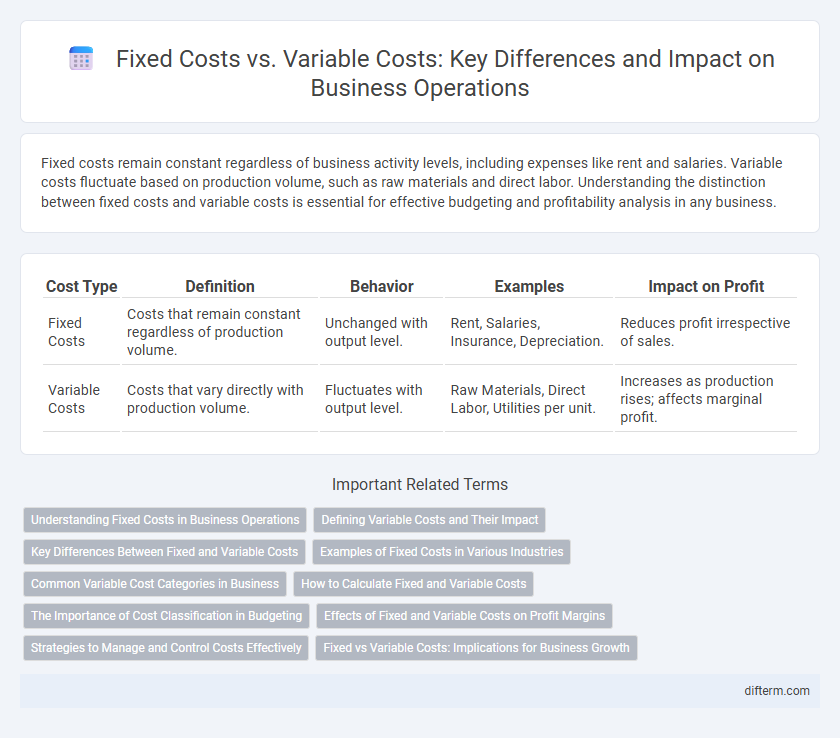

Fixed costs remain constant regardless of business activity levels, including expenses like rent and salaries. Variable costs fluctuate based on production volume, such as raw materials and direct labor. Understanding the distinction between fixed costs and variable costs is essential for effective budgeting and profitability analysis in any business.

Table of Comparison

| Cost Type | Definition | Behavior | Examples | Impact on Profit |

|---|---|---|---|---|

| Fixed Costs | Costs that remain constant regardless of production volume. | Unchanged with output level. | Rent, Salaries, Insurance, Depreciation. | Reduces profit irrespective of sales. |

| Variable Costs | Costs that vary directly with production volume. | Fluctuates with output level. | Raw Materials, Direct Labor, Utilities per unit. | Increases as production rises; affects marginal profit. |

Understanding Fixed Costs in Business Operations

Fixed costs in business operations refer to expenses that remain constant regardless of production volume, such as rent, salaries, and insurance. These costs are crucial for budgeting and financial planning because they do not fluctuate with sales or output levels, providing stability in operational expenses. Understanding fixed costs enables businesses to determine break-even points and set pricing strategies that ensure profitability even during periods of low sales.

Defining Variable Costs and Their Impact

Variable costs fluctuate directly with the level of production or sales volume, encompassing expenses such as raw materials, direct labor, and packaging. These costs impact business profitability by increasing proportionally with output, making cost control essential during expansion phases. Understanding variable costs enables more accurate budgeting and pricing strategies to maintain competitive advantage.

Key Differences Between Fixed and Variable Costs

Fixed costs remain constant regardless of production levels, including expenses like rent, salaries, and insurance. Variable costs fluctuate directly with output, such as raw materials, direct labor, and utility expenses tied to production volume. Understanding the distinction between fixed costs and variable costs is crucial for budgeting, forecasting, and optimizing business profitability.

Examples of Fixed Costs in Various Industries

Fixed costs remain constant regardless of production levels and include expenses such as rent, salaries, and insurance premiums. In the manufacturing sector, examples include factory lease payments and salaried supervisory staff, while service industries often incur fixed costs like office rent and administrative salaries. Retail businesses face fixed costs such as storefront lease agreements and utilities, which remain stable even when sales fluctuate.

Common Variable Cost Categories in Business

Common variable cost categories in business include raw materials, direct labor, and utilities that fluctuate with production volume. Marketing expenses and sales commissions often vary in direct proportion to sales levels, impacting overall profitability. Managing these costs efficiently is crucial for maintaining flexible budgeting and maximizing operational leverage.

How to Calculate Fixed and Variable Costs

Fixed costs remain constant regardless of production volume and are calculated by summing expenses such as rent, salaries, and insurance over a specific period. Variable costs fluctuate with output and are determined by multiplying the cost per unit of materials, labor, and utilities by the number of units produced. Accurate calculation of fixed and variable costs is essential for budgeting, pricing strategies, and profitability analysis in any business.

The Importance of Cost Classification in Budgeting

Accurate cost classification into fixed costs and variable costs is essential for effective budgeting, enabling businesses to predict expenses and allocate resources efficiently. Understanding fixed costs, such as rent and salaries, helps maintain financial stability, while monitoring variable costs, like raw materials and utilities, supports flexible budgeting in response to production changes. This distinction informs pricing strategies and profitability analysis, enhancing overall financial planning and decision-making.

Effects of Fixed and Variable Costs on Profit Margins

Fixed costs, such as rent and salaries, remain constant regardless of production volume, creating a baseline expense that can compress profit margins during low sales periods. Variable costs, including raw materials and direct labor, fluctuate with production levels, directly impacting profit margins by scaling expenses in line with revenue. Managing the balance between fixed and variable costs is essential for optimizing profit margins and maintaining financial stability in dynamic market conditions.

Strategies to Manage and Control Costs Effectively

Effective cost management strategies involve accurately classifying expenses into fixed costs, such as rent and salaries, and variable costs like raw materials and direct labor, to optimize budgeting and forecasting. Implementing activity-based costing and regularly reviewing cost drivers enable companies to identify inefficiencies and reduce unnecessary expenditures. Leveraging technology for real-time cost tracking and adopting flexible supplier contracts further enhance control over variable expenses while maintaining operational efficiency.

Fixed vs Variable Costs: Implications for Business Growth

Fixed costs, such as rent and salaries, remain constant regardless of production levels, providing financial stability but limiting flexibility. Variable costs fluctuate with production volume, enabling businesses to scale expenses in alignment with demand and optimize cash flow. Understanding the balance between fixed and variable costs is crucial for strategic planning, as it impacts profitability, risk management, and the potential for sustainable business growth.

Fixed Costs vs Variable Costs Infographic

difterm.com

difterm.com