to optimize marketing strategies, boost revenue streams, and achieve scalable growth.

ROAS vs ROI Infographic

difterm.com

difterm.com