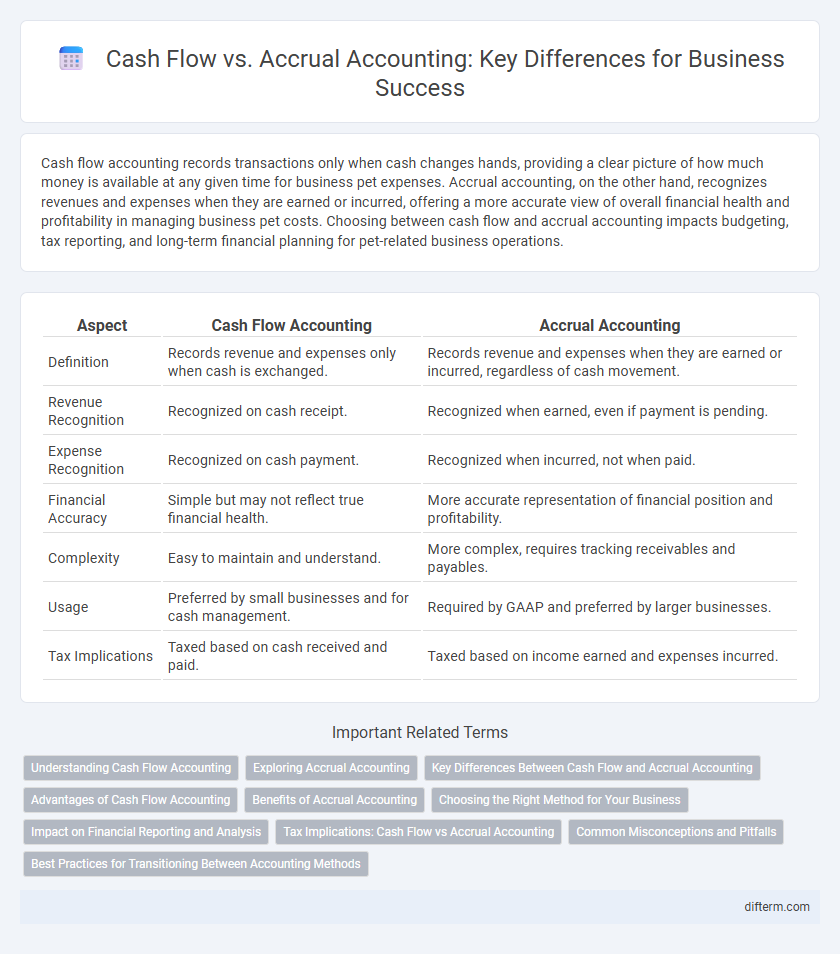

Cash flow accounting records transactions only when cash changes hands, providing a clear picture of how much money is available at any given time for business pet expenses. Accrual accounting, on the other hand, recognizes revenues and expenses when they are earned or incurred, offering a more accurate view of overall financial health and profitability in managing business pet costs. Choosing between cash flow and accrual accounting impacts budgeting, tax reporting, and long-term financial planning for pet-related business operations.

Table of Comparison

| Aspect | Cash Flow Accounting | Accrual Accounting |

|---|---|---|

| Definition | Records revenue and expenses only when cash is exchanged. | Records revenue and expenses when they are earned or incurred, regardless of cash movement. |

| Revenue Recognition | Recognized on cash receipt. | Recognized when earned, even if payment is pending. |

| Expense Recognition | Recognized on cash payment. | Recognized when incurred, not when paid. |

| Financial Accuracy | Simple but may not reflect true financial health. | More accurate representation of financial position and profitability. |

| Complexity | Easy to maintain and understand. | More complex, requires tracking receivables and payables. |

| Usage | Preferred by small businesses and for cash management. | Required by GAAP and preferred by larger businesses. |

| Tax Implications | Taxed based on cash received and paid. | Taxed based on income earned and expenses incurred. |

Understanding Cash Flow Accounting

Cash flow accounting records transactions when cash actually changes hands, providing a clear picture of a company's liquidity and short-term financial health. This method tracks incoming and outgoing cash from operations, investments, and financing activities to ensure businesses maintain enough cash to meet obligations. Focusing on cash flow accounting helps managers make timely decisions regarding budgeting, expenses, and investing based on real-time cash availability rather than future receivables or payables.

Exploring Accrual Accounting

Accrual accounting records revenues and expenses when they are incurred, regardless of cash transactions, providing a more accurate financial picture for business decision-making. This method aligns income and expenses with the period they relate to, enabling better matching of revenues with related costs and improving forecasting and budgeting accuracy. Businesses using accrual accounting benefit from enhanced financial management, compliance with GAAP standards, and improved insights into long-term profitability.

Key Differences Between Cash Flow and Accrual Accounting

Cash flow accounting records transactions only when cash changes hands, providing a clear picture of actual liquidity. Accrual accounting recognizes revenues and expenses when they are earned or incurred, regardless of cash movement, offering a more accurate view of financial performance over time. Understanding these key differences helps businesses manage budgeting, tax obligations, and financial reporting effectively.

Advantages of Cash Flow Accounting

Cash flow accounting provides real-time insights into a business's liquidity by tracking actual cash inflows and outflows, enabling more effective cash management and short-term financial planning. This method simplifies tax reporting and reduces the complexity associated with recognizing revenues and expenses, making it ideal for small businesses and startups. By highlighting immediate financial health, cash flow accounting helps businesses avoid liquidity crises and supports timely decision-making.

Benefits of Accrual Accounting

Accrual accounting provides a more accurate financial picture by recording revenues and expenses when they are incurred, regardless of cash flow timing, which aids in better decision-making and forecasting. This method aligns income and expenses with business activities, improving profit measurement and financial reporting for stakeholders. Enhanced matching of revenues and expenses supports compliance with accounting standards and boosts investor confidence.

Choosing the Right Method for Your Business

Choosing between cash flow and accrual accounting significantly impacts financial clarity and tax obligations for your business. Cash flow accounting records transactions when cash changes hands, ideal for small businesses needing straightforward financial tracking, while accrual accounting records revenue and expenses when they are incurred, providing a more accurate financial picture for larger or growth-focused companies. Evaluating business size, complexity, regulatory requirements, and financial goals ensures selecting the most suitable accounting method optimizes decision-making and compliance.

Impact on Financial Reporting and Analysis

Cash flow accounting provides real-time insights into liquidity by recording actual cash transactions, enabling businesses to manage short-term financial obligations effectively. Accrual accounting captures revenues and expenses when they are earned or incurred, offering a more accurate representation of long-term financial performance and profitability. The choice between cash flow and accrual methods significantly impacts financial reporting accuracy, influencing key metrics like net income, working capital, and financial ratios used in analysis.

Tax Implications: Cash Flow vs Accrual Accounting

Cash flow accounting recognizes income and expenses when cash changes hands, directly impacting taxable income based on actual cash movements, which can defer tax liabilities by timing income recognition. Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash transactions, potentially accelerating tax obligations because income is reported when earned, not received. Choosing between cash flow and accrual accounting methods influences the timing of taxable income recognition and can affect overall tax strategy and compliance.

Common Misconceptions and Pitfalls

Many businesses mistakenly believe cash flow accounting provides a complete financial picture, overlooking revenues and expenses recorded under accrual accounting that impact long-term profitability. A common pitfall is confusing cash flow timing with actual earnings, which can lead to poor budgeting and decision-making. Understanding that accrual accounting matches income and expenses when they occur, not when cash changes hands, is crucial for accurate financial analysis and compliance.

Best Practices for Transitioning Between Accounting Methods

Transitioning from cash flow to accrual accounting requires a clear understanding of timing differences in revenue recognition and expense matching. Best practices include conducting a comprehensive review of existing financial records, implementing dual accounting systems during the transition phase, and providing staff training to ensure accurate application of GAAP principles. Using cloud-based accounting software with automated reconciliation tools enhances data accuracy and supports seamless adaptation to accrual-based reporting.

cash flow vs accrual accounting Infographic

difterm.com

difterm.com