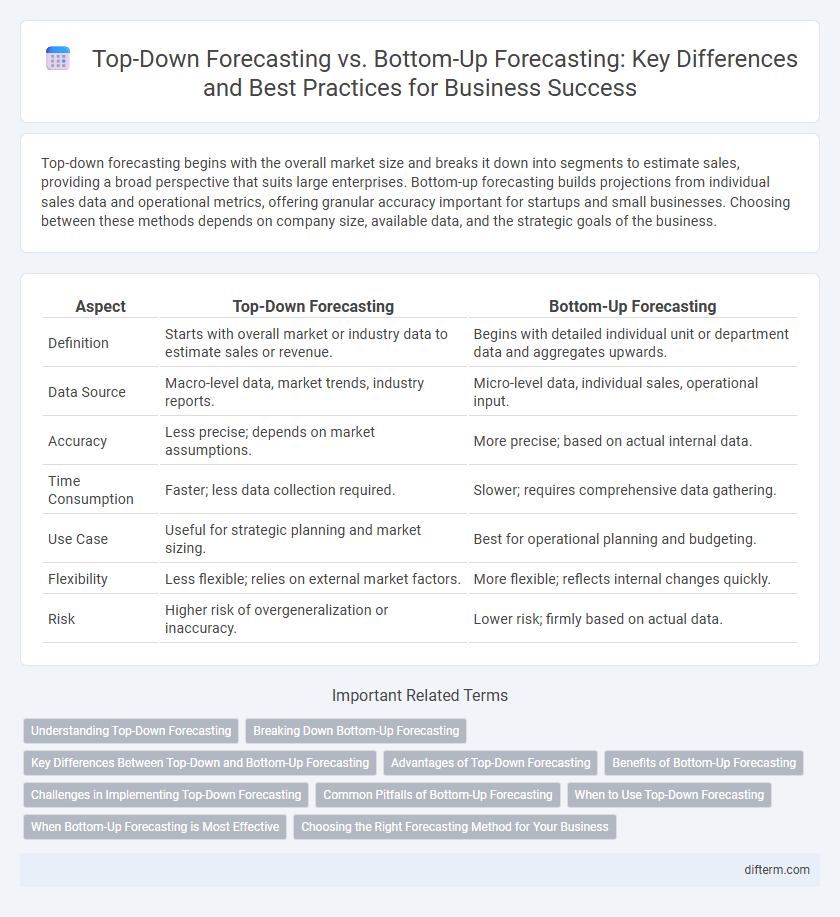

Top-down forecasting begins with the overall market size and breaks it down into segments to estimate sales, providing a broad perspective that suits large enterprises. Bottom-up forecasting builds projections from individual sales data and operational metrics, offering granular accuracy important for startups and small businesses. Choosing between these methods depends on company size, available data, and the strategic goals of the business.

Table of Comparison

| Aspect | Top-Down Forecasting | Bottom-Up Forecasting |

|---|---|---|

| Definition | Starts with overall market or industry data to estimate sales or revenue. | Begins with detailed individual unit or department data and aggregates upwards. |

| Data Source | Macro-level data, market trends, industry reports. | Micro-level data, individual sales, operational input. |

| Accuracy | Less precise; depends on market assumptions. | More precise; based on actual internal data. |

| Time Consumption | Faster; less data collection required. | Slower; requires comprehensive data gathering. |

| Use Case | Useful for strategic planning and market sizing. | Best for operational planning and budgeting. |

| Flexibility | Less flexible; relies on external market factors. | More flexible; reflects internal changes quickly. |

| Risk | Higher risk of overgeneralization or inaccuracy. | Lower risk; firmly based on actual data. |

Understanding Top-Down Forecasting

Top-down forecasting involves estimating overall market trends and then allocating expected sales or revenues to individual segments or units, providing a broad perspective based on macroeconomic indicators and industry data. This approach leverages historical company performance, competitor analysis, and market growth rates to predict future financial outcomes efficiently. It enables senior management to set strategic targets and align resources with anticipated market opportunities, ensuring cohesive organizational planning.

Breaking Down Bottom-Up Forecasting

Bottom-up forecasting involves aggregating detailed forecasts from individual departments or units to build an overall business projection, emphasizing accuracy through granular data. This method enhances predictability by incorporating insights directly from operational teams, facilitating better resource allocation and risk management. Breaking down bottom-up forecasting ensures alignment between ground-level activities and strategic financial goals, leading to more reliable revenue and expense estimates.

Key Differences Between Top-Down and Bottom-Up Forecasting

Top-down forecasting begins with the overall market size or industry outlook, allocating projections down to individual segments or products, while bottom-up forecasting aggregates detailed sales data from individual units to build the total market forecast. Top-down approaches rely heavily on macroeconomic indicators and market trends, whereas bottom-up methods emphasize granular operational data and specific customer insights. The choice between these methods affects forecast accuracy, resource allocation, and strategic decision-making, with bottom-up often providing more precise insights but requiring greater data complexity.

Advantages of Top-Down Forecasting

Top-Down Forecasting offers the advantage of efficiency by leveraging macroeconomic data and industry trends to quickly produce high-level revenue projections. It enables businesses to set strategic objectives aligned with market conditions, facilitating faster decision-making and resource allocation. This approach is particularly beneficial for companies operating in dynamic markets where timely insights drive competitive advantage.

Benefits of Bottom-Up Forecasting

Bottom-up forecasting enhances accuracy by leveraging detailed data from individual departments or units, enabling realistic and granular financial projections. This method fosters greater employee engagement and accountability as teams contribute directly to the forecasting process, improving commitment to targets. Organizations gain flexibility to identify potential operational issues early and adjust strategies based on specific insights gathered from ground-level activities.

Challenges in Implementing Top-Down Forecasting

Top-down forecasting faces challenges such as limited accuracy due to reliance on high-level assumptions and potential misalignment with operational realities. It often struggles with insufficient input from frontline managers, leading to forecasts that overlook granular market trends and customer behaviors. Implementing top-down forecasting requires overcoming resistance from departments accustomed to more detailed, bottom-up methods and ensuring effective communication across organizational levels.

Common Pitfalls of Bottom-Up Forecasting

Bottom-up forecasting often suffers from overly optimistic assumptions made at individual department levels, leading to inflated revenue projections. Inaccurate aggregation of granular data without proper validation causes discrepancies and inconsistencies in overall forecasts. Failure to account for market conditions and external factors further undermines the reliability of bottom-up forecasting models.

When to Use Top-Down Forecasting

Top-down forecasting is most effective when strategic, high-level insights are available and quick, broad estimates are needed, especially in large corporations or markets with reliable macroeconomic data. It leverages overall industry trends, market size, and historical performance to project future sales or revenue, making it ideal for initial budget planning or setting company-wide targets. This approach streamlines decision-making when detailed data is scarce or when a broad overview aligns with executive-level planning.

When Bottom-Up Forecasting is Most Effective

Bottom-up forecasting is most effective in businesses with detailed operational data and active input from multiple departments, allowing for granular accuracy in projecting sales and expenses. It excels in scenarios where product lines or service offerings are diverse, enabling precise identification of growth opportunities and resource allocation. This approach supports dynamic market environments by incorporating frontline insights, fostering responsive and adaptable financial planning.

Choosing the Right Forecasting Method for Your Business

Top-down forecasting uses macro-level data, such as industry trends and overall market size, to estimate a company's future performance, making it ideal for businesses seeking quick, high-level insights. Bottom-up forecasting builds predictions from detailed, ground-level data like sales pipeline analysis and individual product performance, offering greater accuracy for companies with complex operations. Selecting the right forecasting method depends on your business size, data availability, and the precision required for strategic planning and resource allocation.

Top-Down Forecasting vs Bottom-Up Forecasting Infographic

difterm.com

difterm.com