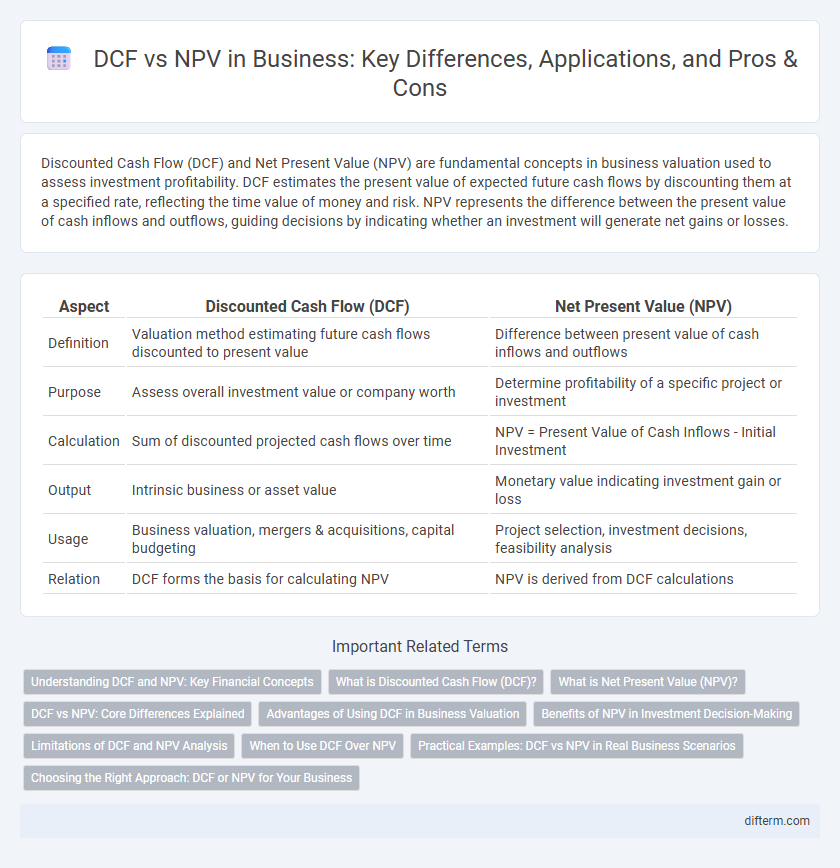

Discounted Cash Flow (DCF) and Net Present Value (NPV) are fundamental concepts in business valuation used to assess investment profitability. DCF estimates the present value of expected future cash flows by discounting them at a specified rate, reflecting the time value of money and risk. NPV represents the difference between the present value of cash inflows and outflows, guiding decisions by indicating whether an investment will generate net gains or losses.

Table of Comparison

| Aspect | Discounted Cash Flow (DCF) | Net Present Value (NPV) |

|---|---|---|

| Definition | Valuation method estimating future cash flows discounted to present value | Difference between present value of cash inflows and outflows |

| Purpose | Assess overall investment value or company worth | Determine profitability of a specific project or investment |

| Calculation | Sum of discounted projected cash flows over time | NPV = Present Value of Cash Inflows - Initial Investment |

| Output | Intrinsic business or asset value | Monetary value indicating investment gain or loss |

| Usage | Business valuation, mergers & acquisitions, capital budgeting | Project selection, investment decisions, feasibility analysis |

| Relation | DCF forms the basis for calculating NPV | NPV is derived from DCF calculations |

Understanding DCF and NPV: Key Financial Concepts

Discounted Cash Flow (DCF) analyzes the present value of expected future cash flows by applying a discount rate reflecting risk and time value of money, providing a fundamental method to evaluate investment profitability. Net Present Value (NPV) calculates the difference between the present value of cash inflows and outflows, offering a quantitative measure to determine whether a project adds value to the firm. Understanding DCF and NPV is critical for business decision-making, as these concepts guide capital budgeting, investment appraisals, and financial planning with precision and clarity.

What is Discounted Cash Flow (DCF)?

Discounted Cash Flow (DCF) is a valuation method used in business finance to estimate the present value of expected future cash flows by applying a discount rate, reflecting the time value of money and investment risk. This technique allows analysts to assess the profitability and viability of projects or companies by converting future earnings into today's dollars. DCF serves as a fundamental tool in investment decisions, mergers and acquisitions, and capital budgeting processes.

What is Net Present Value (NPV)?

Net Present Value (NPV) calculates the difference between the present value of cash inflows and outflows over a specific period, using a discount rate to account for the time value of money. It serves as a critical financial metric to evaluate the profitability of an investment or project by quantifying expected gains or losses in today's dollars. NPV helps businesses prioritize projects by identifying opportunities that generate positive cash flows exceeding their initial costs when discounted to present value.

DCF vs NPV: Core Differences Explained

Discounted Cash Flow (DCF) evaluates a company's value by projecting future cash flows and discounting them to present value using a specific discount rate, emphasizing cash generation ability. Net Present Value (NPV) calculates the difference between the present value of cash inflows and outflows of a project, determining profitability and investment viability. DCF is a broader valuation method, while NPV focuses specifically on the net value created by an investment relative to its cost.

Advantages of Using DCF in Business Valuation

Discounted Cash Flow (DCF) provides a detailed estimation of future cash flows, enabling more precise business valuation by considering time value of money and risk factors. It incorporates projected operational performance and capital expenditures, offering a comprehensive insight into intrinsic value beyond simple profit metrics. This method facilitates better investment decisions by aligning valuation with expected financial performance over time.

Benefits of NPV in Investment Decision-Making

Net Present Value (NPV) provides a clear measure of an investment's profitability by calculating the difference between the present value of cash inflows and outflows, helping businesses identify projects that enhance shareholder value. Unlike Discounted Cash Flow (DCF) analysis, which estimates future cash flows without explicitly indicating profitability, NPV quantifies the expected increase in wealth, facilitating more informed and objective decision-making. Firms benefit from using NPV to prioritize investments with positive values, ensuring resource allocation towards ventures that exceed the required rate of return and minimize financial risk.

Limitations of DCF and NPV Analysis

Discounted Cash Flow (DCF) and Net Present Value (NPV) analyses are limited by their reliance on accurate cash flow projections and discount rate estimations, which can be highly subjective and prone to error. Sensitivity to assumptions regarding growth rates, market conditions, and risk factors often leads to significant valuation variability. These models also struggle to incorporate qualitative factors such as managerial expertise and competitive advantage, potentially oversimplifying complex business dynamics.

When to Use DCF Over NPV

Use Discounted Cash Flow (DCF) analysis over Net Present Value (NPV) when evaluating projects with variable or uncertain cash flows over extended periods, as DCF provides detailed insights into the timing and magnitude of future cash inflows and outflows. DCF is preferable for businesses needing to assess intrinsic value based on projected cash flow forecasts, especially in capital-intensive industries or startups with fluctuating earnings. Employing DCF allows for more granular financial modeling and scenario analysis compared to the aggregate summary approach of NPV.

Practical Examples: DCF vs NPV in Real Business Scenarios

Discounted Cash Flow (DCF) analysis evaluates an investment's value by projecting future cash flows and discounting them to present value, providing a detailed financial forecast for complex projects like capital expenditures or acquisitions. Net Present Value (NPV) uses DCF principles to quantify the difference between present value of inflows and outflows, making it easier to assess profitability in straightforward scenarios such as evaluating new product launches or expansion decisions. In real business scenarios, DCF offers a comprehensive framework for analyzing long-term investments, while NPV serves as a quick decision-making tool for comparing immediate project returns.

Choosing the Right Approach: DCF or NPV for Your Business

Selecting between Discounted Cash Flow (DCF) and Net Present Value (NPV) hinges on your business's financial goals and project scope; DCF evaluates the intrinsic value by forecasting future cash flows, while NPV quantifies the profitability against initial investment costs. Businesses aiming for comprehensive valuation of long-term projects benefit from DCF's detailed cash flow analysis, whereas NPV provides a straightforward decision metric for immediate investment viability. Understanding the nuances of projected cash flow timing, discount rates, and risk factors ensures the chosen method aligns with strategic financial planning and maximizes shareholder value.

DCF vs NPV Infographic

difterm.com

difterm.com