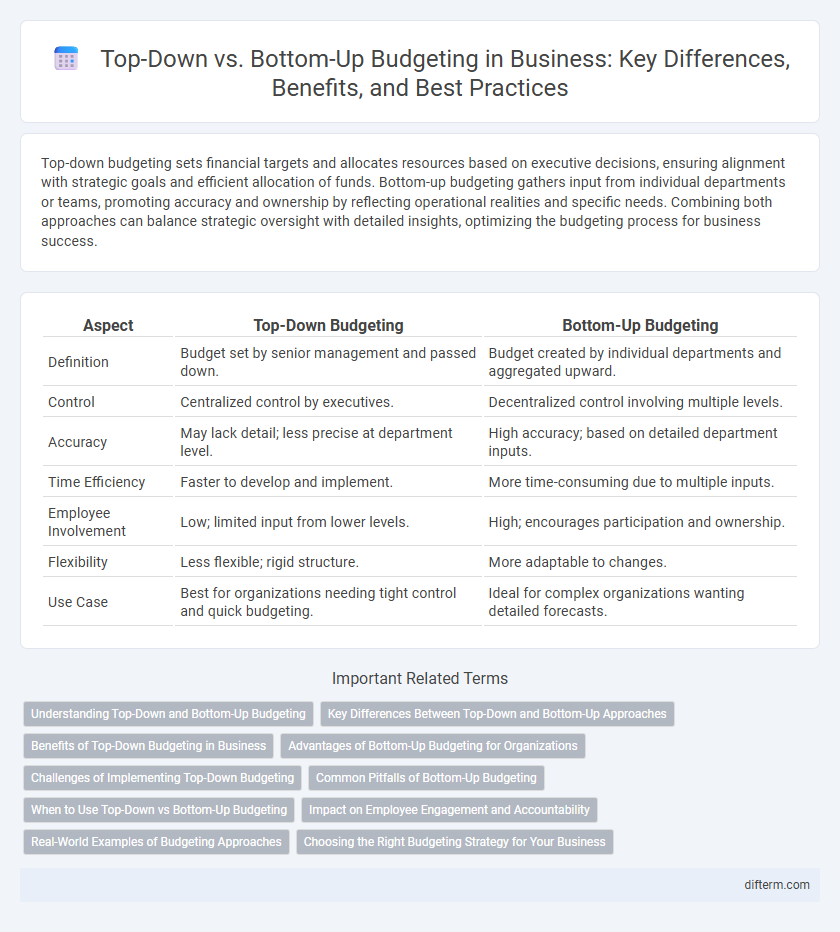

Top-down budgeting sets financial targets and allocates resources based on executive decisions, ensuring alignment with strategic goals and efficient allocation of funds. Bottom-up budgeting gathers input from individual departments or teams, promoting accuracy and ownership by reflecting operational realities and specific needs. Combining both approaches can balance strategic oversight with detailed insights, optimizing the budgeting process for business success.

Table of Comparison

| Aspect | Top-Down Budgeting | Bottom-Up Budgeting |

|---|---|---|

| Definition | Budget set by senior management and passed down. | Budget created by individual departments and aggregated upward. |

| Control | Centralized control by executives. | Decentralized control involving multiple levels. |

| Accuracy | May lack detail; less precise at department level. | High accuracy; based on detailed department inputs. |

| Time Efficiency | Faster to develop and implement. | More time-consuming due to multiple inputs. |

| Employee Involvement | Low; limited input from lower levels. | High; encourages participation and ownership. |

| Flexibility | Less flexible; rigid structure. | More adaptable to changes. |

| Use Case | Best for organizations needing tight control and quick budgeting. | Ideal for complex organizations wanting detailed forecasts. |

Understanding Top-Down and Bottom-Up Budgeting

Top-down budgeting involves senior management setting overall financial targets and allocating resources based on strategic priorities, ensuring alignment with organizational goals. Bottom-up budgeting requires individual departments to create detailed budget proposals that reflect operational needs, promoting accuracy and employee engagement in financial planning. Understanding the strengths and limitations of both approaches helps businesses optimize resource allocation and improve financial control.

Key Differences Between Top-Down and Bottom-Up Approaches

Top-down budgeting is driven by senior management setting financial targets and allocating resources, ensuring alignment with strategic goals but potentially overlooking operational details. Bottom-up budgeting gathers input from departmental teams, promoting accuracy and ownership of budget estimates but requiring more time and coordination. Key differences include the direction of budget creation, decision-making control, and the balance between strategic oversight and granular detail.

Benefits of Top-Down Budgeting in Business

Top-down budgeting accelerates decision-making by leveraging executive insights to set financial targets aligned with strategic goals. This approach ensures resource allocation prioritizes high-impact projects, enhancing organizational efficiency and accountability. It also simplifies budget approval processes, reducing time spent on revisions and streamlining financial management.

Advantages of Bottom-Up Budgeting for Organizations

Bottom-up budgeting fosters accurate financial forecasting by involving department managers who possess detailed knowledge of operational needs, leading to realistic budget allocations and enhanced employee engagement. This participatory approach increases accountability and ownership across teams, driving improved resource utilization and cost control. Furthermore, bottom-up budgeting facilitates agility, enabling organizations to respond swiftly to market changes through granular insights and adaptive financial planning.

Challenges of Implementing Top-Down Budgeting

Top-down budgeting often faces challenges such as limited involvement from lower-level managers, resulting in unrealistic financial targets and reduced employee buy-in. The centralized nature of this approach can overlook critical operational insights, leading to inaccurate resource allocation and potential budget resistance. Ensuring effective communication and incorporating feedback mechanisms are essential to overcoming these obstacles and improving budget accuracy.

Common Pitfalls of Bottom-Up Budgeting

Bottom-up budgeting often faces common pitfalls such as time-consuming processes and inconsistencies in data aggregation from multiple departments. Over-optimism by department heads can lead to inflated budget requests that distort overall financial planning. Lack of central control may result in misaligned priorities, causing inefficiencies and budget overruns.

When to Use Top-Down vs Bottom-Up Budgeting

Top-down budgeting is ideal for organizations requiring tight control and quick decision-making, especially in large corporations with centralized management. Bottom-up budgeting works best for businesses emphasizing accuracy and employee input, often used in departments where detailed cost analysis is critical. Selecting the appropriate approach depends on factors like organizational structure, goal alignment, and resource availability.

Impact on Employee Engagement and Accountability

Top-down budgeting often limits employee engagement by imposing financial targets without frontline input, which can reduce accountability and motivation. Bottom-up budgeting encourages employee participation in forecasting and expense planning, fostering ownership and stronger accountability. Improved engagement through bottom-up approaches typically leads to more accurate budgets and enhanced organizational performance.

Real-World Examples of Budgeting Approaches

Top-down budgeting is exemplified by General Electric, where senior executives set financial targets that cascade down through departments, ensuring alignment with overall corporate strategy. In contrast, Google employs bottom-up budgeting by encouraging individual teams to propose detailed budgets based on project requirements, promoting innovation and accountability. These real-world approaches demonstrate how organizational structure and culture influence the effectiveness of budgeting methods.

Choosing the Right Budgeting Strategy for Your Business

Top-down budgeting accelerates decision-making by allowing senior management to set financial targets based on strategic goals, ensuring alignment with company-wide objectives. Bottom-up budgeting involves input from department heads, promoting accuracy and employee engagement through detailed ground-level insights. Selecting the right budgeting strategy depends on your business's size, culture, and need for flexibility versus control in financial planning.

top-down vs bottom-up budgeting Infographic

difterm.com

difterm.com